Automated tools have revolutionized the forex trading market. These software programs can handle trading decisions and strategy planning without constant oversight from human traders. The best part is that many of these tools don’t require users to write code from scratch.

No-code algorithmic trading refers to the development and deployment of automated trading bots without writing any traditional programming code. No-code platforms provide visual, intuitive interfaces that traders can use to define sophisticated trading rules. The platform then translates these instructions into executable trading logic.

No-code platforms shatter the technical barrier, opening up algorithmic trading to retail traders, financial analysts, and portfolio managers who lack coding skills. In this article, we will explain how no-code trading works, who it’s for and provide a detailed review of the leading platforms.

How No-Code Trading Works

No-code trading replaces complex programming language with a visual, logical assembly of trading rules. Instead of writing manual code to execute trading concepts, no code platforms provide pre-built components or templates that users can easily assemble to create detailed trading instructions that execute automatically.

Many no-code platforms run on a drag-and-drop framework. The user drags instruction blocks onto a canvas and connects them to define the strategy’s flow. Some platforms may also offer prebuilt templates that users can easily modify to create their desired strategy.

For example, Tom a Crypto Swing Trader may automate his manually identified trading signals and execute rule-based strategies consistently while he is at his day job using a no-code platform.

To do this, he defines his strategy (such as an EMA crossover) using pre-built logical blocks: He then proceeds to set a If-Then conditions to initiate a buy order when “Fast EMA crosses above Slow EMA” and “RSI is below 70.” Next, he’d use the platform’s interface to apply essential risk management rules, including a mandatory stop-loss and take-profit percentage, and define his position size.

When this visual flow is completed, the platform’s proprietary engine automatically generates the underlying code required for execution. The trader never sees or touches this code, yet benefits from its functionality.

Key features Most Platforms Offer

A reliable no-code trading platform provides a comprehensive suite of tools that manage the entire lifecycle of an automated strategy. They include:

Backtesting

No code automation trading platforms typically have backtesting features to confirm a strategy’s effectiveness and identify its potential weaknesses before risking live capital. This feature simulates the strategy against years of historical market data. It can be used to calculate important metrics like the total returns, win rate and maximum drawdown.

Live Execution

No code trading platforms can be connected directly to a trader’s brokerage account via APIs. This allows it to automatically create buy/sell orders as soon as the pre-set conditions have been met.

Alerts

No code platforms may provide instant mobile or email notifications when a preset trade condition is triggered or an error occurs during execution. This feature helps to keep the trader informed of the strategy’s performance and allows quick manual intervention if necessary.

Top No-Code Trading Platforms (2025 Overview)

The No-Code trading landscape in 2025 is saturated with several platforms and trading solutions. These platforms cover everything from algorithmic investing to copy trading. Below is an overview of top platforms:

Capitalise.ai

Capitalise.ai is a no-code, natural-language trading automation platform that allows users to write trading strategies in plain English. Capitalize can be used to create trading strategies for different asset classes including stocks, futures, forex, indices, and crypto. The platform was recently acquired by Kraken.

Capitalize offers integration with major global brokers. It is an ideal tool for traders with zero coding skills that want to quickly translate simple trading ideas into an automated strategy. It offers features for backtesting trading strategies, paper trading, and multi-target exits.

Pros

- Easy to use for non-coders

- Quick adaptation to market shifts

- Backtesting and simulation features

Cons

- Requires significant human input and constant oversight

Pricing: Free

Capitalise.ai customer review. Source: Trustpilot

Kryll.io

Kryll.io is a robust block-chain powered trading platform that helps crypto traders create trading strategies and instructions using a visual, drag-and-drop editor. The platform has a visual, flowchart-style strategy editor which leaves plenty of room for high level customization.

Users can set their preferred entry/exit points, backtest strategies or even borrow strategies from others using the strategy marketplace. Kryll is perfect for intermediate to advanced traders who are serious about designing highly customized, flowchart-style strategies for specific market conditions.

Pros

- Powerful visual strategy editor

- Runs on an affordable pay per use pricing system

- Offers Tradingview integration

Cons

- Focused mainly on cryptocurrencies

Pricing: Pay per use

Kryll.io customer review. Source: Trustpilot

AlgoWizard by FX Blue

AlgoWizard is a free, downloadable tool that helps users generate Expert Advisors (EAs) for MetaTrader 4 and 5 (MT4/MT5) without writing MQL code. This platform supports Forex, CFDs, and other assets as long as they’re available on MT4/MT5 brokers.

In addition to creating ready-to-use Expert Advisors based on visual rules, Algowizard also supports the creation of common indicators and logic. AlgoWizard was designed for the average MT4/MT5 users. It is an excellent tool for Forex or CFD traders who already use the MetaTrader platforms and want a simple, no-cost tool to automate their technical indicator-based strategies.

Pros

- MetaTrader compatibility

- Offers highly precise back-testing

- Can generate several strategy variations

Cons

- Relatively steep learning curve for beginners

- Offers limited customization for advanced logic

Pricing: Free

Composer

Composer is an investment-centric platform for creating and automating strategy portfolios for stocks and ETFs based on if/then logic. The AI-powered platform includes a proprietary in-house brokerage, eliminating the need for any external brokerage integration.

Composer offers advanced features such as automated portfolio rebalancing, custom Index/ETF creation with no code, and unlimited backtesting. The features available on this platform are suitable for long-term investors and swing traders looking to automate their portfolio management.

Pros

- Fully automated end-to-end trading execution

- Offers ready-to-use pre-built strategies

- Strategies created on composer are fully editable.

Cons

- Not suitable for high-frequency day trading.

Pricing: $32/month

Composer customer review. Source: Trustpilot

TradeTron

TradeTron is a popular platform focused on algorithmic trading. On TradeTron, users can create their own trading algorithms with conventional trading languages such as Python. However, it also has a no-code visual interface for building strategies. This tool supports various forms of asset trading including Stocks, Options, Futures, Forex, Crypto.

TradeTron has an intuitive drag-and-drop strategy builder. Another impressive feature of this platform is the options wizard, which provides multiple templates for complex options strategies, users can also use the marketplace to find and subscribe to strategies created by other users. TradeTron is an excellent tool built for traders (especially options traders) looking to automate complex, multi-asset strategies.

Pros

- Intuitive platform suitable for beginners

- Robust marketplace for trading strategies

- Supports real-time monitoring

- offers multi-asset support.

Cons

- May not work for high-frequency trading

Pricing: Free with tiered pricing options

Zignaly

Zignaly is primarily a copy trading platform for crypto traders designed to minimize the need for users to build their own bots. Instead, they simply follow the strategies of expert users. It runs on a profit-sharing system, providing users with several copy trading bots, unlimited currency pairs and multiple risk management tools.

The platform has an advanced AI that uses a scoring algorithm to identify and rank the best traders based on their risk appetite and return expectations. Users can simply select a trader that fits their risk profile, while the automated system handles the rest of the process. Although not a strategy builder like the others, Zignaly still works for passive crypto traders and beginners with a passive, results-based investing model.

Pros

- Users won’t have to build, test, or manage any bots themselves

- No subscription payment

- Unlimited currency pairs

Cons

- Not transparent – users can’t assess the risk of signal providers themselves

Pricing: Free

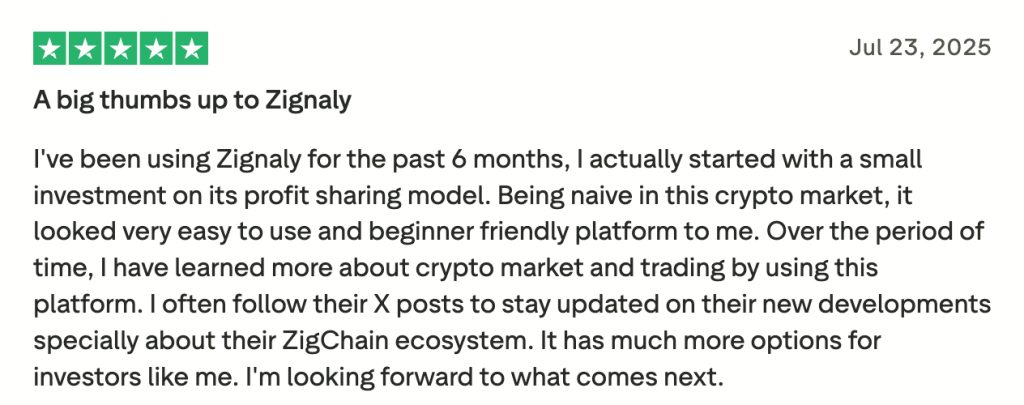

Zignaly customer review. Source: Trustpilot

Who Should Use No-Code Algo Tools?

No-code algorithmic trading tools democratize sophisticated technology. These tools lower the technical barrier to entry for automation, and this makes them suitable for a variety of users. This include:

Beginners in algo trading

No-code platforms are an ideal starting point for newcomers due to their low entry barrier. They eliminate the need to learn complex programming languages. Instead, users rely on intuitive visual interfaces which are easy to understand for virtually anyone. These automated trading platforms also offer the benefit of emotion free execution.

Strategy testers without development background

People who can conceive a profitable strategy but cannot code it will definitely benefit from no-code trading. With these tools, users can quickly translate trading ideas into fully deployable algorithms within a few minutes instead of wasting days on coding.

Crypto/forex traders looking for automation

Crypto and Forex markets operate around the clock. An automated no-code algorithm can monitor conditions and execute trades instantaneously, capturing opportunities while the user is offline. Algorithms execute trades instantly when conditions are met, eliminating human error (like mistyping an order size) and reducing “slippage”. To keep automated trading systems running smoothly 24/7, many traders pair their setup with a reliable Forex VPS

Risks for overconfident users

While no-code tools make trading automation simple, they take nothing away from the risks of trading. In fact, strategies built on an automated no-code trading platform are only as good as the logic behind them. No matter how confident you are about a tool and the strategies it generates, it is crucial that you implement safeguards such as stop-loss orders, max daily loss limits, or position sizing rules.

Quick Start Checklist To Validate or Test a Strategy with No-code

| Action Item | Description |

|---|---|

| Strategy Clarity Check | Ensure your strategy is well-defined and written down with clear, unambiguous entry and exit conditions. |

| Select No-Code Platform | Choose a reputable platform that offers a visual or block-based builder. |

| Broker/Exchange Connection | Connect the no-code platform to your broker or exchange using API keys. (Crucial for execution.) |

| Symbol & Timeframe Defined | Confirm that the bot is targeting the correct asset (symbol) and chart setting (timeframe) as planned. |

| Input Entry Logic | Use the platform’s visual blocks to accurately build all entry conditions. |

| Input Exit Logic | Build the specific exit conditions for the trade. |

| Mandatory Stop-Loss Set | Define and set an automatic stop-loss rule to protect capital on every trade. |

| Take-Profit Set | Define a take-profit level to automatically lock in gains. |

| Run Backtest | Run the strategy against historical data (ideally 2+ years) to evaluate past performance. |

| Review Backtest Metrics | Analyze key performance metrics (look for a positive profit factor, low maximum drawdown, and consistent returns). |

| Optimize Parameters | Based on the backtest results, adjust indicator settings — but avoid overfitting. |

| Start Paper Trading | Deploy the strategy on a demo or paper account to test execution and performance in real-time market conditions. |

| Set Small Capital | After satisfactory paper trading (e.g., 4–6 weeks), begin live trading with minimal capital for final real-world validation. |

Benefits of No-Code Trading

The benefits of no-code trading tools center on accessibility, speed, and simplicity, allowing individuals without programming skills to harness the power of automated trading. Here is a breakdown of the key advantages:

Low barrier to entry

The most significant benefit of these tools is that they eliminate the need to learn complex coding languages like Python, C++, or C#. Traders can focus solely on developing and testing the logic behind their trading strategy.

Quick iteration

No-code tools dramatically reduce the time it takes to go from a trading idea to a live strategy. Instead of spending days writing and debugging code, users can build a basic strategy using drag-and-drop or visual interfaces in a matter of minutes.

Visual logic clarity

The visual design of these platforms makes the trading logic easy to understand and manage. Strategies are often built using intuitive visual blocks or even plain language in some tools. This makes the logic clear, even for complex strategies. Also, since the logic is visual, it’s simpler to review, audit, and troubleshoot a strategy.

Some platforms offer community-built strategies

Many no-code trading platforms foster a community environment that benefits all users. Users often gain access to a marketplace or library of strategies created by other successful traders or the platform itself. Some platforms integrate social or copy trading, allowing users to automatically replicate the trades of a successful algorithm or trader.

Drawbacks and Risks

While no-code tools make algorithmic trading accessible, they are characterized by certain limitations and risks. Some of the most notable drawbacks of this trading approach include:

Limited complexity

No-code platforms work by providing pre-built blocks of logic, most of which are inherently simple. Users are restricted to the features, indicators, and data sources provided by the platform. You cannot implement highly sophisticated, unique, or experimental strategies that require custom code manipulation or proprietary algorithms.

Debugging is harder

The abstraction that makes no-code easy to use also makes it difficult to troubleshoot when something goes wrong. Users don’t get to see the underlying code that the platform generates. If a trade executes incorrectly, you cannot look through the code line-by-line to find the bug, which is the standard procedure for a developer.

False sense of safety with drag-and-drop

The ease of using visual blocks can lead to a dangerous overconfidence, known as the “Set-and-Forget” Mentality. The visual builder only manages the automation, not the market. A beginner might design a simple strategy without key risk management components (like volatility checks, maximum drawdown limits, or robust position sizing). The automation will simply accelerate losses when the strategy inevitably hits a bad market patch.

Broker and latency limitations

For certain high-speed strategies, no-code solutions often fall short on execution performance. No-code platforms often connect to brokers via an API, adding an intermediate layer between your strategy and the exchange. This can introduce milliseconds of latency (delay) compared to dedicated coded solutions that use advanced co-location (servers physically near the exchange) or specialized low-latency protocols.

Tips for Using No-Code Tools Effectively

No-code trading platforms are powerful tools, but their effectiveness depends on how the user approaches strategy design, testing, and risk management. Here are the essential tips for using no-code tools effectively:

Start with a simple strategy and paper trade

Resist the urge to build a highly complex system immediately. The strength of no-code is its speed in validating simple ideas. Additionally, you should always deploy your newly built strategy in a paper trading or demo account first.

Use third-party analytics or simulators before going live

Do not rely solely on the backtesting feature built into the no-code platform as it might have optimistic biases. Export your strategy’s historical trade data and analyze it using external tools (like a spreadsheet or a dedicated third-party analytics suite).

Don’t rely on pre-made templates without review

Many platforms offer community or platform-designed templates for popular strategies. These should be treated as starting points, not final products. Every template is a black box until you dissect it. Understand every single block, indicator setting, and exit rule. You must know why the strategy buys and sells, and under what conditions it fails.

Combine AI helpers (e.g., ChatGPT) to test logic

While AI cannot build the visual logic blocks directly, it is an excellent resource for refining the underlying trading idea. The AI can expose logical flaws or missing risk controls before you build the blocks.

Watch for tool lock-in (limited portability of strategies)

Be mindful that your carefully crafted visual strategy might be trapped on the platform you built it on. Choose platforms that offer an export function, even if it’s only to a simple text-based format like JSON or XML. Some advanced no-code tools can generate the underlying code for your strategy. These provide maximum flexibility and eliminate lock-in risk.

When to Graduate to Low-Code or Full-Code

Transitioning from a no-code environment to low-code or full-code scripting is a natural progression for successful algorithmic traders. It grants greater control and unlocks more advanced strategies. Here are the signs you have outgrown your no-code tool, the benefits of scripting, and the best ways to bridge the gap.

Signs that you’ve outgrown no-code tools

The limitations of no-code platforms become apparent when your strategies require logic the visual builder simply can’t handle. Some of these signs include:

- When you need to create an indicator that is not available in the platform’s pre-built list.

- When your strategy needs to manage positions across multiple assets simultaneously or needs a central risk manager that dynamically adjusts settings.

- When your platform’s execution speed is too slow, and you need direct access to the broker’s API for faster order routing and better fills.

- When you want to incorporate alternative data (e.g., social media sentiment, weather data, proprietary economic models) that the platform does not natively support.

Benefits of scripting (e.g., custom indicators, ML models)

Switching to a coding environment offers unparalleled power and flexibility. Some of the benefits of this approach include:

- Full customization

- Possibility of implementing advanced trading concepts

- The strategy logic (the code) is yours

- You can use professional-grade trading libraries and APIs

Best hybrid tools for transitioning

A hybrid or “low-code” tool is the perfect bridge, allowing you to gradually learn to code without immediately jumping into complex programming languages. A good example is Meta Trader’s MQL5 Wizards. This tool is designed to guide you through the process of creating an Expert Advisor (EA) skeleton without full coding. You can then customize this further by adding a few lines of code.

Tradingview’s Pine Script is another good example. It is an easy-to-learn, proprietary language for building indicators and strategies directly on the chart. Its simplicity is ideal for beginners, and the community is large. You can start with basic logic and introduce advanced functions as you learn.

Final Thoughts

No-code tools have democratized entry into algorithmic trading. It is a powerful revolution that has enabled rapid prototyping and testing of trading ideas without the technical barrier of coding. However, they are not magic and will inevitably be outgrown as a trader’s strategies become more complex and require deep customization. No-code is best utilized as a starting block. But should be followed by an inevitable graduation to the full flexibility and power of low-code or full-code environments. This strategy should also not be used in isolation. It is best paired with informed trading logic and risk awareness on the trader’s part.

FAQs

Can I automate forex/crypto trading with no-code tools?

Yes, you can. Many of the leading no-code and low-code platforms were designed specifically for the 24/7 nature of forex and crypto markets. Platforms like Capitalise.ai (for forex/stock/crypto) and Coinrule or Cryptohopper (primarily for crypto) allow you to build and automate complex strategies using drag-and-drop or simple “if-then” text-based logic.

Are no-code bots profitable?

A no-code bot is only as profitable as the strategy behind it. The platform itself does not generate profits; it merely automates your trading rules. If you have a well-researched, backtested, and robust trading idea, a no-code bot can execute it perfectly, eliminating human error and emotional trading.

Do no-code platforms let me customize risk settings?

Yes, to a point. All reputable no-code platforms offer essential, customizable risk management features. These typically include: stop-loss and take-profit, trailing stops and position sizing. However, complex, portfolio-level risk management features such as dynamically adjusting position sizes based on the drawdown of an entire portfolio or using advanced volatility metrics often require graduating to a low-code or full-code environment.

What’s the best free no-code trading platform?

At the end of the day, the best free no-code trading platform depends on your unique needs. Some platforms like Capitalise.ai are offered free of charge when you trade through one of their partner brokers or exchanges, making them a functionally free solution for live execution. Whether or not the features of this platform is sufficient for you is entirely up to you.

Sources

https://www.greatworklife.com/automated-trading-platforms

https://www.utradealgos.com/blog/no-coding-required-algo-trading-platforms-for-newbies