Forex VPS Hosting for 24/7, Low-Latency Trading

- 1 ms latency network and optimized Forex VPS servers

- Global datacenters near major forex brokers

- Seamless upgrades with zero data loss

- 24/7 support from forex trading experts

- Free backups included

- DDoS protection and advanced server security

- Top-tier value for professional forex traders

Our customers say

Excellent

4.5 out of 5 based on 160 reviews

Choose The Best

Forex VPS Hosting

Choose The Best Forex VPS Hosting

Choose The Best Forex VPS Hosting

Lightning-Fast

Trade Execution

Experience blazing-fast performance with ultra-low latency Forex VPS servers, ensuring your trades are executed instantly.

24/7

Uninterrupted Trading

Multiple power sources and redundant infrastructure keep your Forex VPS online around the clock so you never miss a trade.

14-days money back

guarantee

If you are not satisfied with our Forex VPS for whatever reason, we will give you a full refund within 14 days, no questions asked.

No service termination policy

on Forex days

Your VPS stays live during trading hours even if payment is overdue. We never suspend accounts on active Forex trading days.

Forex VPS Hosting Plans & Pricing

Select the ideal Forex VPS plan for your trading strategy

VPS

Smart

New

York

- Run up to 4 MT4/MT5

- AMD EPYC CPU 3 CORE

- RAM 4 GB ECC

- 120 GB NVMe SSD with HA

- 1 Gbps network bandwidth

- Weekly VPS backups included

- Server deployment time 5 minutes

- Windows 2022 Server Standard

- London

- Amsterdam

- New York

- Vilnius

You will be able to choose different parameters by making order

All prices are subject to VAT

VPS

Boost

New

York

- Run up to 7 MT4/MT5

- AMD EPYC CPU 6 CORE

- RAM 6 GB ECC

- 180 GB NVMe SSD with HA

- 1 Gbps network bandwidth

- Daily VPS backups included

- Server deployment time 5 minutes

- Windows 2022 Server Standard

- London

- Amsterdam

- New York

- Vilnius

You will be able to choose different parameters by making order

All prices are subject to VAT

VPS

Max

New

York

- Run up to 10 MT4/MT5

- AMD EPYC CPU 8 CORE

- RAM 8 GB ECC

- 250 GB NVMe SSD with HA

- 1 Gbps network bandwidth

- Daily VPS backups included

- Server deployment time 5 minutes

- Windows 2022 Server Standard

- London

- Amsterdam

- New York

- Vilnius

You will be able to choose different parameters by making order

All prices are subject to VAT

VPS

Smart

New

York

- Run up to 4 MT4/MT5

- AMD EPYC CPU 3 CORE

- RAM 4 GB ECC

- 120 GB NVMe SSD with HA

- 1 Gbps network bandwidth

- Weekly VPS backups included

- Server deployment time 5 minutes

- Windows 2022 Server Standard

- London

- Amsterdam

- New York

- Vilnius

You will be able to choose different parameters by making order

All prices are subject to VAT

VPS

Boost

New

York

- Run up to 7 MT4/MT5

- AMD EPYC CPU 6 CORE

- RAM 6 GB ECC

- 180 GB NVMe SSD with HA

- 1 Gbps network bandwidth

- Daily VPS backups included

- Server deployment time 5 minutes

- Windows 2022 Server Standard

- London

- Amsterdam

- New York

- Vilnius

You will be able to choose different parameters by making order

All prices are subject to VAT

VPS

Max

New

York

- Run up to 10 MT4/MT5

- AMD EPYC CPU 8 CORE

- RAM 8 GB ECC

- 250 GB NVMe SSD with HA

- 1 Gbps network bandwidth

- Daily VPS backups included

- Server deployment time 5 minutes

- Windows 2022 Server Standard

- London

- Amsterdam

- New York

- Vilnius

You will be able to choose different parameters by making order

All prices are subject to VAT

Trusted By Forex Traders Worldwide

But don’t take our word for it! Here’s what our clients are saying about our service.

I just purchased first month of Dedicated server after some PreSales quesions that was answered well and quick by a Support guy Called Leo.

Review from: Trustpilot.com

The customer service is simply OUTSTANDING. No matter the issue; they have the answer and the fix for you.

I have a Dedicated NY server running smoothly for my trading business. I’m running several MT4s at the same time with no issues.

Review from: Trustpilot.com

Leo at VPS Forex Trader provides excellent customer service. I had a few issues with my dedicated server and Leo responded with detailed answers that help me solve the problem. This a good company with great customer service. I will use their services for years to come!

Review from: Trustpilot.com

So far, I experienced no downtime. The server is fast and able to take many terminals. I have both the vps and dedicated server, and I am very satisfied with it. I have not experienced better customer service elsewhere.

Review from: Trustpilot.com

Tried their smallest VPS plan 2 weeks ago. Already decided to upgrade to the biggest VPS they provide and will probably switch to a dedicated server in the next couple of months.

Their service and connections are outstanding!

Review from: Trustpilot.com

I am truly pleased with my service with VPS Forex Trader. I am getting great connection, stability and performance. […] I highly recommend VPS Forex Trader for your VPS needs!

Review from: Trustpilot.com

I am here to write a review about the guy called Julian who took time to resolve my login problem. I must have forgotten my Admin password and ran into problems. He took his time and even got into a Teamviewer to resolve my problem.

Review from: Trustpilot.com

Onboarding and setup of the VPS was seamless. In 3 months time there were no notable outages. Customer support is very quick, and they went out of their way to help me when I needed to unexpectedly cancel my subscription. Highly recommended!

Review from: Trustpilot.com

Any issues, questions, or concerns that I’ve had were all dealt with in a timely manner! I’m giving 5 stars because this company is treating me the way I would treat a customer, unlike some other hosting companies I’ve dealt with in the past!

Review from: Trustpilot.com

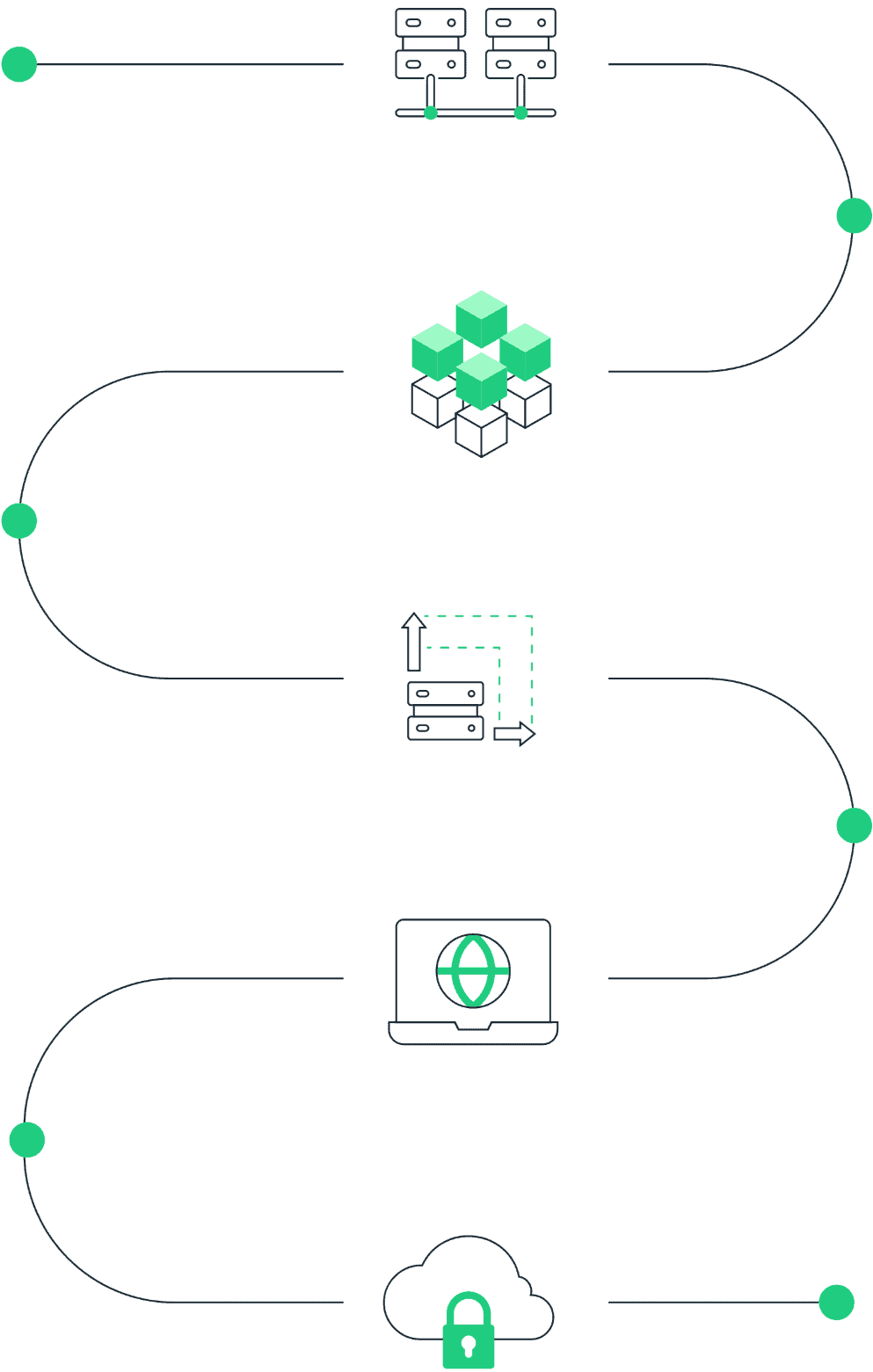

Cutting-Edge Server Technology

Our Forex VPS hosting is powered by the latest server infrastructure, including high-performance AMD EPYC processors, ultra-fast solid-state drives (SSDs), and enterprise-grade components. This architecture ensures consistently smooth and uninterrupted trading operations, even during periods of extreme market volatility, when execution speed and stability are most critical.

Optimized Server Configuration

We’ve meticulously optimized our Forex VPS configurations for high-performance trading environments. Every server is fine-tuned to deliver superior execution speeds and minimize latency for MetaTrader 4/5, Expert Advisors (EAs), and algorithmic strategies. This advanced setup provides a significant competitive advantage by enabling lightning-fast order processing and reduced slippage, even during high-volume trading windows.

Scalable Resources

As your forex trading strategies evolve and grow, so do your VPS resource requirements. Our hosting plans are fully scalable, allowing you to easily upgrade critical resources such as RAM, SSD storage, and bandwidth to meet the demands of complex strategies or multiple trading platforms. This flexibility ensures your Forex VPS hosting continues to support your performance needs, without downtime or disruptions.

Tier-1 Network Connectivity

Our Forex VPS solution connects to premium Tier-1 networks with direct access to major forex brokers, liquidity providers, and financial exchanges around the world. These high-speed and low-latency connections enable real-time market data streaming and faster trade execution. With ping as low as 1 ms to Equinix NY4 or LD4 data centers, you gain a clear speed advantage in fast-moving trading conditions.

SECURITY AGAINST ONLINE THREATS

Keeping your trading data secure is our highest priority. Our Forex VPS hosting is protected by robust DDoS mitigation, encrypted access protocols, and real-time monitoring. In addition, we implement automatic server backups and failover protections to ensure that your trading environment remains stable, redundant, and fully protected, even in the face of unexpected threats or hardware failures.

CUTTING-EDGE TECH

Our Forex VPS hosting is powered by the latest server technology, including high-performance processors, solid-state drives (SSDs), and enterprise-grade hardware. This ensures smooth and uninterrupted forex trading, even during periods of high market volatility.

FOREX-OPTIMIZED SERVERS

We've meticulously optimized our VPS hosting configurations for forex trading, resulting in a fine-tuned environment that delivers the best Forex VPS performance. Our server settings are designed to maximize trade execution speed and minimize latency, giving the edge.

SCALABLE RESOURCES

As your forex trading needs grow, so do your VPS hosting requirements. Our plans are easily scalable, allowing you to upgrade your server resources whenever you need more power. This ensures your Forex VPS hosting can keep up with your evolving requirements.

TIER-1 NETWORK

Our Forex VPS hosting service boasts premium Tier-1 network connectivity, ensuring high-speed and reliable connections to major forex brokers. You'll get faster order execution and real-time market data, helping you stay ahead of the competition

TOP NOTCH SECURITY

Protecting your valuable trading data is our top priority. Our Forex VPS hosting comes with advanced DDoS protection and secure backup solutions, ensuring your trading environment remains stable and safe from external threats.

Is your trading setup costing you money?

For a Forex trader, speed is everything.

A slow computer or VPS can reduce your profits or even cost you money.

Picture this: you’re seeing a lot of volatility on your favorite currency pairs, and you’re all set to pounce on some promising trades. But alas, your PC can’t keep up with the pace. Worse still, imagine your setup suddenly going down before you could exit a losing trade.

But what if you had something that works with you, not against you?

Enter VPSForexTrader – a premium Forex VPS solution designed specifically for Forex traders like yourself. With ultra-low latency, unmatched reliability, and expert support, we are here to take your trading to the next level.

Don’t Settle for Less. Power Your Trading with the Best Forex VPS

Don't Settle For Less. Choose The Best Forex VPS

Boost your forex strategy with our specialized Forex VPS servers, built for low latency, high uptime, and seamless execution. Order from VPS Forex Trader today and experience the speed, reliability, and performance trusted by thousands of traders.

What Is Forex VPS Hosting?

Forex VPS hosting provides traders with a remote, always-on server used to run platforms such as MetaTrader 4, MetaTrader 5, cTrader, or other trading software independently of their home computer. Because the VPS operates inside a data-center environment, your trading terminals stay online 24/7, unaffected by local power cuts, device issues, or internet instability. This makes a VPS especially valuable for traders who rely on consistent uptime, stable performance, and uninterrupted access to market data across multiple trading sessions.

Why Latency and Reliability Matter?

In fast-moving markets, the connection between your trading platform and your broker’s server plays a major role in execution quality. A home internet connection may produce 100–300 ms of latency, depending on routing and network congestion, which can lead to slower fills or execution delays. A VPS located close to your broker’s infrastructure can reduce this to approximately 1–5 ms, depending on the broker’s server location and network path. Additionally, high-availability VPS environments help ensure that your trading platforms remain connected even during local outages, computer restarts, or ISP interruptions, supporting continuity for both manual and automated trading.

How a VPS Improves Trading Performance

Broker Proximity

Servers located in major financial hubs such as London (LD4), New York/NJ, Hong Kong, and Amsterdam reduce the physical and network distance to many brokers, supporting more responsive communication with trading servers.

Continuous Uptime

A VPS runs continuously with high availability, helping keep your platforms, indicators, and automated strategies active throughout all market sessions.

Dedicated Resources

Each VPS includes dedicated CPU cores, ECC RAM, and NVMe SSD storage, supporting stable performance even when running multiple terminals, charts, or automated systems.

Optimized Financial Network

The VPS uses low-jitter, low-packet-loss network routes, supporting more consistent data delivery and timely order transmission.

Cross-Platform Access

Access your trading environment securely from desktop, laptop, tablet, or mobile through encrypted Remote Desktop connections, allowing you to manage trades from virtually anywhere.

Platform Stability

A VPS isolates your trading environment from home PC crashes, updates, or power outages, helping prevent missed trades or interrupted strategies.

The Bottom Line

For traders who value consistent execution, stable connectivity, and uninterrupted platform performance, a low-latency VPS provides a dependable foundation. By reducing network delays, improving reliability, and keeping trading platforms online, a VPS helps support smoother operation across a wide range of strategies. Whether you trade manually or run automated systems, a VPS offers an environment designed for continuity, stability, and dependable performance.

Forex VPS FAQs

A Forex VPS (Virtual Private Server) is a remote server that you use to host trading platforms like MetaTrader 4. It allows you to access your trading platform from anywhere in the world with a secure internet connection, allowing you to take advantage of market opportunities quickly and efficiently.

Forex trading VPS is an essential tool for forex traders. Our Forex VPS hosting services will allow you to monitor your trading activity 24/7 and make decisions in a timely manner. Additionally, Forex VPS eliminates the need for dealing with latency issues and server availability, giving you smooth and reliable trading.

With advanced features and expert customer support, our Forex VPS servers provide a significant competitive advantage for forex traders like yourself.

Forex VPS hosting is specifically designed to cater to the needs of Forex traders, providing optimized server configurations for low latency, high-speed trade execution, and superior connectivity to brokers and liquidity providers. Regular VPS hosting, on the other hand, is a more general solution for various web-based applications and projects.

Forex VPS hosting often comes with pre-installed trading platform compatibility, such as MetaTrader, and offers dedicated support for trading-related issues. In contrast, regular VPS hosting typically lacks these specialized features and services tailored for Forex trading.

As a forex trader, you need a Forex VPS to ensure that your transactions are secure and reliable. With a Forex VPS, you can monitor your trading activity more easily, make decisions quickly, and take advantage of market opportunities as they arise. You‘ll also be able to avoid latency issues and server availability problems that can impede your success.

A Forex VPS is an essential tool for any serious trader. A Forex VPS also allows you to access your trading platform from anywhere in the world, giving you the flexibility to respond to opportunities and make trades from any location on the globe. With VPS Forex Trader, you will take your trading to the next level.

At VPS Forex Trader, customer satisfaction is our number one priority. We have been a reliable Forex VPS provider since April 2011. We conduct our operations on a quad router multi-gigabit network, which grants superior routing, redundancy, and capacity.

We own servers in multiple locations around the world so that you get the best connection to your forex broker. On top of that, our servers are fully scalable, so you can upgrade or downgrade your service plan without any data loss.

With VPS Forex Trader, you can be sure you‘re getting the best forex VPS hosting possible.

Yes, you can run Forex robots or expert advisors on our high performance Forex VPS! Our forex VPS solutions and servers are designed to provide you with a powerful and reliable platform to run your automated trading strategies with ease.

With lightning-fast connectivity, customizable options, and expert tech support, our VPS servers are the perfect choice for traders looking to do automated trading.

Our Forex VPS service takes just 15 minutes to set up, allowing you to quickly and easily get started with your trading activities without major delays. Our user-friendly setup process and expert tech support make it simple and hassle-free to get your forex VPS plans up and running in no time.

You can run up to four, seven, or ten applications of MT4/MT5 on a single fx VPS, depending on which Forex VPS plan you choose. If you have doubts as to which service plan you should choose, feel free to contact our customer support and we will help you out!

We accept PayPal, credit and debit cards, and cryptocurrency payments.

Single‑digit to low double‑digit ms is ideal for active traders. Choose a VPS region close to your broker’s matching engine and test ping from the VPS to the broker server for the most accurate figure.

Pick the data center nearest your broker (e.g., Equinix NY4 for many US brokers, LD4 for London). Closer geography usually means lower latency and more consistent fills.

A VPS can’t control market conditions, but hosting close to your broker reduces network delay, which often reduces slippage in fast markets.

Our stack is built for 24/7 trading, with redundant infrastructure and DDoS mitigation for stability during volatile sessions; see our SLA/Terms for details.

As a guide: Smart (up to 4 MT4/MT5), Boost (up to 7), Max (up to 10); heavier indicators or multiple charts may warrant the next tier.

The VPS is optimized for MetaTrader 4/5 and compatible with cTrader and NinjaTrader

Use Microsoft Remote Desktop on macOS/iOS/Android to RDP into your VPS, then run MT4/MT5 as if you were on a Windows PC.

VPS plans run Windows Server 2022 Standard pre‑installed; you log in via Administrator to install and manage platforms, indicators and EAs.

Upgrades are engineered for seamless scaling with zero data loss; backup/restore options are available to protect your environment.

Plans are fully scalable, you can upgrade RAM/CPU/SSD as strategies grow, minimizing or avoiding interruptions.

Yes, just size the plan to your terminal count and EA load; keep charts lean, use sensible logs, and periodically restart terminals to avoid resource creep