Institutional traders significantly influence the forex market. This is the foundation of ICT, a trading methodology that stands for Inner Circle Trader. ICT is a structured forex trading style that focuses on gaining an understanding of the market through the lens of institutional traders. In this article, we will explore how this trading style works to help you understand how you can trade with it effectively.

What is ICT in trading?

ICT is short for Inner Circle Trader, referring to Michael J. Huddleston, the trader who came up with the trading methodology. ICT focuses on using market structure and liquidity to identify high-probability trading opportunities by following the activities of large institutional traders (smart money traders).

The goal of this strategy is to understand how smart money traders influence the market and cause significant price movements. freefff has been applying this method since the early 2010s.

It is based on the idea that large institutional traders, such as banks and hedge funds, influence price behavior before entering any significant positions. However, their action leaves “footprints” that can be identified through specific chart patterns and market structure assessments. By identifying these footprints, retail traders can capitalize on institutional order flows to find potentially profitable positions.

Understanding ICT Trading Patterns: Key Concepts and Structures

Inner Circle traders position themselves to profit from the smart money moves of big institutional traders. To do this, ICT traders rely on a number of key concepts that can help them recognize institutional trading actions. Some of the core concepts of this trading methodology include:

Swing Points

A Swing point is an important concept in ICT trading which focuses on identifying the highs and lows in a market structure that may signal potential turning points of a price action. A swing high is formed when the price reaches a peak that is higher than the prices immediately before and after it, often indicating a potential resistance area. On the other hand, a swing low is formed when the price moves down to create a lower low over two previous swings, representing a support.

Equal Lows/Highs

This is another concept that can be used to identify support and resistance levels in ICT. This is formed when the price returns to a level that has been touched previously. Many retail traders tend to place their stop-loss orders in areas of Equal Lows/Highs. Institutional traders then target these areas to create liquidity for their orders. An Inner Circle Trader may follow this move to identify a liquidity sweep that will trigger a trend reversal.

Liquidity Zones

Liquidity zones are areas with a high concentration of buy or sell orders. Liquidity can either be on the buy side (more buy orders at a price level) or on the sell side (more sell orders at a price level). Institutional traders look out for these zones to fill their large orders which makes it an area of interest for inner circle traders as well.

Discount & Premium Zones

A discount zone represents an area on the chart where price levels are undervalued. This occurs when the price falls below the 50% retracement levels of a recent range. On the other hand, an overvalued price level is known as a premium zone and it occurs when the price rises above 50% of the retracement. Discount zones are ideal for buying while premium zones present a good selling opportunity.

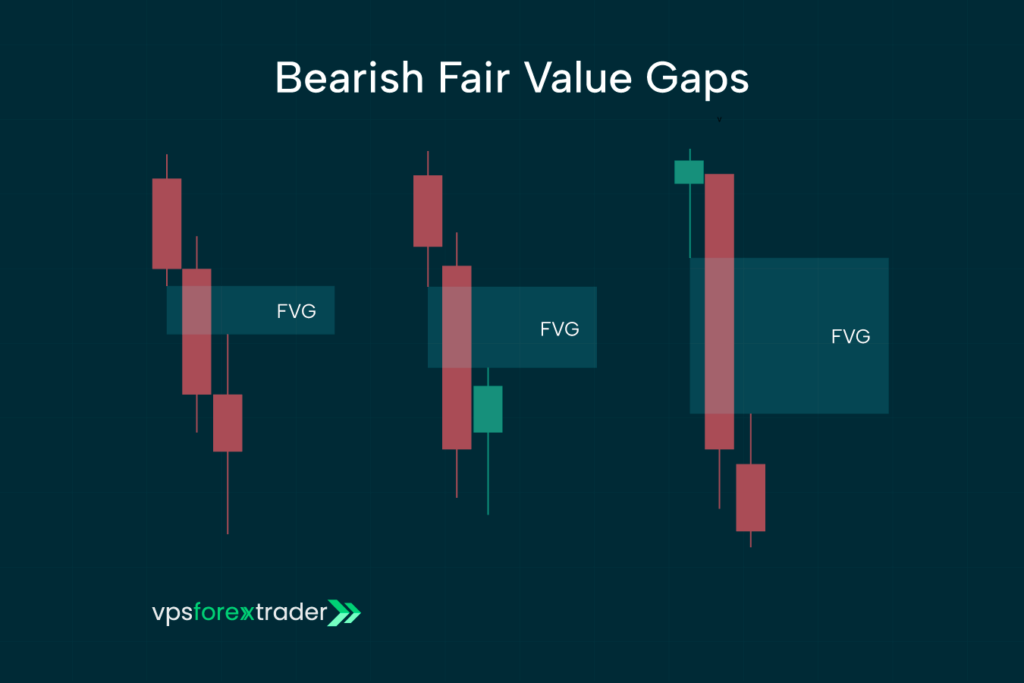

Fair Value Gap

A fair value gap is formed on a trading chart when there’s a significant price movement that causes an imbalance between buying and selling pressure. The gap can be bullish (in the case of strong buying interest which causes price to jump), or bearish (when there’s higher selling pressure causing a price drop). The Fair Value Gap can be used to find optimal entry points and manage risks in trading. After the fair value gap has been identified, you wait for a price retracement toward the gap. After the gap has been filled, you can make a trade based on the direction of the price movement.

Key Components of an Effective ICT Trading Strategy

An ICT trading strategy is built on a combination of trading concepts all of which are focused on institutional price movements. Some of the key components of an effective ICT strategy include:

Market Structure Analysis

ICT Traders analyze the market structure to make trading decisions. Specifically, they focus on the transition between the bullish and bearish phases of the market with the goal of identifying key zones of support and resistance that may serve as potential entry and exit points for institutional traders.

Identifying Liquidity Pools

Another strategy ICT traders have to get good at is identifying liquidity pools. These are areas where a large number of stop-loss orders have been placed. Liquidity pools attract institutional traders who take out these pools allowing trade to go in the other direction. ICT traders can then place their trade in the direction of the institutional flow.

Time and Price Theory

ICT trading prioritizes certain trading sessions over others because these are preferred sessions for institutional traders. Examples include London and New York Open sessions. Placing trades during these sessions allows you to align with the smart money moves of institutional traders.

Step-by-Step Guide to Implementing an ICT Strategy

Understanding ICT concepts is one thing—putting them into practice is something else entirely. Below is a practical, step-by-step approach to applying the core principles of the ICT (Inner Circle Trader) methodology in real trading. This framework helps bring structure and consistency to how you analyze the market and plan your trades.

1. Establish a Daily Bias

Before you do anything else, establish a directional bias for the day. In ICT terms, this means identifying whether the market is more likely to expand higher or lower during the current session. This directional bias serves as your filter—it doesn’t tell you exactly where to trade, but it tells you what direction to favor.

To determine this, look at:

- The previous day’s high and low

- Weekly and daily opens

- Higher time frame structure (especially on the 4H and Daily charts)

Your goal is to align with the institutional narrative—are they accumulating to go long, or distributing to push price lower?

2. Identify Liquidity Pools

Once you have a bias, the next step is to find where liquidity is likely resting. ICT strategies revolve around the idea that large players seek out liquidity to enter and exit their positions. Liquidity pools tend to form around:

- Previous session highs and lows

- Equal highs or equal lows

- Obvious swing points that retail traders use for stop placement

Mark these areas on your chart. These are your potential targets—zones the market is likely to move into before reversing.

3. Wait for a Liquidity Sweep

ICT doesn’t encourage chasing breakouts. Instead, you wait for the market to run the liquidity. For example, if your bias is bearish, and the market takes out a previous high (where stop-losses from retail sellers are sitting), that liquidity sweep can serve as your setup trigger.

You’re looking for a clear raid—price reaching into a liquidity pool and then rejecting. This sets the stage for a potential reversal and confirms that the market has cleared the “obvious” stops.

4. Look for a Market Structure Shift (MSS)

After a liquidity sweep, you don’t enter right away. Instead, wait for a shift in market structure that confirms the move. This usually shows up as a break in the short-term trend in the opposite direction.

For a bearish trade:

- Price sweeps a prior high (liquidity)

- Then forms a lower low (break of structure)

- Then offers a lower high (your potential entry)

This shift is your confirmation that the market is transitioning away from retail positioning and toward the institutional direction you’re trying to follow.

5. Enter at an Optimal Trade Entry Point (OTE)

Once structure shifts in your favor, look for your entry—ideally at a retracement. ICT traders often use the 62%–79% Fibonacci retracement zone, drawn from the impulse leg created by the market structure shift.

This “OTE zone” is where institutions tend to load positions, and where you’ll typically find order blocks or fair value gaps that act as entry confluence.

The goal is not just to enter at any point, but to wait for the market to pull back into a premium or discount before stepping in. This improves your risk-to-reward and puts you in alignment with institutional flows.

6. Set Your Stop-Loss and Take-Profit Levels

With your entry planned, set risk parameters. ICT methodology encourages logical stop placement—typically just beyond the high or low of the swing that created the structure shift. Avoid arbitrary pip-based stops.

For take-profit, the most common targets are:

- The opposite side of the market’s recent liquidity (e.g., if you’re short, target a previous low)

- A specific measured move based on the recent leg

- A fair value gap or order block on a higher time frame

Always define your risk and reward clearly before entering the trade. ICT strategies aren’t about “catching a big move” every time—they’re about precision, timing, and consistent execution.

Putting It All Together

This process may seem complex at first, but with practice, it becomes second nature. The key is patience. ICT trading isn’t reactive—it’s about anticipating where the market wants to go and positioning yourself accordingly, often before the obvious move has happened.

By building this structured flow into your routine—from bias to liquidity, from sweep to structure shift—you’re thinking like a professional, not a retail follower.

If you’re serious about mastering ICT principles, this step-by-step framework is where it all begins.

Conclusion

ICT is a comprehensive trading methodology that has gained popularity in recent years. It is not a single strategy in itself. Instead, it is a trading philosophy that leverages several existing concepts and methodologies to predict the moves of institutional traders and guide your trading decision.

Frequently Asked Questions About ICT Trading

What Does ICT Stand For In Trading?

ICT is short for Inner Circle Trader, a trading methodology created by Michael Huddleston.

What Is VI In ICT Trading?

In ICT trading, VI means Volume Imbalance, referring to areas on a price chart where the price action shows deviation from the normal order flow. The VI indicates a potential reversal or continuation of a price trend.

Who Created ICT Trading?

ICT was created by Michael Huddleston, a seasoned trader with over 25 years of trading experience famously called Inner Circle Trader.

What Is BPR In ICT Trading?

In Inner Circle Trading, BPR stands for Balance Price Range. This is a trading concept that focuses on identifying the overlap between two Fair Value Gaps. In this overlapping zone, there’s a temporary equilibrium between buyers and sellers. The BPR is a potentially good point to enter a trade during market pullbacks.

How To Learn ICT Trading?

Michael Huddleston, the creator of the ICT trading strategy has a YouTube channel where you can find videos to help you learn how this trading methodology works and develop a strategy that works for you. You can also learn from other traders who learned from Micheal and have gone on to create courses of their own based on the strategies they have learned and practiced.