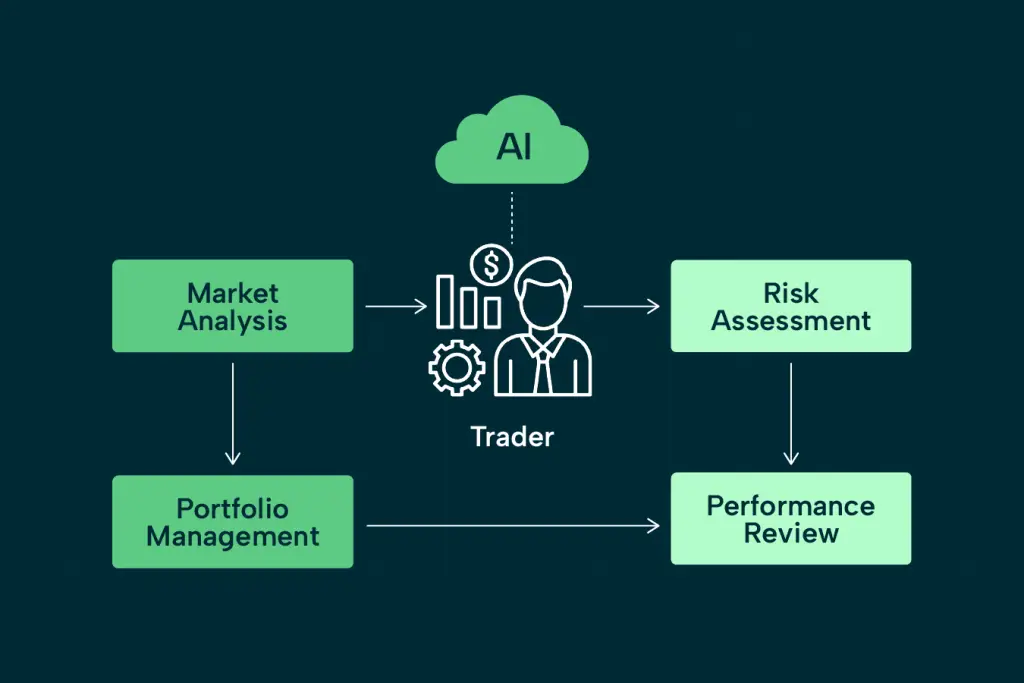

Artificial intelligence offers powerful capabilities like real-time data processing and predictive analytics. These are features that you’ll find incredibly valuable as a forex trader. To put it simply, if AI were a person, it’d make the perfect assistant.

Today’s AI trading co-pilots can analyze vast amounts of trading data and generate sophisticated models that are useful to your forex trading workflow. The best part is that they’re not complex code-based systems. Instead, traders, including those without tech skills, can leverage the benefits of AI using simple but well-structured prompts. To make sure these AI-driven workflows run reliably alongside your trading platforms, many traders host their setup on a dedicated forex VPS for stable and low-latency connectivity.

This article is a comprehensive guide to the world of AI trading co-pilots, explaining how AI can assist you with analysis, strategy, and risk management.

What is an AI Trading Co-pilot?

An AI trading co-pilot is a powerful tool that leverages advanced machine learning algorithms and real-time data analysis to assist traders with trading decisions. These tools are capable of processing data from thousands of sources in real time and provide traders with up-to-date insights, strategies, and directional signals.

An AI trading co-pilot empowers traders to navigate volatile trading markets with greater precision. It achieves this through quick and efficient data processing, presenting insights in a comprehensive and actionable way.

In 2025, AI co-pilots are an integral part of the tech-savvy trader’s evolution. They’re designed to process vast amounts of structured and unstructured data from news sentiments to economic reports, social media posts, fundamentals, and technical indicators. They then contextualize these data points and create increasingly accurate predictive models based on them. At the end of the day, these tools help traders maximize success while simplifying decision-making and reducing stress for traders.

AI copilots make sophisticated, enterprise-grade market analysis available for small-scale retail traders. Everyone, including non-coders (non-quants), can tap into these simple prompt-based AI models to leverage their extensive data processing and predictive modeling capabilities. Part traders with limited time and experience to carry out these analyses can also benefit from the reduced research time and intelligent assistance provided by these tools.

From Tools to Teammates: What AI Co-Pilots Really Do

AI co-pilots are intuitive assistants that work together with traders to give them a comprehensive view of the trading market. These tools help traders make trading decisions faster and more effectively. It’s like having a smart analyst capable of processing vast amounts of data and generating clear insights that will help you make the right decisions.

An AI trading co-pilot is designed to augment and enhance the capabilities of human traders. They’re different from AI trading bots, which have been designed to fully automate trading decisions based on specific pre-set rules. Instead, the co-pilot is a sophisticated partner, equipped to provide insights, expert analysis, and support so you can make better informed decisions.

An AI co-pilot also goes beyond simply answering questions (like an assistant). These tools are capable of understanding contexts and can provide proactive suggestions that will help a trader streamline their workflow comprehensively. However, the execution of the recommended strategies is still up to the human traders.

Thanks to recent advancements in AI and machine learning technologies, AI copilots have become incredibly versatile, providing intelligent assistants for various trading needs. There are numerous examples of traders who use AI tools like BetterTrader.co’s AI-Trader copilot to answer trading questions in real time. This tool is capable of pulling the latest insights and organizing them into easy-to-digest recommendations.

Traders also tend to use the advanced algorithms offered by tools like this to analyze patterns and get actionable suggestions. Many users claim that they use Algobull’s autopilot function to generate strategy logic without writing a line of code. According to one user, “I just described my trading logic and Copilot gave me a working version I could test right away.”

A trading co-pilot tool is also a valuable tool for risk assessment and analysis. Traders can use this tool to calculate the optimal position size for a specific trade, identify the risk, and determine the recommended stop-loss level.

Practical Use Cases for AI in Trading

AI co-pilots are augmenting the capabilities of human traders by providing deep insights and streamlining workflows for greater efficiency. The following are some of the practical use cases of copilots in the trading process.

Market Analysis (Macro + Technical)

AI copilots can help traders stay ahead with real-time market analysis based on their specific trading strategy and goals. These tools are capable of analyzing both technical and macroeconomic data. AI copilots can stay on top of news, events, and market sentiments. This way, traders don’t have to manually sift through the news to find information most relevant to their trade. They can also use past price data to gauge and determine likely price movement. The expert market analysis provided by these tools allows traders to seize opportunities without delay while also reducing the stress and complexity associated with manual data analysis.

Strategy generation

Human traders can make better trading decisions by leveraging AI-powered strategies and insights. AI copilots are trained to recognize patterns in the market and provide data-backed recommendations to traders. While it isn’t a fail-safe solution, these advanced tools are capable of generating insights with a high probability of success. They can also be used to back-test strategies before applying them to determine how they’ll likely play out in real life.

Risk Evaluation

Risk evaluation is a vital part of every Forex trader’s strategy. Traders can use AI co-pilots to evaluate specific trading scenarios or their entire trading strategy. These tools are capable of running complex simulations, showing potential losses and a specific confidence level for any strategy or insight generated.

Based on the trader’s individual risk tolerance, account size, and the specific trade’s volatility characteristics, the co-pilot can suggest optimal trading conditions such as the ideal top-loss/take profit level, optimal position size, hedging strategies, and other factors to manage their portfolio smartly.

Idea validation

AI copilots don’t just recommend trading strategies; they can also help validate ideas or strategies generated by human traders. The co-pilot can run specific simulations based on scenarios described by the trader and validate them against historical and current market data, generating insights and recommendations within minutes or seconds. This is a much faster approach compared to manual testing or the traditional coding applied by seasoned quants and institutional traders.

Trade Journaling

An AI co-pilot can be integrated directly into your trading account or brokerage platform to keep a record of vital metrics related to your trade. This is recorded along with contextual information for each trade as part of a trader’s comprehensive journal. The data collected in the journal can be analyzed in the future to pinpoint specific trading strategies, chart patterns, or market conditions that have been favorable to the trader.

Prompt Library for Traders

AI co-pilots empower traders with sophisticated analysis that goes beyond simple data presentation. These AI tools can offer actionable insights and strategic recommendations based on specific prompts. The table below shows some prompt examples that illustrate how traders can use copilots.

| Use case | The problem | Specific Prompt Example | Result |

| Market trend summary prompt | It’s challenging to synthesize all the critical information from global financial news, economic data, and technical indicators into concise and actionable insights. | “Summarize the key market trends for EUR/USD on the 4-hour timeframe, including major support/resistance, current sentiment from news, and relevant economic catalysts expected this week. Highlight any potential high-impact events.” | The AI co-pilot creates a digestible summary based on real-time price data, technical indicators, news feeds, economic calendars, and sentiment analysis from various sources. |

| Generating trading strategies | A trader has an idea for a trading strategy but struggles to formalize the entry, exit, and risk management rules. | “Generate a forex strategy for GBP/JPY based on a breakout of daily support/resistance levels. Include specific entry rules (e.g., candle close outside range), a logical stop-loss placement, a profit target method (e.g., 2x ATR), and consideration for risk per trade (e.g., 1% of equity). Add conditions for trading only during the London session.” | The AI copilot uses its knowledge of technical analysis, risk management principles, and market session dynamics to construct a coherent strategy framework based on the user’s input. |

| Check for flaws in entry logic | A trader has been experiencing unexpected losses or whipsaws and suspects their entry logic might be flawed, perhaps leading to entries against strong momentum or into liquidity traps. | “Analyze my recent 10 losing trades on AUD/USD. My entry logic for these trades was: ‘Enter long if price breaks above previous day’s high AND 10-period SMA is above 20-period SMA on the 30-minute chart.’ Identify any common flaws, missing confirmations, or market conditions that consistently led to these losing entries.” | The AI accesses the trader’s specified losing trades, analyzes the market context at each entry point, and compares it against the stated entry logic to identify failure patterns. |

AI Tools & Platforms That Work Well

There are several AI tools and platforms that traders can adopt for trading purposes. This ranges from general-purpose AI platforms to trading-specific tools with AI capabilities. Some of the most notable examples are listed below:

General-Purpose LLMs – GPT, Claude, Gemini

General-purpose Large Language Models like ChatGPT, Gemini, or Claude are not built specifically for trading. However, traders can still leverage the rudimentary features of these tools for basic market research, data analysis, and idea generation. For instance, you can ask the LLM to summarize reports, news, or other relevant market data. You can also describe specific trading scenarios and ask for ideas or recommendations based on the information you have provided. However, since these tools are not primarily meant for trading, they may not be suitable as stand-alone trading co-pilots.

Specialized AI Trading Platforms & Tools

Many specialized AI trading tools now feature AI-powered features that make them useful as co-pilots for traders. For instance, analysis platform Capitalize.AI allows users to describe complex trading scenarios in order to simulate and backtest strategies before they’re applied to their trade. This platform can help generate sophisticated conditional logic for trade entries, exits, and risk management.

Similarly, StockGPT is like ChatGPT but for trading, with features that support in-depth research and fundamental analysis. TrendSpider is another tool with useful AI features. Specifically, it has an AI-powered technical analysis system that can analyze the market to detect chat patterns, trendlines, and other indicators.

Brokers with Integrated AI Insights

Many modern brokerage platforms now incorporate AI features directly into their platform. The main advantage of this is that you get AI-assisted directly where you trade instead of relying on external tools or co-pilots. These tools can pull live data from the platform for analysis and strategy recommendations. AI-copilots built into brokerage platforms are particularly useful for generating detailed breakdowns of your performance so you can adjust your strategy accordingly.

No-Code Workflows (e.g., ChatGPT/Gemini + Excel or TradingView)

Quants and expert coders often build complex trading workflows with code to optimize their trading strategy. Non-coders can create their own workflows as well, using a combination of AI-powered tools with co-pilot functionalities. For instance, you can use an LLM like ChatGPT or Gemini to generate complex formulas that can be applied within an Excel spreadsheet for quantitative analysis. Similarly, traders can generate Pine Script (or modify an existing script to be used in TradingView for advanced charting and backtesting purposes.

AI Co-Pilot vs Bot: What’s the Difference?

AI can be applied to trading in two different ways: either as a co-pilot or as an automated bot. The main difference between these two solutions is in the level of autonomy or control that the AI tool has and how much human traders have to do as part of the trading process.

Manual + Supported vs Automated

An AI co-pilot acts as an intelligent assistant that works alongside a human trader. Its primary role in this arrangement is to augment human capabilities by providing real-time insights, suggestions, advanced analysis, and decision support. The human remains firmly in control, making the final decisions and executing the actions.

On the other hand, the AI Bot or agent is designed to operate autonomously. It is programmed to execute trades, send alerts, exit trades, or carry out any other action based on predefined rules or algorithms. Once set up, bots require minimal to no human intervention except to stop or alter their operation.

Control vs Delegation

With an AI co-pilot, the human trader retains full control over all trading actions. The AI’s job is to simply provide insights, identify opportunities, and recommend trading action. The tool is only there to enhance the trader’s decision-making rather than taking charge itself. Traders who use AI bots delegate responsibility to the bot. Once the bot is activated, it autonomously performs the trading operations based on the rules that have been programmed into it.

| Feature | AI Co-Pilot | Trading Bot | Assistant (e.g Financial Advisor) |

| Autonomy/Control | Assists human; human retains full control & final decision. | Autonomous execution; operates independently after setup. | Assists human; human retains full control & final decision. |

| Primary Function | Augments human decision-making, provides insights & analysis. | Automates trade execution based on predefined rules/algorithms. | Provides personalized advice, strategy, and administrative support. |

| Data Processing | Processes vast amounts of structured & unstructured data in real-time. | Processes structured market data; can integrate some unstructured data (e.g., sentiment). | Processes data based on human capacity; relies on curated reports/sources. |

| Decision-Making | Offers data-driven recommendations, “what-if” scenarios, and risk assessments. | Makes decisions based on programmed logic or learned patterns. | Uses experience, market knowledge, and client’s financial goals. |

| Human Interaction | Highly interactive, conversational, provides explanations. | Minimal direct interaction once configured; mostly monitoring. | Highly interactive, builds rapport, personalized communication. |

| Learning/Adaptation | Continuously learns from user feedback, new data, and market changes. | Can learn and adapt over time (for AI agents/ML bots); rule-based bots are static. | Learn from experience, market events, and professional development. |

| Best Use Cases | Enhancing complex decision-making, in-depth research, risk assessment, learning. | Automating repetitive strategies, high-frequency trading, disciplined execution. | Long-term financial planning, complex asset allocation, and personalized guidance. |

Strengths, Limitations & Responsible Use

In a field as complex as trading, you need all the help that you can get. This includes tapping into the incredible computational power of AI copilots. Of course, with any tool, you need to be aware of its potential limitations and figure out how to use it successfully. Below is our analysis of the strengths and limitations of AI in trading.

Where AI shines (speed, objectivity, logic)

The primary strength of AI copilots lies in their ability to analyse vast amounts of data and compute complex technical analysis within a few seconds to identify patterns and recommend smart strategies. This is significantly faster than what any human can do on their own, which means tapping into AI can give you an edge in terms of speed and efficiency.

But AI isn’t just fast; these tools are programmed with sound logic and a level of objectivity that humans simply don’t have. Artificial intelligence isn’t subject to human emotions, which makes it less prone to irrational decisions. Zero emotions means there’s no bias or human error that may lead to costly mistakes and losses.

Where it fails (context, hallucination, emotional markets)

But while emotions are often seen as a limitation in humans, they sometimes act as a brake that can guide smart decision-making. Human intuition and common sense make it easier to understand nuances that make certain trades more practical than others. AI lacks this sense of intuition, and this can profoundly impair its recommendations in certain instances.

Additionally, an AI tool is only as smart as the data provided to it. Although AI algorithms have gotten quite advanced at understanding contexts, they’re still prone to contextual blind spots due to limited data, leading to inaccurate recommendations in some instances.

So while AI co-pilots can be trusted to a large extent, it must be done with a good measure of caution. Traders might become overly reliant on the co-pilot’s suggestions, neglecting their own critical thinking and due diligence. This can be dangerous if the AI makes an error or operates on faulty assumptions.

The Future of AI for Traders

The future of AI in trading looks quite promising. As computers become more advanced and new technologies emerge, we’ll be able to see AI systems process vast amounts of data quickly and in real time. This will allow traders to get instant feedback and trading strategy recommendations that will be valuable in the fast-paced trading market.

As AI continues to evolve, we’ll likely witness the emergence of more sophisticated systems with advanced features such as voice-activated assistance. Traders will be able to describe complex queries verbally to the AI and prompt it to provide immediate and relevant analysis. This feature will allow hands-free operation, which will be particularly beneficial for active traders who need to monitor multiple screens or charts. For instance, players can keep their hands on their keyboard/mouse for execution while querying the AI for real-time information or analysis by voice.

In the future, we’ll likely see the emergence of AI copilots capable of learning and optimizing their strategies or recommendations based on feedback. This will allow the AI system to learn from small successes and failures, even as it recommends smart strategies. AI co-pilots will become better adapted to individual trader profiles in order to maximize their effectiveness for that specific trader.

Final Thoughts

AI trading co-pilot empowers traders by providing actionable insights, recommendations, and risk-management features based on real-time and historical market data. It’s like having an intelligent assistant at your beck and call, constantly scanning the market for potential opportunities and optimizing your trading strategies accordingly. A tool like this has the potential to amplify our trading expertise. AI isn’t a substitute for your trading skills and experience, but it can definitely enhance decision-making when used correctly. Interested in learning how AI trading can give you an edge? Consider incorporating copilot workflows into your trading strategy and iterating gradually for optimal performance.

FAQs

Can Ai Co-Pilots Automate Trades For Me?

By design, AI co-pilots are not meant to automate trades without human intervention. They’re different from trading bots designed specifically for automating trades. Co-pilots simply optimize a trader’s decision-making by assisting and augmenting their trading strategy.

What’s The Best AI Tool For New Traders?

An AI co-pilot is the best tool for new traders. These tools focus on education, guided analysis, and insight-based recommendation, often with a user-friendly, no-code interface. You can start with a conventional LLM, a specialized AI trading tool, or use brokers with integrated AI features.

Do I Need Coding Skills To Use Ai In My Strategy?

No. You do not need coding skills to adopt AI in your trading strategy. Many AI co-pilots work based on text-based prompts, allowing non-coders to use them effectively.

How Is This Different From A Trading Bot?

AI co-pilots are different from trading bots in the sense that they do work autonomously to automate trading. Bots carry out specific actions based on preset rules, while co-pilots assist traders with the trading process. The final action is still within the user’s full control.