The hammer is a popular single-candle pattern traders typically use to identify potential reversals on a chart. Named after its distinctive visual resemblance to an actual hammer, this candle can be quite valuable in predicting market movements and working out your trading strategy. Read on as we explore the concept of hammer candlesticks, how to identify them and how to incorporate them into your trading strategy.

Introduction to Hammer Candlesticks

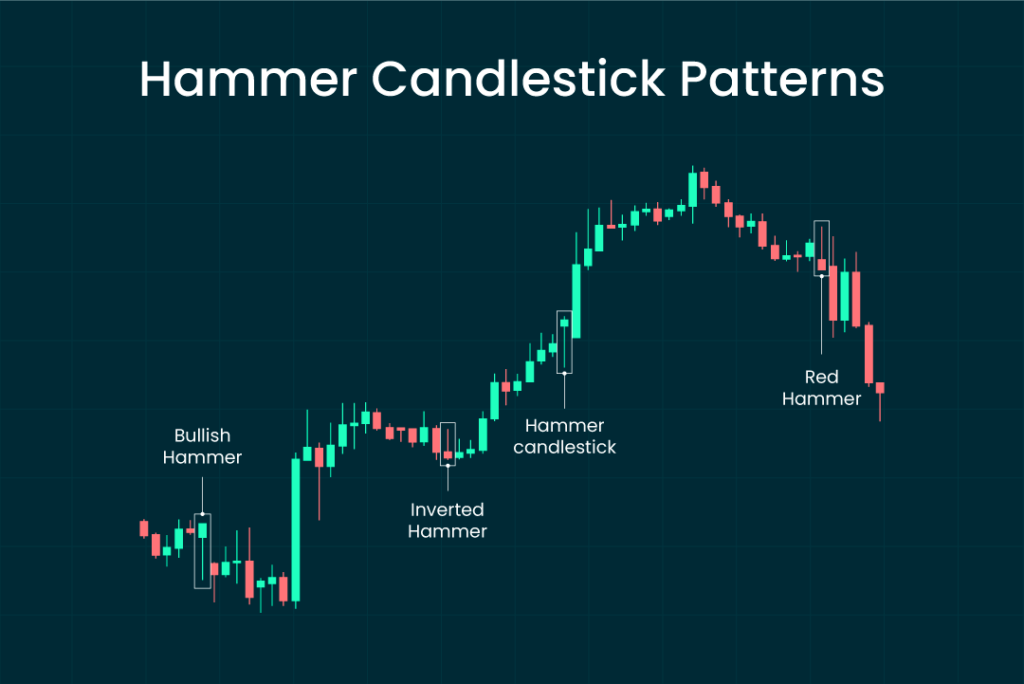

When it shows up on a chart, the hammer candle is typically interpreted as a reversal pattern. It is formed when the price of a traded asset falls significantly lower than the opening price, but rallies within the trading period so it closes near the opening price (either above or below the opening). This kind of price trend suggests that the market is trying to determine a bottom.

The Hammer candlestick is a sign that there has been a possible change in the market trend. The long shadow means the market rejected a significant pressure to sell, so a potential trend reversal to the upside is imminent.

Identifying Hammer Candlestick Patterns

You should have no trouble recognizing the hammer candlestick. As the name suggests, the candlestick looks very much like an actual “hammer” or the letter “T”. This type of shape is formed by a small candlestick body with a long wick or shadow. The wick is typically twice as long as the candle’s body. Hammer candles also tend to have a short upper shadow. This implies that there was limited buying interest after the rejection of selling pressure.

The hammer candle has an appearance closely similar to the “Doji candle”. However, it has a longer and more prominent body compared to the Doji, which is often so short that it almost looks like a horizontal line. Both green and red hammers can be found on charts. The green color means the market trend is strongly bullish, while the red color means the bullish run is weaker.

Understanding Inverted Hammer Candlesticks

If you turn the hammer candlestick upside down, what you get is the inverted hammer. This means the candle will have a long upper shadow and a short body. The wick is typically twice as long as the body, while the closing and opening prices are all near the same level at the bottom of the candle. The inverted hammer candle indicates a significant rejection of buying pressure, which could lead to a potential reversal to the downside.

Bullish Hammer Candlesticks Explained

Technically, both green and red hammer candlesticks are considered bullish signals. However, the green bullish hammer candle is considered a stronger signal as it indicates the bulls have a stronger potential to overpower the bears during the trading session. Consequently, the green bullish hammer candlestick is often taken as a stronger trading signal compared to the red.

Significance of Red Hammer Candlesticks

In technical analysis, the color red signifies high selling pressure in the market. However, in the case of a red hammer candlestick, the market is still bullish despite the selling pressure. The long lower shadow of this candle indicates that the buyers ultimately rejected the selling pressure and the market stayed bullish.

Using Hammer Candlesticks to Predict Market Movements

A hammer candlestick typically appears after a price decline (at the bottom of a downtrend). When this occurs, it signals a potential reversal to a bullish market, with the buying pressure overcoming the selling pressure.

However, this reversal to the upside will only be confirmed if the candle following the market prediction hammer candlestick closes above the hammer’s closing price, indicating strong buying. Generally, it is recommended to wait for this confirmation before entering a trade.

Incorporating Hammer Candlesticks into Your Trading Strategy

Incorporating hammer candlesticks into your trading strategy depends on your risk aversion. Traders with a high-risk appetite typically take a trading position as soon as they see a hammer pattern form in anticipation of a trend reversal. In this case, the hammer’s closing price is taken as the entry point to the trade while its low price is used as the stop loss. However, traders with a low-risk appetite will typically wait for the next two to three candles to confirm the trend reversal.

Most traders use a hammer candlestick strategy as an indicator to enter a long trade. However, it could serve as a signal to exit a short position on a downtrend before the trend reverses. Note that when trading with hammer candlesticks, the appearance of a hammer candle does not guarantee a trend reversal. The market can still continue to move in its current direction after a hammer signal appears which is why it is always best to wait for a confirmation.

Common Mistakes and How to Avoid Them

The hammer candlestick pattern is one of the most recognizable reversal signals in technical analysis, but it’s also one of the most misunderstood. Many traders spot what looks like a hammer, jump into a trade, and end up getting stopped out because they overlooked key details. Here are three of the most common mistakes traders make with hammer patterns-and how to avoid them.

1. Misidentifying the Pattern

Not every candle with a small body and a long lower wick is a valid hammer. The most important context is that a hammer must occur after a clear downtrend. If you see a similar-looking candle in a sideways market or during an uptrend, it’s not a hammer-it’s just noise.

How to avoid it:

Only treat the pattern as a hammer if it forms after a visible bearish move. Look for multiple red candles leading up to it, ideally breaking previous lows. If price has been trending sideways or upward, ignore the pattern-even if it looks technically correct.

2. Ignoring Confirmation

A single candle doesn’t make a trend reversal. One of the biggest mistakes newer traders make is entering a trade immediately after spotting a hammer without waiting to see what happens next. Without bullish confirmation in the following candle, the pattern could easily fail.

How to avoid it:

Wait for confirmation-usually in the form of a strong bullish candle that closes above the hammer’s body. This shows that buyers are actually stepping in, not just covering shorts or pausing. In some cases, a break above the hammer’s high can serve as an entry trigger.

3. Overlooking Market Context

Relying solely on candlestick patterns without considering the broader market environment is a recipe for inconsistency. A hammer pattern might appear at a strong support level and signal a high-probability reversal-or it might form in the middle of nowhere and mean nothing at all.

How to avoid it:

Zoom out and assess the overall trend, support/resistance levels, and recent price action. A hammer at the bottom of a long-term range, near a daily support zone, or at a Fibonacci retracement level carries much more weight than one floating in the middle of a trendless chart.

By avoiding these common mistakes and focusing on proper context, confirmation, and structure, traders can use the hammer candlestick pattern far more effectively. As with any tool, it’s not the pattern itself that matters most-it’s how you apply it within a disciplined, thoughtful strategy.

Frequently Asked Questions

What is a hammer candlestick?

A hammer is a bullish candlestick pattern characterized by a short body and a long lower shadow (typically two or three times the length of the body).

How do you identify a hammer candlestick pattern?

The hammer candlestick is a single candle shaped like a hammer or the letter “T” ” It is characterized by a short body, a long lower shadow and a short upper shadow.

What does an inverted hammer candlestick indicate?

An inverted hammer candlestick has a long upper shadow indicating a rejection of buying pressures, which leads to a potential reversal to the downside.

How is a bullish hammer candle used in trading?

A bullish hammer candle in a downtrend is considered a sign of a potential trend reversal. Traders can take this as an indicator to enter a long trade or as a sign to exit a short.

What is the difference between a red hammer candlestick and a green one?

Red and green hammers are both bullish trend reversal patterns. However, the red color implies that the selling pressure was still greater than the buying pressure during the trading period. Consequently, the green signal is considered a stronger bullish signal than the red.

Can hammer candlesticks predict market reversals?

Yes, hammer candlesticks are good indicators of a potential market reversal. It suggests a change in market sentiments leading to buyers gaining control.

How do hammer candlesticks fit into a trading strategy?

Hammer candlesticks can be used to identify potential trend reversals. Consequently, they can be used as an indicator to enter or exit a trade. It can also be used to manage risks in trading such as setting stop-loss orders and limiting your position size.