Algorithmic trading, or algo-trading, is a method of executing orders using automated, pre-programmed trading instructions. These instructions, or algorithms, account for variables such as time, price, volume, and various mathematical models. In essence, you are writing a code that tells a computer exactly when to buy or sell a security (like stocks, futures, or options) on your behalf.

In the world of algo trading, your strategy is the most critical asset, far outweighing the importance of the software or programming language you use. Sustainable profits (or “alpha”) come from identifying and exploiting a persistent, repeatable market inefficiency—this is the strategy. The execution tools only ensure that you capture that edge quickly and precisely.

This article provides a comprehensive overview of top strategies for a diverse audience, including coders, non-coders and traders. The goal is to help you find the best path into automated trading and figure out the best strategy for you.

What Are Algo Trading Strategies?

At its simplest, an algo trading strategy is an explicit, quantifiable trading plan translated into computer code. The algorithm monitors market conditions—such as price, volume, time, and indicators—and automatically executes trades at high speed and precision when all predefined criteria are met.

Core idea: rules + automation

The success of any algorithmic strategy rests on two fundamental pillars: rules and automation. The rule is the core intellectual property that gives the trader a market edge. These rules must be unambiguous and quantifiable. A rule might be, “Buy when the 50-day Moving Average (MA) crosses above the 200-day MA.” The rule defines the entry, exit, position size, and risk management parameters.

Automation is the how aspect of your algo trading strategy. It involves using computer systems to execute the rules without human intervention. This removes the major drawbacks of manual trading: emotional decision-making (fear and greed), slow reaction time, and human error (like mistyping an order quantity). The automation ensures speed and consistency.

To ensure these automated strategies run with minimal latency and no interruptions, many traders deploy them on a dedicated Forex VPS such as VPSForexTrader, which provides always-on connectivity and faster execution than a home PC.

AI vs classic rule-based strategies

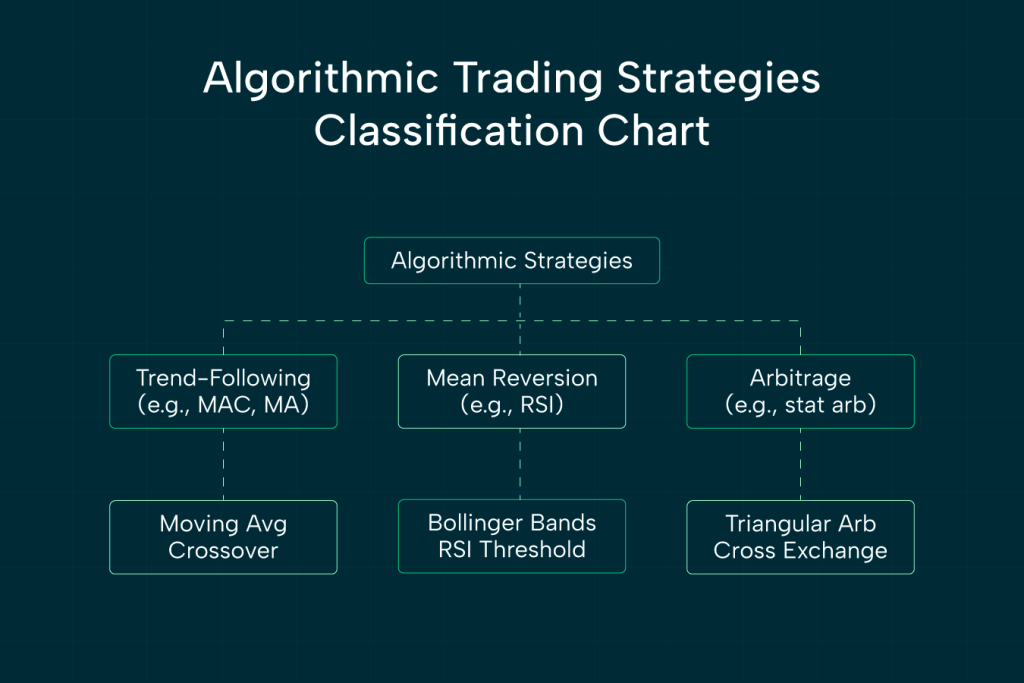

A classic rule-based strategy uses traditional technical indicators (MACD, RSI, MAs) or simple arbitrage logic to define trading strategy. Today, we are seeing the emergence of AI based systems that use machine learning models to identify patterns and define algo-trading strategies.

The classic rule based system is deterministic and outputs are more predictable. If Condition A is met, then Action B is taken. For instance, Buy when RSI is below 30 and price crosses the 20-period moving average.

AI-based strategies are probabilities. The model assigns a probability to an outcome and can adjust its parameters as it processes new data. For instance, a model could analyze 100 variables (including order book data, social sentiment, price history) and predict a 65% chance of a 0.5% price increase in the next 5 minutes, then execute a trade.

Top Algorithmic Trading Strategies (2026 Edition)

The field of algorithmic trading is dynamic, with strategies constantly evolving to exploit new market inefficiencies. Below are the top algorithmic trading strategies to use in 2026, detailing their core logic, ideal assets, and primary strengths and weaknesses for the current environment.

Trend-following

Trend following is a trading strategy that aims to profit by capturing the majority of a market trend, holding positions for extended periods (weeks to months).

Core Logic

The algorithm waits for an existing price movement (up or down) to be clearly established using indicators like Moving Averages (MA crossovers) or price channels. It buys (goes long) when the trend is confirmed upward and sells (goes short) when the trend is confirmed downward, holding until an opposite signal or stop-loss is hit. It is essentially based on the market’s inertia.

Ideal Asset Class

Futures (Commodities, Indices), Forex, and highly liquid Equities that exhibit strong, persistent trends.

| Strengths | Weaknesses |

| High Profit Potential during long, strong market regimes. | Heavy losses (Whipsaws) in choppy, range-bound markets. |

| Low Maintenance (typically trades less frequently). | Late Entry/Exit: Always misses the very top and very bottom of a move. |

Mean reversion

Mean reversion is based on the belief that a security’s price, having deviated significantly from its long-term average (the “mean”), will eventually revert back to that average.

Core Logic

The algorithm calculates a statistical mean (e.g., a simple MA or a Z-score relative to a band like Bollinger Bands). When the price deviates to an extreme (e.g., falls two standard deviations below the mean, signaling “oversold”), the algo buys. It then sells for a profit when the price returns to the mean. The trade assumes the deviation is temporary.

Ideal Asset Class

Options, Equities, and Futures when markets are range-bound or oscillating (i.e., not strongly trending).

| Strengths | Weaknesses |

| Works well in sideways, consolidating markets where trends fail. | Catastrophic failure if a strong new trend starts (a “dead-cat bounce” scenario). |

| High probability of small, consistent wins. | Profits are generally small and require high trading frequency. |

Momentum

A short-to-medium-term strategy that buys assets showing strong recent performance and sells those showing poor recent performance, betting that the relative performance will continue.

Core Logic

Unlike Trend-Following, which focuses on absolute price movement, Momentum focuses on Relative Strength. The algo ranks a basket of assets based on their past return (e.g., past 3, 6, or 12 months) and systematically allocates capital to the top performers, assuming herd behavior and psychological biases will sustain the move.

Ideal Asset Class

Large universe of Equities (stocks), ETFs, and Cryptocurrencies.

| Strengths | Weaknesses |

| Captures investor herding and behavioral biases, generating large gains in bull markets. | High risk of sharp reversals (crashes), as it inherently buys high. |

| Can be applied across a massive cross-section of assets. | Vulnerable to high turnover and trading costs. |

Statistical arbitrage

Statistical arbitrage is a high-frequency, market-neutral strategy that profits from temporary pricing deviations between related financial instruments based on complex statistical relationships.

Core Logic

A sophisticated form of Mean Reversion applied to a basket of assets. The algorithm identifies a group of securities (e.g., 50 tech stocks) whose collective price movement is statistically predictable. If one security deviates from the group’s pattern, the algo simultaneously buys the underperforming asset and shorts the overperforming asset, expecting the prices to converge back to the mean relationship.

Ideal Asset Class

Highly liquid, correlated Equities (e.g., sector stocks), ETFs, and Futures.

| Strengths | Weaknesses |

| Market-Neutral: Less exposed to overall market direction (bull or bear). | Model Risk: The statistical relationship can break down (“regime change”), leading to large losses. |

| Very high Sharpe Ratios (risk-adjusted returns). | Extremely competitive; primarily the domain of large quantitative hedge funds. |

Breakout

This is a strategy that assumes strong, directional moves are initiated when price moves beyond a defined trading range, key support, or resistance level.

Core Logic

The algorithm identifies a period of consolidation (a tight range or pattern like a triangle). It places buy stop orders above the resistance and sell stop orders below the support. Once price breaks out, the trade is entered in the direction of the move, expecting increased momentum and volume to follow. Confirmation using volume is critical to avoid “false breakouts.”

Ideal Asset Class

Futures, Forex, and Stocks that are highly volatile after periods of low volatility.

| Strengths | Weaknesses |

| Captures the beginning of a new, strong trend with explosive movement. | Prone to False Breakouts (fake-outs) where price briefly moves out of range and then reverses. |

| Clear, objective entry and exit points. | Execution can be difficult due to high volatility after the signal. |

VWAP/TWAP

VWAP/TWAP are not predictive strategies. They’re execution strategies used by institutional traders to minimize the market impact of a large order.

Core Logic

- VWAP (Volume-Weighted Average Price): The algorithm slices a large order and executes portions of it throughout the day, adjusting the size of each slice to match the historical or real-time volume profile of the asset. The goal is to get a final execution price close to the day’s VWAP.

- TWAP (Time-Weighted Average Price): The algorithm slices a large order into equal-sized chunks and executes them at regular time intervals (e.g., every 5 minutes), ignoring market volume. The goal is to trade discreetly and avoid signaling a large buy/sell to the market.

Ideal Asset Class

High-volume Equities and Futures where large block trades are common.

| Strengths | Weaknesses |

| Minimizes Market Impact and slippage for large orders. | Not a profitable strategy on its own; it’s purely for efficient execution. |

| Provides an excellent benchmark for execution quality. | May result in a poor execution price if a major trend starts midway through the day. |

Pairs Trading

This is a market-neutral strategy that involves simultaneously buying one asset and selling short a highly correlated asset when their price ratio temporarily deviates from its historical mean.

Core Logic

The algorithm identifies two historically highly correlated assets (e.g., Coca-Cola and Pepsi, or two oil ETFs). It calculates the spread between their prices. When the spread widens beyond a statistical threshold (i.e., Asset A is historically cheap relative to Asset B), the algo buys the cheap asset (A) and shorts the expensive asset (B). The trade profits when the spread returns to normal.

Ideal Asset Class

Equities within the same sector, ETFs, and related Commodities (e.g., gold and silver).

| Strengths | Weaknesses |

| Market-Neutral: The paired trade hedges against overall market volatility. | Relationship Risk: The historical correlation/cointegration can break down permanently. |

| Risk is confined to the spread, not the overall market direction. | Requires sophisticated statistical tools to identify truly cointegrated pairs. |

Scalping (HFT & Retail)

A strategy focused on profiting from the smallest price movements. It involves high-volume, extremely short-duration trades (seconds to minutes).

Core Logic

- HFT Scalping (Institutional): Utilizes co-location and fiber-optic networks to gain a speed advantage (micro-seconds). Strategies include Market Making (profiting from the bid-ask spread) and exploiting tiny latency differences between exchanges.

- Retail/Mid-Frequency Scalping: Uses tighter stop-losses and targets to capture small intraday moves. Core logic is often based on Level 2 order book data and high-frequency indicators like tick volume.

Ideal Asset Class

Highly liquid, high-volume markets like Forex (majors) and large-cap Futures.

| Strengths | Weaknesses |

| High win rates possible, but profits are highly cost- and latency-sensitive. | HFT is cost-prohibitive; requires significant infrastructure and exchange access. |

| Unaffected by long-term market trends. | Retail Scalping is severely impacted by transaction costs (commissions/spreads). |

Grid trading

Grid trading is a range-bound strategy that places a network (grid) of ascending buy orders and descending sell orders within a predefined price channel.

Core Logic

The algorithm sets up a series of buy and sell limit orders at fixed intervals (e.g., every $50). When a buy order is filled (price falls), a corresponding sell order is automatically placed one interval higher, and vice versa. It profits repeatedly from the natural volatility and oscillation of the price within the channel, with no need to predict the direction.

Ideal Asset Class

Volatile, range-bound markets like certain Forex pairs and Cryptocurrencies.

| Strengths | Weaknesses |

| Profits from volatility without predicting market direction. | Disastrous in a strong trend: If the price trends outside the grid range, losses can accumulate rapidly. |

| Highly automated and removes emotional bias. | Requires continuous monitoring and manual adjustment of the price range. |

AI-powered strategy (e.g., reinforcement learning)

The next generation of algo trading where complex, non-linear machine learning models (like Deep Neural Networks or Reinforcement Learning (RL) agents) are used to decide trades, rather than fixed human-designed rules.

Core Logic

- AI/ML: The model is trained on vast amounts of data (price, volume, news sentiment, satellite imagery) to find hidden, non-linear relationships that human traders miss.

- Reinforcement Learning (RL): The trading agent learns by interacting with a simulated market environment. It is rewarded for profitable actions and penalized for losses. Over countless iterations, the agent develops an adaptive policy for trading, optimizing for long-term cumulative reward rather than a single win/loss.

Ideal Asset Class

All asset classes, particularly multi-asset portfolios where the ability to process and correlate diverse data sets provides an edge.

| Strengths | Weaknesses |

| Adaptive: Can automatically adjust to changing market conditions and regimes. | Lack of Interpretability (“Black Box”): It’s often impossible to know why the AI made a specific decision. |

| Can process massive, diverse datasets beyond human capability. | High Data and Compute Cost: Requires massive, clean data sets and powerful infrastructure. |

| Potential to find highly non-linear, novel sources of alpha. | Overfitting Risk: The model might learn the noise in the historical data rather than true underlying patterns. |

How to Choose the Right Strategy

Choosing the right algorithmic trading strategy depends less on finding the best strategy overall and more on finding the strategy that best fits your market perspective, resources, and psychological profile. The primary factors to consider are detailed below:

Market type: volatile vs stable

The current market environment is the most critical factor for strategy selection. Strategies that thrive in one regime often fail disastrously in another. In a volatile or trending market characterized by strong directional moves and high daily price changes, a momentum or breakout trading strategy is more recommended. Conversely, in a stable market where price oscillates between clear support/resistance levels, you can use mean reversion, pairs trading, or grid trading.

Timeframe: intraday vs swing

The timeframe dictates the holding period and the type of data and speed required. Intraday trading requires low-latency execution, high-frequency (tick) data, robust connectivity, and significant technical expertise. Trades here are typically held for mere minutes or seconds.

Swing/Position, on the other hand, focuses on robust signals and risk management over execution speed. Trades are held for days to weeks. This is generally more accessible to retail traders as it requires less advanced technology.

Capital and risk tolerance

Your capital base and how much you are willing to lose directly influence strategy selection. For instance, simple strategies like grid trading mean reversion has low transaction cost. On the flip side, HFT Scalping requires massive infrastructure while statistical arbitrage has high modeling cost. Relying on AI/ML also requires significant data spending.

Your risk profile is another important consideration. If fixed stop-losses are essential, you should focus on strategies with a high winning percentage, even if profits are small. However, if you can tolerate wider swings and higher maximum drawdowns associated, you can use strategies with high expected alpha.

Trading experience & technical ability

The technical sophistication of your trading must match your skill set. For traders with low to moderate technical ability, classic rule-based strategies such as Simple Moving Average Crossovers, basic VWAP/TWAP are recommended because they’re easier to backtest and understand.

Complex statistical arbitrage, high-frequency scalping, and reinforcement learning (AI) requires extensive programming (Python/C++), or knowledge of statistical modeling, and data engineering.

Case Study: How One Trader Implemented A Mean Reversion Bot And What Happened

Bob, a forex trader, traded the ranging (sideways) market using a mean reversion bot. His trading bot was programmed to monitor the 1-hour EUR/USD chart and execute trades only when the price deviation from the mean reaches an extreme, suggesting an imminent “snap-back.”

The algorithm used a combination of two classic technical indicators (20-Period Simple Moving Average and Bollinger Bands) to define the “mean” and measure the “deviation” from it. The Relative Strength Index was also used to confirm the severity of the deviation.

Bob set an exit parameter of his bot that closed the position when the price reverts to and touches the 20-Period SMA (the Mean). An adaptive stop-loss was placed 1.5 to 2 times the Average True Range (ATR) away from the entry price to protect against strong breakouts.

Over a six-month period, the bot achieved a strong net profit of +18.7% with a high 68% win rate. The strategy successfully exploited short-term deviations, frequently capturing the ‘snap-back’ to the 20-period moving average with quick gains.

Backtesting and Optimization

Backtesting and optimization are the cornerstones of developing a robust algorithmic trading strategy. They allow you to test your strategy’s logic, measure its risk, and fine-tune its parameters using historical data before risking real capital.

Why it matters

Backtesting is the process of applying a trading strategy to historical market data to simulate its performance. This provides a safe, risk-free environment to validate a trading idea and analyze its potential profitability and risk profile.

Backtesting also generates key metrics (like Sharpe Ratio and Drawdown) that help you objectively compare the strategy’s performance against a benchmark or other strategies. This way, you can identify the optimal parameters for your strategy.

Common pitfalls

The greatest danger in backtesting is creating a strategy that performs perfectly on historical data but fails completely in live trading. This is caused by various forms of data mining bias including:

- Overfitting (Curve-Fitting) – Excessively tuning a strategy’s parameters (rules, indicators, lookback periods) to match the noise and specific historical price movements of the test data.

- Look-Ahead Bias – Accidentally using future information in a past decision (e.g., using the next day’s closing price to calculate a signal today).

- Ignoring Transaction Costs/Slippage – Failing to account for commissions, exchange fees, and the difference between the expected and actual execution price.

Best tools: QuantConnect, Backtrader, MT5

The “best” tool for backtesting depends on your technical ability and the complexity of the strategies you want to run. Some of the most popular examples include:

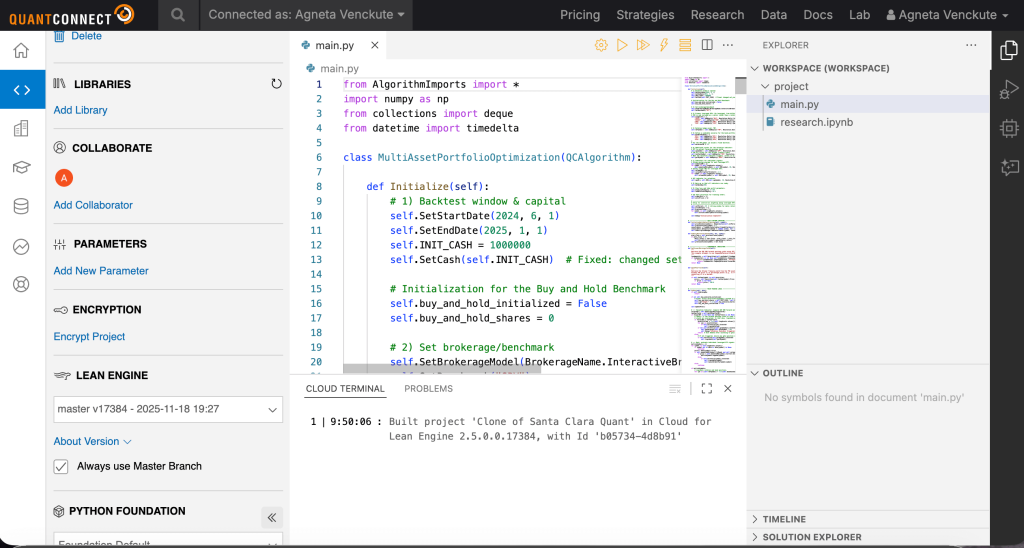

- QuantConnect : this is a Cloud-based Quant Platform for professional and advanced retail quants. It supports a vast array of assets and multiple programming languages. QuantConnect includes robust features like minute-level data and corporate action modeling.

- Backtrader is a python library for retail traders and developers. It is open-source, highly flexible, and integrates seamlessly with the Python data science ecosystem. This tool has features for rapid prototyping and custom strategy development.

- MT5 (MetaTrader 5) is a broker-agnostic retail Platform popularly used by Forex and CFDs. Features a built-in strategy tester and uses the MQL5 language. Accessible for traders who prefer a GUI-based, all-in-one environment typically provided by a broker.

QuantVPS interface. Source: Quantvps.com

Key metrics

Several metrics are used to evaluate a strategy’s health and risk-adjusted return. Examples include:

- Sharpe Ratio is used to measure risk-adjusted return. A sharpe ratio above 1.0 is generally considered good while a higher figure above 2.0 is excellent.

- Maximum Drawdown (MDD): shows the largest peak-to-trough decline during a specific period. It indicates the worst-case loss you would have endured. A lower percentage is better as it shows greater capital preservation.

- Hit Rate (Win Rate) measures the percentage of winning trades out of total trades. Note that a high hit rate doesn’t guarantee profit if the average loss is much larger than the average win.

Tools & Platforms to Use

To develop an algorithmic trading strategy, traders use different tools and strategies. The best tool or platform for you depends on your coding skills and brokerage knowledge. Below is a list of some recommended tools to try:

For coders: Python + Backtrader, QuantConnect

A combination of Python & Backtrader is a popular choice for traders with coding skills. These are open-source frameworks for backtesting and paper trading strategies directly using code.

QuantConnect is another popular option. This is a cloud platform that uses an open-source LEAN engine. It supports multiple languages (including Python and C#) and offers extensive data, backtesting, and a path to live trading with various brokers.

For no-coders: Capitalise.ai, AlgoWizard, Tradetron

Non-coders can use Capitalise.ai, a natural language processing (NLP) tool that can turn plain English sentences (e.g., “If RSI is below 30, buy 10 shares”) into automated strategies. AlgoWizard by FX Blue is also commonly used by non-quants. It is often associated with MetaTrader, and uses a visual, block-based editor to build Expert Advisors (EAs) or indicators without coding.

Then there’s Tradetron, a popular cloud platform in India. This tool uses a visual builder for creating, backtesting, and deploying strategies. It also features a marketplace for strategy sharing.

Broker-integrated solutions (MT5, cTrader, etc.)

Some brokerage platforms have strategy tools built directly into them or offer options for seamless integration. For instance, MetaTrader 5 (MT5), a widely-used platform has a proprietary language (MQL5) for building trading robots (Expert Advisors or EAs) and custom indicators. Similarly, cTrader has the ability to build automated systems (cBots) and custom indicators using C#.

Cloud deployment & API trading (e.g., Alpaca, Interactive Brokers)

Platforms like Alpaca provide commission-free trading via a modern, easy-to-use API (SDKs available in Python, Node, etc.) and are ideal for deploying custom algorithms in the cloud. Interactive Brokers (IBKR) offers multiple APIs as well (TWS API, Web API, FIX). These tools allow for advanced, high-volume algorithmic trading across a massive range of global assets.

Risks of Algorithmic Strategies

Trading with algorithmic strategies can be hugely beneficial, but it also comes with a few notable risks and downsides. They include:

- Over-optimization: This occurs when a strategy is tuned too perfectly to past market data, making it perform exceptionally well in backtests but poorly in live trading due to its inability to adapt to unseen market conditions

- Latency and slippage: Latency is the time delay in sending and executing an order, while slippage is the difference between the expected price and the actual execution price; both can significantly erode the profitability of high-frequency or short-term algorithms.

- Platform downtime: Any unexpected failure or interruption in the trading platform, broker’s API, or the algorithm’s hosting server can prevent the strategy from executing trades or, critically, closing open positions, leading to massive losses.

- Black box strategies: These are purchased or rented strategies where the core logic remains hidden from the user, making it impossible to understand why a trade was executed, debug issues, or adapt to a changing market environment.

- Behavioral market shifts post-AI: As more sophisticated AI and machine learning algorithms are deployed, they can collectively alter traditional market behavior, creating new, unpredictable risks and making historically successful strategies obsolete or even dangerous.

Tips for Getting Started

Ready to start creating algo-trading strategies. Below are some practical steps you can follow to begin your journey.

- Start with paper/dummy accounts: Always begin by simulating your strategy in a paper or demo account with fake money to test its viability and build confidence without risking actual capital.

- Copy or adapt open-source strategies: Leveraging existing, vetted open-source strategies is a great way to learn best practices and accelerate development by avoiding common pitfalls.

- Track performance rigorously: Maintain a detailed log of your algorithm’s trades, metrics, and key decisions, going beyond basic profit/loss to understand its actual edge and drawdown characteristics.

- Keep strategy simple (at first): Focus initially on implementing a straightforward, easy-to-debug strategy (like a simple moving average crossover) to master the technical deployment process before introducing complexity.

- Adjust based on live feedback: Recognize that backtesting is imperfect; continuously monitor your live strategy for unexpected behavior, such as higher-than-expected slippage or latency issues, and iteratively refine your code.

Conclusion

Algo trading isn’t just for quants anymore: With increasingly accessible platforms and tools, the power of automated trading is now available to retail and non-institutional traders. You just have to choose and follow the right strategies. Success in algorithmic trading depends entirely on selecting a strategy that aligns with your financial goals, risk tolerance, and the specific market you plan to trade.

Don’t just rely on your gut feeling. Every automated decision must be grounded in rigorous backtesting on historical data and continuous monitoring rather than mere intuition or speculation. The tips covered in this guide will help you develop robust, data-driven strategies for algorithmic trading.

FAQs

What’s the most profitable algo trading strategy?

There is no single “most profitable” strategy, as effectiveness depends on market conditions (e.g., volatile vs. trending) and execution speed. Historically successful categories include Arbitrage (exploiting price differences), Mean Reversion (betting on prices return to an average), and High-Frequency Trading (HFT) for institutional players

Can I use AI to generate strategies?

Yes, AI and Machine Learning (ML) has become increasingly useful for analyzing vast, complex datasets, recognizing subtle patterns, and generating or refining trading rules. However, AI-generated strategies must still be rigorously backtested and monitored for risks like overfitting before deployment.

What’s the best free algo trading platform?

Popular choices offering robust features at a free tier include QuantConnect and broker-agnostic platforms like TradingView for basic alerts. You can also use Tradetron and Zerodha Streak (for no-code strategy building and paper trading.

Do you need to know coding for algorithmic trading?

No, not necessarily. While proficiency in languages like Python or R is required to build highly customized, institutional-grade algorithms, many retail platforms now offer “no-code” or “drag-and-drop” strategy builders, allowing non-coders to automate trades using pre-built indicators.

Sources

https://medium.com/coding-nexus/15-algorithmic-trading-strategies-that-actually-work-07ef8eb0be23

https://www.quantinsti.com/articles/algorithmic-trading-strategies