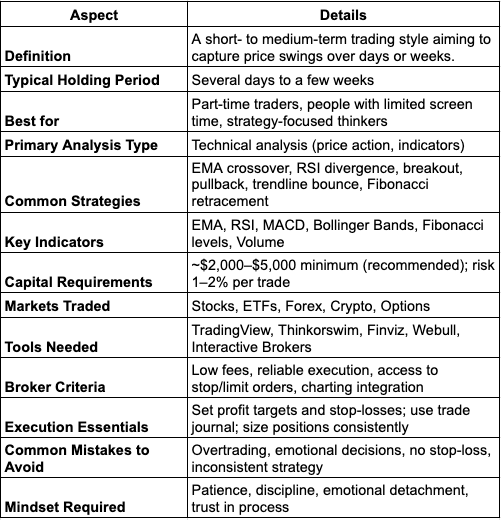

Swing trading is a trading style focused on capturing short- to medium-term price movements in a financial asset—typically over a span of a few days to a few weeks. The goal is to profit from upward or downward “swings” in price that occur within broader market trends. It strikes a balance between the fast-paced nature of day trading and the patience required for long-term investing, making it popular among traders who want meaningful opportunities without the need to monitor markets minute-by-minute. To keep your swing trading setups running smoothly as markets move between sessions, many traders rely on a dedicated forex VPS for stable, low-latency access to their platforms.

Successful swing trading is built on structured strategies. These are repeatable systems that guide decisions on when to enter a trade, where to set stop-losses, how to manage risk, and when to exit. These strategies often rely on technical analysis—tools like moving averages, RSI, MACD, trendlines, and candlestick patterns—to identify high-probability setups. Some common examples include breakout strategies, pullback entries in trending markets, or reversal setups using overbought and oversold signals.

In essence, swing trading is about anticipating where the market is likely to move next and positioning yourself to profit from that move—with a clear plan in place. The strategies that support this approach are what make swing trading both structured and scalable for serious traders.

Quick Reference: Key Aspects of Swing Trading

Swing Trading vs Other Types of Trading

Swing trading isn’t the only way to approach the markets—but it sits in a uniquely balanced spot between high-speed intraday tactics and long-term investment plays. To really understand what makes swing trading different, it’s helpful to look at how it compares to other common styles: scalping, day trading, and investing.

Swing Trading vs. Scalping

Scalping is the fastest, most intense form of trading. Scalpers might open and close dozens of positions within a single hour, targeting tiny price changes that last just seconds or minutes. It’s high-pressure, requires rapid-fire execution, and often demands specialized tools like Level II data or ultra-low-latency platforms.

Swing trading couldn’t be more different. Instead of chasing micro-movements, swing traders aim to capture meaningful price moves that play out over several days or weeks. There’s more time to analyze, plan, and make decisions—without staring at the screen all day.

In short: scalping is a full-time job with a steep learning curve. Swing trading is more accessible and forgiving, especially for part-time or solo traders who want room to breathe.

Swing Trading vs. Day Trading

Day trading still happens on short timeframes, but it slows things down a bit compared to scalping. The goal is to profit from price movement within a single day—trades are opened and closed before the market closes, which avoids overnight risk.

Swing trading, on the other hand, embraces that overnight risk in exchange for catching bigger, more sustained moves. Traders might hold positions for several days, watching price action develop across 4-hour or daily charts. It’s less stressful, less time-intensive, and far more flexible—especially for those with day jobs or other commitments.

If you don’t have the time, discipline, or desire to day trade five days a week, swing trading offers a far more sustainable alternative.

Swing Trading vs. Long-Term Investing

Investing is a different world altogether. Long-term investors buy and hold assets for months or even years, focusing on fundamentals like earnings, valuation, and macroeconomic trends. It’s slow-moving and designed to build wealth gradually over time.

Swing trading doesn’t care much about quarterly reports or balance sheets. It’s technical by nature—looking at price patterns, momentum, and trader sentiment. While investors ride out market cycles, swing traders aim to catch individual waves within them.

If you enjoy active decision-making but don’t want the pressure of being glued to your screen all day, swing trading provides that middle ground between hands-off investing and hyperactive trading.

Advantages and Risks of Swing Trading

Like any trading style, swing trading comes with a mix of upsides and trade-offs. For many traders—especially those looking for flexibility, structure, and the ability to stay active without being glued to a screen—swing trading offers a compelling path. But it’s not without its challenges.

Understanding both the advantages and the potential pitfalls is key. If you’re someone who thrives on structured planning, has the patience to wait for strong setups, and can stick to a well-defined system—swing trading might be your ideal fit.

Advantages of Swing Trading

1. Time Efficiency

One of the biggest draws of swing trading is that it doesn’t require constant screen time. You can analyze charts after hours, set alerts, schedule trades, and check in once or twice a day. It’s a great fit for people with day jobs, businesses, or other time demands.

2. Lower Stress Compared to Day Trading

While day traders are tied to every tick and often forced to make split-second decisions, swing traders operate on slower timeframes. There’s more time to analyze setups and make thoughtful decisions—reducing pressure and emotional fatigue.

3. Larger Price Moves

Since trades are held for days or weeks, swing traders often aim to catch bigger portions of market moves than day traders or scalpers. This can translate to better risk-reward ratios on individual trades.

4. Works in Different Market Conditions

Swing trading can be applied in trending or sideways markets, across stocks, forex, crypto, and commodities. Whether the market is going up, down, or chopping around, there are always swing opportunities if you know what to look for.

5. More Strategic, Less Reactive

With end-of-day data and broader timeframes, swing traders can take a more analytical approach. Trades are based on patterns, signals, and strategy—not moment-to-moment noise.

Risks of Swing Trading

1. Overnight and Weekend Risk

Holding positions overnight means you’re exposed to gaps from unexpected news, earnings reports, geopolitical events, or macro announcements. A stock that looked great at close could open the next day with a major jump or crash.

2. False Signals and Whipsaws

Swing strategies rely heavily on technical indicators and chart patterns—but these aren’t foolproof. In choppy or unpredictable markets, false breakouts and fakeouts are common. Without strong risk management, even good setups can go sideways.

3. Requires Patience and Discipline

Unlike fast-paced trading styles, swing setups can take time to develop. Entering too early, overtrading, or closing trades too soon are common mistakes that stem from impatience.

4. Capital at Risk for Extended Periods

Because trades are held longer, your capital is exposed to more market variables, including broader economic shifts or sector-specific changes. It’s not as passive as investing, but not as nimble as intraday trading either.

5. Emotional Temptation to Tweak Trades

Just because you’re not day trading doesn’t mean emotions disappear. Watching trades fluctuate over several days can still tempt you to close early, move stop-losses, or second-guess your plan.

Most Common Strategies for Swing Trading

Swing trading is all about finding short- to medium-term opportunities to ride momentum within a broader trend. The good news? You don’t need dozens of complex systems to trade successfully. A handful of proven strategies—when understood and executed well—can give you all the edge you need.

Here are six of the most popular and effective swing trading strategies, each used by traders across asset classes like stocks, forex, and crypto.

1. EMA Crossover Strategy

The Exponential Moving Average (EMA) crossover is a classic trend-following strategy. It helps traders identify when momentum is shifting by tracking two moving averages—typically a shorter EMA (e.g. 9 or 12) and a longer EMA (e.g. 26 or 50).

- Buy signal: When the short EMA crosses above the long EMA (a bullish crossover).

- Sell signal: When the short EMA crosses below the long EMA (a bearish crossover).

This strategy is simple but powerful. It works best in clearly trending markets, and it’s often used in combination with support/resistance levels or volume confirmation.

Learn more: Understanding the EMA Cross Over Strategy: A Step-by-Step Guide

2. RSI Divergence Strategy

The Relative Strength Index (RSI) measures whether a stock is overbought or oversold. But more importantly, traders use RSI divergence to spot potential reversals.

- Bullish divergence: Price makes a lower low, but RSI makes a higher low — suggesting momentum is building upward.

- Bearish divergence: Price makes a higher high, but RSI makes a lower high — hinting at weakening strength.

RSI divergence is especially useful during pullbacks or extended trends, helping traders catch early signs of a swing in the opposite direction.

Learn more: RSI Trading Strategy (91% Win Rate): Backtest, Indicator, And Settings

3. Breakout Trading Strategy

Breakout trading focuses on entering a trade when price breaks through a key support or resistance level—usually signaling the start of a stronger move.

- Common breakout zones include horizontal resistance, chart patterns (like triangles or flags), or price consolidations.

- Breakouts are often accompanied by a spike in volume, confirming interest and momentum.

The key to success here is waiting for confirmation, not jumping the gun. False breakouts (a.k.a. fakeouts) can trap impatient traders, so tools like volume or retest entries help reduce risk.

Learn more: Best Breakout Trading Strategy Used by Professional Traders

4. Pullback Strategy

Instead of chasing price during a strong trend, pullback traders wait for a temporary retracement—then enter when momentum resumes.

- For example, in an uptrend, price might pull back to a moving average, trendline, or Fibonacci level, then bounce back upward.

- In a downtrend, you look for a short-term bounce before entering short as the trend continues down.

Pullbacks offer excellent risk-reward setups since you’re entering closer to support/resistance with a tighter stop-loss and room for the trend to resume.

Learn more: Top Strategies for Perfecting Pullback Trading

5. Trendline Strategy

Drawing trendlines helps visualize the direction and strength of a trend. In swing trading, traders often enter trades as price respects or bounces off these lines.

- In an uptrend, price typically forms higher lows and respects an ascending trendline.

- In a downtrend, price forms lower highs and follows a descending trendline.

Trendlines can act like dynamic support or resistance, and when combined with candlestick signals or volume analysis, they offer clean setups for trend continuation or reversal trades.

Learn more: How To Use Trend Lines As A Trading Strategy For Swing Trading

6. Fibonacci Retracement Strategy

The Fibonacci retracement tool is used to identify potential reversal levels during a pullback. Key levels—38.2%, 50%, and 61.8%—often act as bounce zones within an ongoing trend.

- After a strong move, traders plot the Fibonacci tool from the swing low to swing high (or vice versa).

- When price retraces to one of these levels and shows signs of reversing (e.g. bullish engulfing candle, RSI bounce), it’s often used as an entry point.

This strategy is especially useful when combined with other tools like trendlines, EMAs, or support zones to confirm confluence.

Learn more: Fibonacci Retracement Swing Trading Strategy

Swing Trading Strategies vs Tactics

If you’re serious about swing trading, it’s not enough to just follow setups blindly. One of the biggest mistakes beginners make is confusing strategy with tactics. The distinction may sound subtle, but it’s a game-changer in how you approach the market.

Understanding the difference can turn you from a reactive trader into a structured, consistent one.

What Is a Strategy in Swing Trading?

A strategy is your high-level plan—your framework for how you approach the market as a whole. It’s built around your goals, time availability, risk tolerance, and style. A strategy defines what kind of market behavior you’re trying to exploit, and it dictates what conditions need to be present before you even think about entering a trade.

For example, these are all strategies:

- Trend-following: Buying during uptrends and selling during downtrends.

- Reversal trading: Entering when momentum weakens and a change in direction is likely.

- Breakout trading: Capturing price moves that happen after consolidation zones are breached.

- Pullback trading: Waiting for temporary dips in a trend before entering.

Each of these approaches outlines a broad philosophy: what to trade, when to look, and how the market should behave before you act.

What Are Tactics in Swing Trading?

Tactics are the specific methods you use to execute your strategy. These include your exact entry and exit criteria, the indicators you use, how you size positions, where you place stop-losses, and what confirms your trade.

Tactics are about precision. They take your broad strategy and turn it into a repeatable process.

Examples of tactics:

- Using a 20 EMA and 50 EMA crossover as an entry signal in a trend-following strategy.

- Waiting for RSI divergence at a support zone in a reversal strategy.

- Placing a stop-loss just below the most recent swing low in a pullback trade.

- Entering only if a breakout is confirmed by a volume spike of 150%+ average.

The tactics are where your discipline lives. They protect you from acting impulsively and make your strategy measurable and testable.

Why It Matters

Failing to separate strategy from tactics can lead to messy trading. You might enter based on a clean RSI signal (tactic), but without a clear broader strategy, you’ll second-guess the trade. You won’t know what kind of market it works in—or when to sit out.

On the flip side, having a strong strategy with poor or inconsistent tactics will produce unreliable results. It’s like having a map but no tools to navigate.

You need both:

- Strategy gives your trading direction.

- Tactics give your strategy structure and execution.

Key Considerations Before You Start Swing Trading

Before you place your first trade, take a step back. Swing trading can be rewarding, but like any skill-based pursuit, it demands thoughtful preparation. Jumping in without a plan—or without the right tools—can turn what should be a strategic endeavor into costly chaos.

Here are the key factors every aspiring swing trader should consider before getting started.

1. Capital Requirements

You don’t need tens of thousands to begin swing trading, but you do need enough to weather losses and follow proper risk management.

- Recommended starting capital: For stocks, many traders start with at least $2,000–$5,000. For options or forex, you might need less, but risk increases.

- Margin accounts: Some brokers require a minimum of $2,000 to open a margin account, which is often necessary if you want to short-sell or use leverage.

- Risk per trade: A common rule is to risk no more than 1–2% of your capital on a single trade. So if you have $5,000, that’s a max risk of $50–$100 per position.

Starting with too little capital often leads to over-leveraging or emotional trading. Make sure you’re funded enough to be rational.

2. Market Hours and Time Commitment

Swing trading doesn’t require full-time hours—but it’s not passive either.

- You’ll typically analyze charts after the market closes or early in the morning.

- Some traders check in at midday or end of day to adjust orders or monitor setups.

- You’ll need time to plan trades, review charts, and stay informed—but not the minute-to-minute stress of day trading.

This makes swing trading ideal for people with jobs or other responsibilities who still want to be actively involved in the markets.

3. Asset Types You Want to Trade

Swing trading is flexible—you can apply it across multiple asset classes. But each comes with its own nuances.

- Stocks & ETFs: Most common. Highly liquid, with good chart data and volume. Watch for earnings reports and overnight gaps.

- Forex: 24/5 markets. Often has tighter spreads, but moves are more technical and leverage is higher.

- Crypto: Trades 24/7. Volatile and emotional, but highly responsive to technical patterns.

- Options: Requires deeper knowledge. Offers leverage and flexibility but adds complexity (greeks, expiration, etc.).

Start with one asset class until you’re consistent—don’t spread yourself thin trying to master all at once.

4. Choosing the Right Broker

Your broker will directly impact how smoothly your trades execute and what tools you have access to.

Here’s what to look for:

- Low fees and commissions: Commission-free trading is now standard, but watch out for hidden fees or wide spreads.

- Charting and tools: Platforms like TradingView, Thinkorswim, or Trading212 offer strong charting capabilities.

- Order types: You’ll want the ability to place stop-loss, limit, and OCO (One Cancels Other) orders.

- Execution speed: Delays or slippage can ruin a solid setup.

5. Risk Management Mindset

This isn’t just a setup consideration—it’s a survival necessity.

- Every trade needs a stop-loss.

- Define your risk-to-reward ratio (many aim for 1:2 or better).

- Never risk more than you’re comfortable losing.

Swing trading isn’t about winning every trade—it’s about managing the ones that don’t work out and sticking with the ones that do.

6. Understanding Your Emotional Triggers

No, this isn’t soft advice. The truth is, swing trading will test your patience, your confidence, and your discipline.

Ask yourself:

- Can I stick to a plan even when a trade turns red?

- Am I comfortable holding trades overnight or over weekends?

- Do I know when to walk away or take a break?

If you haven’t considered these questions, the market will ask them for you—at a cost.

How to Execute Swing Trading Strategies Successfully (and the Mistakes to Avoid)

Having a good swing trading strategy on paper is one thing—executing it consistently is another. In reality, most traders don’t fail because their strategy is flawed; they fail because they can’t follow it with discipline.

Below are the most important execution tips that will help you stick to your edge—and the mistakes to avoid if you want to survive (and thrive) long-term.

1. Treat It Like a Business, Not a Bet

Execution Tip: Set up a structure. Define your daily routine, when you review charts, when you place trades, and how you log performance.

Common Mistake: Trading randomly or “winging it” based on emotion or headlines.

Good trading isn’t about adrenaline—it’s about process. The more structured you are, the more likely you are to stay consistent through good and bad streaks.

2. Use a Trade Journal—Seriously

Execution Tip: Track every trade: entry/exit, reason for entry, result, what worked, and what didn’t. Over time, patterns will emerge—what you’re good at, what you need to avoid, and how your strategy really performs.

Common Mistake: Not journaling, which means repeating the same avoidable mistakes over and over.

Even top traders use journals. It’s how they refine their edge. No memory or intuition can replace written, objective self-feedback.

3. Set Realistic Profit Targets and Stops

Execution Tip: Before entering any trade, define your profit target and stop-loss. Aiming for a 2:1 or 3:1 risk/reward ratio ensures that even with a 40–50% win rate, you stay profitable.

Common Mistake: Letting losers run, cutting winners short, or moving your stop after you’ve placed it.

Trying to be “right” all the time leads to overtrading and second-guessing. Focus on being consistent and managing risk instead.

4. Stick to Your Strategy, Especially When It’s Boring

Execution Tip: Trust your process—even when setups take time to appear. Swing trading is about waiting for the right moment, not forcing trades.

Common Mistake: Overtrading out of boredom or fear of missing out (FOMO).

Patience pays. The best swing trades often come after long periods of waiting. Don’t trade just to be active—trade when the conditions truly align with your setup.

5. Avoid Trading Without a Clear Plan

Execution Tip: Every trade should answer three questions before it’s placed:

- Why am I entering here?

- Where is my stop?

- Where is my exit?

Common Mistake: Entering because “it looks good” or “feels right” with no defined structure.

If you can’t explain a trade to someone else in 30 seconds, you probably shouldn’t be in it.

6. Don’t Ignore Position Sizing

Execution Tip: Use consistent position sizing based on account size and risk per trade. Many pros risk no more than 1–2% of their account on any single setup.

Common Mistake: Going too big on one trade and too small on the next, often based on emotional conviction rather than calculated risk.

Sizing inconsistently guarantees emotional swings—and that leads to poor decisions.

7. Stay Emotionally Detached From Outcomes

Execution Tip: Focus on execution, not outcome. If you followed your system and took a loss, that’s still a good trade.

Common Mistake: Letting wins inflate your confidence and losses destroy your confidence.

You are not your P&L. View each trade as a business decision, not a reflection of your intelligence or worth.

Tools and Resources to Succeed (and Grow) as a Swing Trader

Swing trading isn’t just about spotting the right chart pattern—it’s about having the right tools, the right platforms, and the right information flow. If you want to trade with precision and improve over time, you need to build your trading environment like a pro.

Essential Tools for Swing Trading

1. Charting Platforms

Charting is where everything starts. A clean, reliable interface with customizable indicators is non-negotiable for swing traders.

- TradingView – Widely used, great for stocks, crypto, forex, and has a vibrant community. Free and paid plans available.

- Thinkorswim by TD Ameritrade – Powerful tools for stock and options traders. Excellent for U.S. users.

- TrendSpider – AI-enhanced charting with automated trendlines and pattern detection.

- StockCharts – Easy to use, great for long-term and swing traders alike.

Look for platforms that let you use indicators like RSI, MACD, EMA, Bollinger Bands, and Fibonacci levels without hassle.

2. Brokerage Accounts

Your broker is your execution gateway. You want one that’s low-cost, fast, and integrated with solid tools.

- Webull – Zero-commission trading with strong mobile/charting support.

- TD Ameritrade – Great for Thinkorswim users; strong research tools.

- Interactive Brokers – Great for international traders and access to global markets.

- Robinhood – Simple UI, but lacks the advanced tools serious swing traders need.

Tip: Choose a broker that integrates with your charting platform or lets you automate alerts and orders based on setups.

3. Stock and Screener Tools

Sifting through thousands of tickers? Use a screener to filter by volume, price action, RSI levels, or chart patterns.

- Finviz – Excellent free screener with custom filters, heatmaps, and news integration.

- TradingView Screener – Integrated with the charting tool, perfect for setting up alerts based on your strategy.

- MarketSmith – More advanced; great for fundamental and technical combo screening.

4. News Feeds & Market Sentiment

Swing trades are often held overnight—so keeping an eye on market-moving news is critical.

- Benzinga Pro – Fast, trader-focused news.

- Seeking Alpha – Deep-dive articles and earnings recaps.

- Yahoo Finance – Good for earnings calendars and basic news.

- Twitter/X – Surprisingly valuable for real-time sentiment and trade ideas (try following @traderstewie, @thechartist, @zerohedge).

5. Community & Forums

Learning in isolation slows you down. Forums and social channels give insight into how others are thinking, what’s working, and what’s noise.

- Reddit: r/swingtrading, r/stocks, r/options for discussions and setups.

- Discord: Many public trading communities host free or paid chatrooms.

- TradingView Ideas: Users post trade setups with annotations and reasoning.

Just remember—use communities to learn, not to blindly follow.

Resources to Level Up Your Swing Trading

Books

- “Swing Trading” by Marc Rivalland – Strategy-focused with a great foundation on setups.

- “Come Into My Trading Room” by Dr. Alexander Elder – Covers psychology, discipline, and technical systems.

- “Technical Analysis of the Financial Markets” by John Murphy – A must-read classic for indicator-driven traders.

Newsletters & Email Briefings

- The Chart Report – Daily curated technical setups.

- TraderLion – Focused on momentum and swing setups.

- Finimize – Digestible market overviews with trader takeaways.

YouTube Channels

- The Trading Channel – Strategy breakdowns and how-tos.

- Rayner Teo – Educational, beginner-friendly content on price action and risk management.

- Humbled Trader – Realistic insights with humor and experience.

Podcasts

- Chat With Traders – Long-form interviews with experienced traders.

- The Trading Coach Podcast – Bite-sized episodes focused on mindset and execution.

- We Study Billionaires (Investors Podcast Network) – Broader, but useful for macro context and market structure.

Courses & Backtesting Tools

- Udemy – Tons of swing trading courses ranging from beginner to advanced.

- TradingView Bar Replay – Useful for practicing setups on historical data.

- TraderVue or Edgewonk – Journaling and analytics platforms to review your trades with data.