In the highly liquid and dynamic forex trading market, speed and the ability to capture tiny profits can be a competitive advantage. This is the premise for high frequency trading (HFT), an algorithmic trading strategy where traders use powerful computers to execute a vast number of orders at extremely high speeds.

HFT is a race against time, driven by sophisticated technology, to profit from tiny, fleeting price differences. HFT has fundamentally reshaped global financial markets, as it accounts for a significant portion of daily trading volume. However, it is also highly controversial. Critics argue that HFT can create market instability, trigger “flash crashes,” and give technologically superior firms an unfair advantage over traditional investors.

Although it is mainly used by large institutional investors, HFT matters to everyone who participates in the market, from the individual retail investor to the largest pension fund. In this article, we will explain how high frequency trading works, core strategies and the technology behind this impressive trading principle.

How High Frequency Trading Works

High-Frequency Trading (HFT) is a type of algorithmic trading strategy that relies on superior speed and technology to profit from tiny, fleeting price discrepancies. These discrepancies are often measured in fractions of a cent, but the system involves placing massive volumes of trades, which eventually makes up for the small gains in each trade.

The main driver of an HFT strategy is the electronic and fragmented nature of the global forex market. This causes prices to vary slightly between different trading venues. Traders using HFT ensure that they have the lowest latency (smallest the delay between an event and an action). The time scale required to gain such competitive advantage is in nanoseconds, which is about one-billionth of a second. A difference of a few nanoseconds can determine whether a trade is executed profitably or missed.

To achieve this level of low latency, firms invest heavily in technology such as server colocation (placing their servers physically next to the exchange’s servers), and microwave or millimeter-wave radio transmissions instead of fiber optic cables. These technologies help shave off precious milliseconds of latency, giving them a speed advantage.

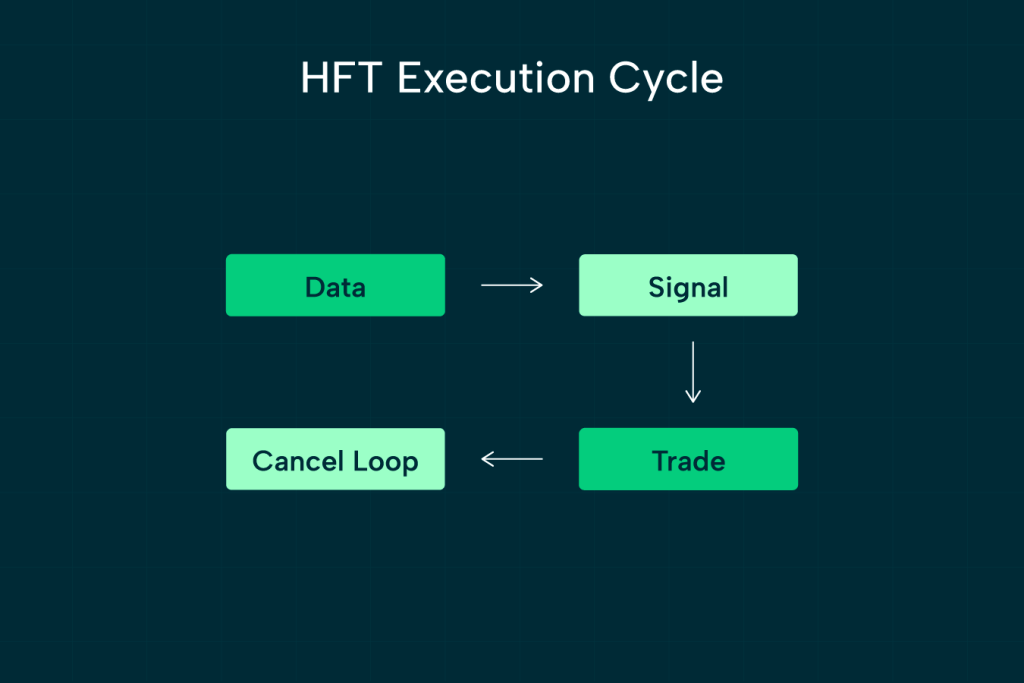

The Data → signal → trade → cancel loop

HFT strategies operate on a continuous, machine-driven loop that generates an extremely high order-to-trade ratio. Details of how this loop works are explained below:

Data (Ingestion):

HFT systems ingest massive, real-time streams of market data from exchanges, including every bid, every offer, and every trade. The goal is to receive this data stream faster than the competition.

Signal (Analysis):

Powerful algorithms and specialized hardware (like FPGAs) process the incoming data stream in microseconds to identify a fleeting signal or opportunity. Common signals include latency arbitrage, order anticipation and market making.

Trade (Execution):

Once a signal is detected, the HFT system instantly sends an order to the exchange for execution. The goal is to be the first to execute the trade, securing the small profit before the opportunity disappears or another HFT firm acts.

Cancel (or Update):

Crucially, if the opportunity disappears (e.g., another firm trades first, or the market moves) or the order is not immediately filled, the standing order is instantly canceled or updated.This rapid cancellation is why HFT generates high volumes of “ghost liquidity”—orders that appear on the book for a fraction of a second but are quickly pulled.

Core HFT Strategies

The core of High-Frequency Trading (HFT) is the exploitation of minute, short-lived market inefficiencies through technological speed. HFT strategies are typically market-neutral, meaning they aim to profit regardless of whether the broader market is going up or down.

Market making

Market making is the practice of continuously quoting two-sided prices, typically a bid (to buy) and an ask (to sell). The goal is to capture the bid-ask spread, which is the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept.

An HFT market maker algorithm simultaneously places a buy limit order slightly below the market price and a sell limit order slightly above the market price. The firm’s speed is critical to rapidly update or cancel its quotes if the market price moves. This allows the HFT to avoid adverse selection (getting stuck with a bad trade). Market makers may also earn revenue from exchange rebates.

Arbitrage (latency, cross-exchange, statistical)

Arbitrage involves locking in a risk-free profit by exploiting a temporary price difference for the same or related asset. HFT firms are designed to spot and execute these opportunities in microseconds. There are different types of arbitrage depending on the type of situation they target.

For instance:

- Latency arbitrage tries to exploit the tiny time delay (latency) in the dissemination of price data between different exchanges or market participants.

- Cross-exchange arbitrage exploits price differences for the exact same security trading on two different venues (e.g., NYSE and Nasdaq).

- Statistical Arbitrage involves looking for temporary deviations from statistically predicted price relationships between two or more related assets

Momentum ignition

This is a controversial, directional strategy designed to trigger a short-term price move by exploiting the way other algorithms and market orders are structured. The HFT algorithm initiates a rapid sequence of aggressive small market orders on one side (e.g., all buy orders). This rapid, one-sided volume is intended to:

- Force the price higher by “eating through” the available sell limit orders on the order book.

- Trigger stop-loss orders or other momentum-following algorithms run by slower traders.

The goal of this strategy is to create a burst of price momentum (ignition) that allows the initiating HFT firm to profit by closing its position into the ensuing price spike. Regulators often scrutinize this practice due to its potential to manipulate price.

Quote stuffing

Quote stuffing is the practice of rapidly submitting and canceling a massive volume of non-bona fide (not intended to be executed) limit orders to a trading venue. The HFT algorithm floods the exchange’s data feed and matching engine with hundreds or thousands of quotes and cancellations per second.

The intention is to create an excessive volume of information, which strains the capacity of the exchange’s infrastructure and the processing systems of slower market participants. This can artificially increase latency (delay) for those slower firms, effectively creating a brief technological bottleneck.

By slowing down their rivals, the initiating HFT firm may gain an additional few microseconds of uncontested speed, allowing them to execute an arbitrage trade or another high-speed strategy successfully.

HFT Strategy Comparison Table

| Strategy | Core Mechanism | Objective / Edge | Risk Profile | Reward Profile | Key Risks & Controls |

| Market Making | Continuous two-sided quoting (bid/ask) around market price; profits from bid-ask spread and exchange rebates. | Capture micro-spreads and provide liquidity. | Moderate: exposure to adverse selection if market moves sharply before quotes can be adjusted; inventory risk. | Steady, small profits per trade; accumulates with high volume. | – Latency risk (speed critical).- Inventory limits & real-time hedging.- Robust quote-cancel algorithms. |

| Latency Arbitrage | Exploits timing delays in data dissemination between venues or participants. | Profit from price changes seen early before others. | Low to Moderate: dependent on microsecond latency edge; risks vanish if speed advantage erodes. | High short-term returns possible; vanishes as competition equalizes latency. | – Infrastructure cost (colocation, FPGA).- Regulatory risk if deemed manipulative. |

| Cross-Exchange Arbitrage | Trades same security across venues (e.g., buy on NYSE, sell on Nasdaq). | Lock in price discrepancies between exchanges. | Low: near risk-free if execution is perfectly synchronized. | Small per-trade profit, multiplied by frequency. | – Execution mismatch (one leg fills, other fails).- Latency and fee costs. |

| Statistical Arbitrage | Uses models to identify mean-reversion or co-movement deviations among correlated assets. | Profit from short-term pricing inefficiencies based on statistical signals. | Moderate: model risk and correlation breakdowns during market stress. | Moderate to high, depending on model accuracy and leverage. | – Requires large datasets, low latency backtesting.- Must rebalance quickly as relationships decay. |

| Momentum Ignition | Initiates aggressive orders to spark short-term price moves, then profits from resulting volatility. | Exploit reaction of slower participants and algos. | High: highly directional and often scrutinized by regulators. | Potentially high but short-lived if successful. | – Legal/ethical risk (market manipulation).- High execution cost and slippage if misfired. |

| Quote Stuffing | Floods exchanges with large volumes of non-executable quotes to slow competitors. | Create artificial latency to gain temporary speed edge. | Very High: potential for regulatory penalties; operational risks. | Marginal temporary gain (microseconds of edge). | – Prohibited in most jurisdictions.- May cause self-induced system stress. |

Technology Behind HFT

HFT is a trading technology that depends heavily on technology. The technology behind this trading method focuses on achieving the absolute minimum latency across all parts of the trading process. This is achieved through three core technical areas:

Colocation and proximity to exchanges

HFT firms often place their computer servers physically inside or immediately next to the exchange’s data center where the matching engine resides. This level of proximity is paramount because data transmission, even at the speed of light, takes time.

By minimizing the physical distance, HFT firms reduce the network latency (the time it takes for market data to travel from the exchange to the trader’s server and for the order to travel back). This setup can shave off microseconds (millionths of a second), which is crucial for exploiting tiny, fleeting price differences (arbitrage) and reacting to market changes faster than competitors

Fiber vs microwave transmission

HFT firms utilize advanced networking to transmit data over long distances with minimal delay. Fiber-optic cable transmits data as light pulses through glass fiber. While extremely fast, the speed of light in glass is about 30–40% slower than in a vacuum or air. Fiber is generally reliable and provides high bandwidth, but microwave transmission is more preferred for HFT.

Microwave transmission (radio signals through the air) is often used for long-distance, point-to-point connections. Since radio waves travel in air at a speed much closer to the speed of light in a vacuum, a straight-line microwave path can offer lower latency than a winding fiber-optic cable route, especially over very long distances (e.g., between financial centers). HFT firms invest heavily in building, or leasing access to, these ultra-low-latency microwave networks.

Custom-built hardware: FPGAs, GPUs, custom tick engines

HFT firms use specialized hardware to process market data and execute algorithms faster than standard commercial servers. Some of these tools include:

- Field-Programmable Gate Arrays (FPGAs): These are integrated circuits that can be custom-programmed after manufacturing. In HFT, FPGAs are programmed to implement the entire trading algorithm, from processing raw market data feeds to generating trade orders directly in the hardware’s logic circuits. This allows for massively parallel processing and nanosecond-level latency because the data never has to be processed sequentially by a general-purpose operating system or CPU.

- Graphics Processing Units (GPUs): While FPGAs are superior for ultra-low latency, GPUs are used for tasks that require high-throughput parallel computation, such as rapidly running complex statistical models, large-scale simulations, and machine learning components of trading strategies.

- Custom Tick Engines: These are highly optimized software or hardware systems, often implemented on FPGAs or specialized CPU architectures, designed for the sole purpose of receiving, processing, and maintaining the order book from the exchange’s market data feed (known as “ticks”) with the absolute lowest latency and the highest level of determinism.

HFT vs Retail Algo Trading

High-Frequency Trading (HFT) and Retail Algorithmic Trading are both forms of automated trading, but they differ dramatically in terms of their execution speed, strategy complexity, and infrastructure requirements.

Execution speed

HFT is defined by its extreme speed, where trades are executed in microseconds to nanoseconds. Speed is not just an advantage; it is the core factor that determines profitability. HFT firms participate in a constant, expensive latency arms race to be the very first to react to new market data, exploit fleeting price differences, or gain priority in the exchange’s order queue. Positions are typically held for milliseconds or seconds. Conversely, Retail Algorithmic Trading operates at a much slower speed, generally with execution times measured in milliseconds (ms) or seconds (s). While faster execution is always beneficial, the retail algo’s profitability does not depend on being faster than the institutional players; instead, it relies on the strategy’s signal being valid over a longer time horizon (minutes, hours, or days).

Strategy complexity

The strategies employed in HFT are exceptionally complex, often focusing on market microstructure—the detailed mechanics of the order book and exchange rules. Strategies like latency arbitrage, high-speed market making, and order flow prediction require sophisticated, proprietary mathematical models and massive computing power to process and act on vast amounts of real-time data. Success relies on extracting tiny, consistent profits from a massive volume of trades. Retail Algorithmic Trading utilizes strategies that are generally less complex in their real-time execution demands. They tend to be based on more traditional, though automated, quantitative models, such as trend following, mean reversion, or execution algorithms (like VWAP) designed to handle larger orders efficiently without causing significant market impact

Infrastructure requirements

The Infrastructure requirements for HFT are prohibitive for most participants, often costing millions of dollars. The required setup includes co-location, the use of specialized, expensive hardware for processing data at the hardware level, and accessing Direct Market Access (DMA) data feeds for the absolute lowest latency data. In stark contrast, Retail Algorithmic Trading can run on standard consumer-grade computers or, for better performance, use Virtual Private Servers (VPS) rented from cloud providers. Retail setups use standard broker APIs for order execution and consolidated market data feeds, making the barrier to entry significantly lower and prioritizing convenience and reliability over ultra-low latency.

| Aspect | High-Frequency Trading (HFT) | Retail Algorithmic Trading |

|---|---|---|

| Speed | Executes in microseconds–nanoseconds; profits depend on being fastest. | Executes in milliseconds–seconds; speed less critical. |

| Complexity | Uses advanced, proprietary algorithms and real-time data models. | Relies on simpler, rule-based or quantitative strategies. |

| Infrastructure | Requires co-location, FPGAs, DMA, and multi-million setups. | Runs on standard PCs or VPS via broker APIs. |

| Cost & Access | High cost, limited to institutions. | Affordable, accessible to individuals. |

| Holding Period | Milliseconds–seconds | Minutes–days |

Risks & Criticisms

HFT is a highly controversial trading strategy. Not only has it been criticized due to its impact on the market, it also introduces several major risks that traders have to consider before making a decision some of these risks include:

Liquidity mirage

The liquidity mirage is the misleading impression of deep, stable market liquidity (many buyers and sellers). This illusion is created by HFT algorithms constantly posting and updating limit orders, which makes the electronic order book appear “thick” with depth.

The Reality is that these orders are typically conditional and designed to be canceled instantly when market conditions change or volatility increases. HFT algorithms are designed for self-preservation and are often among the first to withdraw their quotes when a large, unexpected order arrives.When genuine selling pressure hits, this “ghost liquidity” vanishes in milliseconds, leaving a thin market. This can lead to rapid, drastic price movements.

Flash crashes

HFT is widely criticized for its role in contributing to, or amplifying, sudden and severe market drops known as flash crashes. When a significant event or large order hits the market, HFT algorithms can trigger a cascading effect. They rapidly detect price movement and, in a fraction of a second, cancel their offers and submit massive sell/buy orders.

The ultra-fast, interconnected nature of these algorithms means that one machine’s defensive action (canceling quotes) can instantly trigger a similar reaction in hundreds of others, quickly draining liquidity and sending prices into a freefall.

For instance, the May 6, 2010 “Flash Crash,” where the Dow Jones Industrial Average dropped nearly 1,000 points in minutes before quickly recovering, is a key example often linked to algorithmic trading behavior.

Regulatory blind spots

The speed and complexity of HFT can outpace traditional market oversight, creating gaps for potentially abusive or destabilizing practices. Regulators often struggle to keep up with the sophisticated, proprietary technology and strategies (like custom hardware and closed-source algorithms) used by HFT firms. What’s worse? A universally accepted, legal definition of HFT remains elusive, complicating efforts to write targeted regulations.

Certain HFT tactics, such as Spoofing (submitting large orders with the intent to cancel them before execution to manipulate prices) and Quote Stuffing (flooding the market with orders and cancellations to slow down competitors’ systems), are considered illegal in many jurisdictions but are notoriously difficult to detect and prosecute in real-time.

Concentration of power

The immense cost of co-location, custom-built hardware (FPGAs), and top-tier engineering talent creates an extremely high barrier to entry, effectively excluding all but the most well-funded institutions.

This technological edge grants these few firms an asymmetric informational advantage over traditional investors, allowing them to consistently profit from minute price discrepancies (latency arbitrage) at the expense of slower market participants. The concentration of market-making activity in a few large firms means that a bug or failure in one major HFT system could have a disproportionate, destabilizing impact on the entire market.

Regulation & Oversight

Regulation of HFT is a major focus for global financial authorities, aiming to mitigate systemic risks like flash crashes while preserving the benefits HFT provides. Below is an overview of the things you need to know about how the industry is regulated.

Key global regulators

The primary regulators overseeing HFT activity in the US include the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission. While the SEC oversees equity markets, focusing on market stability, investor protection, and fairness, the CFTC oversees the US derivatives and futures markets. This is where the most significant amount of HFT occurs. The CFTC has been particularly active in prosecuting abusive practices like “spoofing.”

In the EU, the European Securities and Markets Authority is in charge of coordinating market regulation across the European Union. They also oversee the implementation of major directives like MiFID II.

HFT Rules

Regulators have implemented specific rules and tools to manage the speed and systemic risk of HFT. The MiFID II (Markets in Financial Instruments Directive II) is one example of such regulations. This is a comprehensive framework that introduced specific rules for algorithmic and high-frequency traders, including:

- Organisational Requirements

- Market Making Obligations.

- Order-to-Trade Ratio

Another rule is the Reg NMS (Regulation National Market System). This requires that orders be executed at the best available price across all markets. While not exclusively for HFT, it drives HFT’s strategy of scanning multiple venues (exchanges and dark pools) for arbitrage and best execution.

There are also automated mechanisms (like the Limit Up/Limit Down plan in the US) that temporarily halt trading in a stock or the entire market if the price moves outside a specified band in a short period. These are known as circuit breakers and they’re designed to pause trading and allow for a more orderly market correction during flash crashes.

HFT licensing and transparency efforts

A central regulatory push has been on to bring HFT firms, many of which traditionally operated outside strict oversight, under formal control. Measures like those in MiFID II require firms engaging in high-volume, proprietary algorithmic trading to be authorized as investment firms and subjected to full regulatory oversight, including capital requirements and record-keeping.

Regulators are pushing for greater transparency through various initiatives. Examples include algorithm registration which would require HFT firms to provide regulators with details about the algorithms they use. Maintaining an Audit trail will also enhance the ability ability of regulators to trace the flow of every order and cancellation to detect manipulation.

The Future of HFT

Considering how technology-dependent HFT is, The future of High-Frequency Trading (HFT) will be defined by the advancement in various technological concepts such as next generation of computing power and algorithmic intelligence. These technologies push the speed arms race to its absolute physical limits.

Will quantum computing change HFT?

Quantum computing won’t necessarily make HFT faster in terms of fiber-optic speed (which is a physical limit), but it will make it smarter and more optimized within the current speed limits. Quantum algorithms (like QAOA) are ideal for solving combinatorial optimization problems instantly. This includes:

- Finding the optimal, most profitable arbitrage path across dozens of highly-correlated assets and markets.

- Calculating Value-at-Risk (VaR) and dynamically rebalancing massive, high-dimensional portfolios in real-time.

- Quantum Machine Learning (QML) could process exponentially more data, including non-linear and high-dimensional market relationships. This can be used to generate superior predictive signals with lower latency than current AI models.

Will AI models Improve HFT strategies?

AI is already being used in HFT. This evolution isn’t replacement; it’s a merger. Traditional HFT is based on simple, hard-coded rules and latency arbitrage. Modern systems are becoming increasingly dominated by advanced AI as the new engine of HFT.

They are used for predictive modeling (forecasting short-term price movements). They can also handle execution optimization (determining when, where, and how much to trade to minimize market impact).

AI allows HFT to move beyond static strategies to adaptive models that learn and adjust their parameters based on live market feedback, creating a competitive loop that only faster, smarter algorithms can win.

Arms race: is there a limit to how fast we can go?

The HFT arms race is primarily a contest in latency reduction, which is governed by physics.The Hard Barrier: The absolute, theoretical limit is the speed of light in a vacuum. Since market data and orders travel through physical mediums (fiber optic cables or air via microwave), the practical speed limit is lower.

Firms are currently operating in the microsecond (millionths of a second) to nanosecond (billionths of a second) range. The entire industry is now focused on optimizing the “last mile” of connection. But in the near future, the arms race will likely shift from shaving off milliseconds to refining the intelligence of the algorithms (using AI/Quantum) to make superior decisions within the fixed nanosecond window imposed by the physical world.

Final Thoughts

High-Frequency Trading has transformed the modern financial landscape from a human-driven environment to a high-speed, algorithmically-managed ecosystem.HFT is an entrenched feature of global markets, driving the vast majority of trading volume in equities and futures. As technology continues to advance, so too will algorithmic dominance. Efforts by regulators are focused on managing its risks, not eliminating the practice.

Despite these benefits, the barrier to entry for HFT is exceptionally high, requiring multi-million dollar investments in proprietary technology, co-location, microwave links, and specialized talent. It is strictly a realm for institutional players and specialized quantitative firms, not for the average retail or long-term investor.

But even if you can’t join in on the HFT race, it is essential that you understand it instead of trying to fight it. An understanding of this concept helps you see the microstructure of finance, which governs how prices are set and liquidity is provided in real-time. You can’t compete on latency alone, so you must use other strategies like smart order routers (SORs) that are designed to navigate the fragmented, HFT-dominated landscape

FAQs

Can I start HFT with $10,000?

No you can’t. High-Frequency Trading is reserved for institutional firms that compete in the microsecond and nanosecond (millionths and billionths of a second) range. The required investment is typically tens of millions of dollars and includes:

Is HFT legal in my country?

HFT itself is legal under U.S. and EU rules, subject to strict conduct requirements; manipulative practices are prohibited and enforced. Of course, you should confirm locally before assuming that this strategy is allowed

Do HFT firms cause flash crashes?

Yes. HFT firms are a major factor in flash crashes. However, this isn’t always the case as there are other causes as well.

Is latency still the biggest edge?

The future of HFT is shifting from a pure speed race to a contest of algorithmic intelligence. Consequently, the greatest competitive edge now comes from developing superior AI and quantitative models that can generate unique, highly predictive signals and adapt instantly to changing market conditions, allowing firms to win with smarter decisions within the constrained nanosecond time frame.

Sources

https://www.investopedia.com/terms/h/high-frequency-trading.asp

https://corporatefinanceinstitute.com/resources/equities/high-frequency-trading-hft