Introduction

Options trading strategies are structured approaches to buying and selling options that help traders achieve specific financial goals—whether it’s hedging risk, generating income, or speculating on price movements. These options strategies empower traders to tailor their approach based on market conditions, volatility levels, and portfolio goals. This comprehensive guide is designed for both beginners seeking clarity and intermediate traders looking to refine their strategies.

By the end of this article, you’ll understand what option strategies are, when and how to use them, and how they can be adapted to different market conditions. Whether you’re seeking conservative income or high-reward speculation, this options strategies guide will provide tools to succeed in any market environment.

What Are Option Strategies?

An options strategy is a carefully structured combination of one or more options contracts—calls, puts, or a mix of both—used to achieve a specific financial goal. These strategies are not random bets but deliberate constructs designed to balance potential reward with acceptable levels of risk. By choosing the right strategy, traders can fine-tune their exposure to market movements, volatility, and time decay.

Options strategies are commonly employed for three primary objectives:

- Hedging: Many investors use options as insurance against downside risk in their portfolios. For example, buying puts on a stock you own can limit potential losses in a market downturn, allowing you to stay invested while managing risk.

- Income Generation: Strategies like covered calls or cash-secured puts are popular for generating consistent premium income, particularly in sideways or moderately bullish markets. These approaches enable traders to monetize stagnant positions or capitalize on market inefficiencies.

- Speculation: For traders with a directional view on a stock or index, options offer leveraged exposure with defined risk. Bullish strategies like long calls or call spreads, and bearish plays such as puts or bear spreads, allow for targeted bets on price movements without the need to own the underlying asset.What makes options especially powerful is their flexibility—strategies can be crafted to benefit from nearly any market condition: uptrends, downtrends, high or low volatility, or even time-based decay. From simple single-leg trades to complex multi-leg positions involving multiple expirations and strike prices, the range of choices can suit beginners and seasoned professionals alike.

Categories of Option Strategies

These four categories of options strategies provide a foundation for selecting the right position based on your directional bias and risk appetite.

| Strategy Type | Market Outlook | Example Strategies |

| Bullish | Expecting a rise | Long Call, Bull Call Spread |

| Bearish | Expecting a fall | Long Put, Bear Put Spread |

| Neutral | Expecting no move | Iron Condor, Calendar Spread |

| Volatile | Expecting big move | Straddle, Strangle |

How to Choose the Right Strategy

With so many strategies available, selecting the right one might feel overwhelming at first. But with a structured approach, even beginners can quickly narrow down their choices. The key is to align your strategy with your outlook, comfort level, and resources. To maintain uninterrupted access to your trading tools and ensure quick response times when executing option strategies, many traders use a dedicated forex VPS for reliable, low-latency infrastructure.

Start with your market view: Are you expecting prices to rise, fall, remain flat, or swing wildly in either direction? That’s your first major filter. From there, consider your risk tolerance. If the thought of losing more than your initial investment keeps you up at night, you’ll likely want to stick with defined-risk strategies like spreads or protective options.

Your available capital also plays a critical role. Complex strategies with multiple legs may require margin or significant upfront capital—something to keep in mind if you’re trading in a smaller account.

And don’t forget about time horizon. Some strategies are best for short-term trades, capitalizing on quick moves or time decay. Others may be more appropriate for longer-term plays, such as hedging a portfolio or generating monthly income.

A helpful way to decide is to ask:

- What is my expectation for the market?

- How much can I afford to risk?

- Do I need income, protection, or growth?

- How actively do I want to manage the trade?

Once you clarify these answers, a filtered list of suitable options strategies—such as spreads, iron condors, or long calls—will emerge to match your objectives.

Core Option Strategies Explained

Options trading offers a wide range of strategies tailored to different market views, risk tolerances, and portfolio goals. Whether you’re seeking income, protection, or speculative opportunities, understanding the core strategies is essential. This guide breaks down five foundational options strategies using a consistent format—making it easier to compare, learn, and apply them in real-world trading.

Each strategy includes a breakdown of:

- What it is

- When to use it

- Pros and cons

- Example trade

Let’s dive in.

1. Covered Call

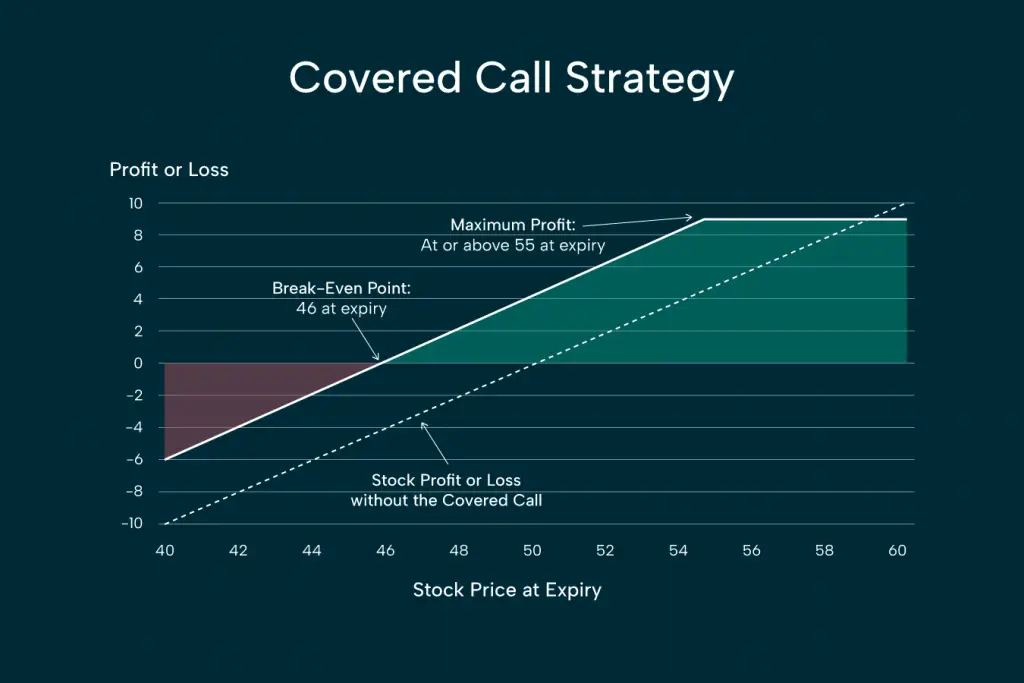

What it is

A covered call involves owning the underlying stock and selling a call option against it. You collect the premium from the call option while holding the stock.

When to use it

Use this strategy when you’re neutral to moderately bullish on the stock and want to generate additional income.

Pros and cons

Pros:

- Generates premium income

- Provides limited downside protection

Cons:

- Caps upside profit

- Still exposed to downside risk in the underlying stock

Example trade

Buy 100 shares of XYZ at $50

Sell 1 call option with a $55 strike, collecting $4 premium

Max gain: $900 (from $5 stock gain + $4 premium)

Breakeven: $46

Risk: Same as stock ownership, offset by $4 premium

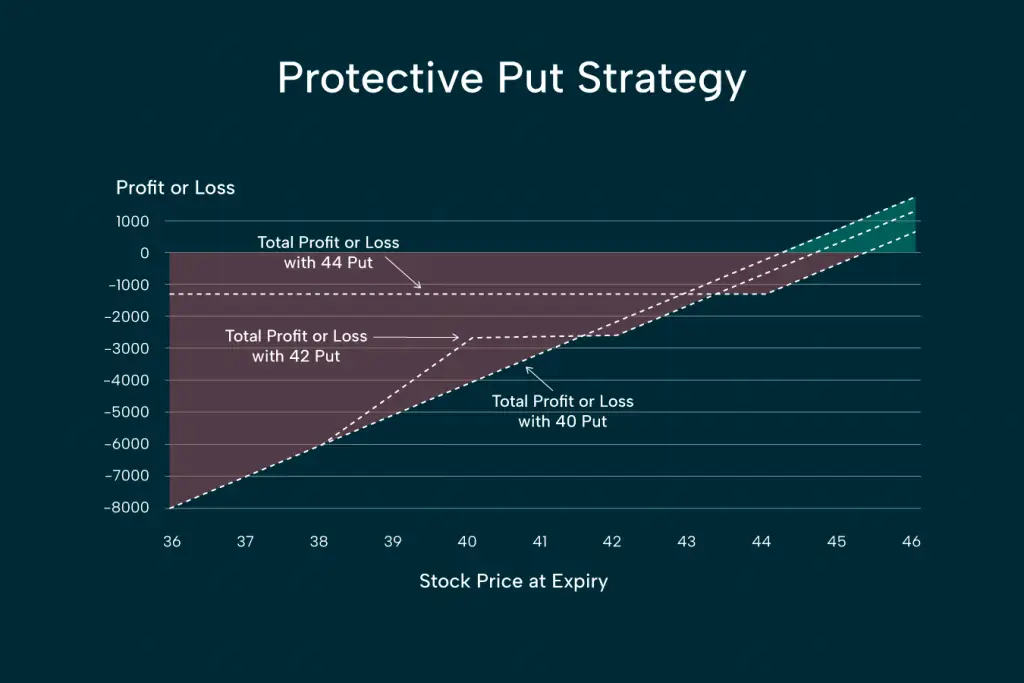

2. Protective Put

What it is

This strategy involves buying a put option while holding the underlying stock. It acts like insurance to limit downside losses.

When to use it

Ideal during uncertain market conditions when you want to protect unrealized gains or limit losses.

Pros and cons

Pros:

- Downside protection

- Unlimited upside from stock

Cons:

- Premium cost reduces overall return

- May expire worthless

Example trade

Buy 100 shares of XYZ at $46

Buy 1 put option with a $42 strike for downside protection

Max loss (with $42 put): Limited near -$3,000 if stock drops below $42

Max loss (with $40 put): Deeper, around -$5,000 if stock drops below $40

Upside: Unlimited above $46, reduced by put cost

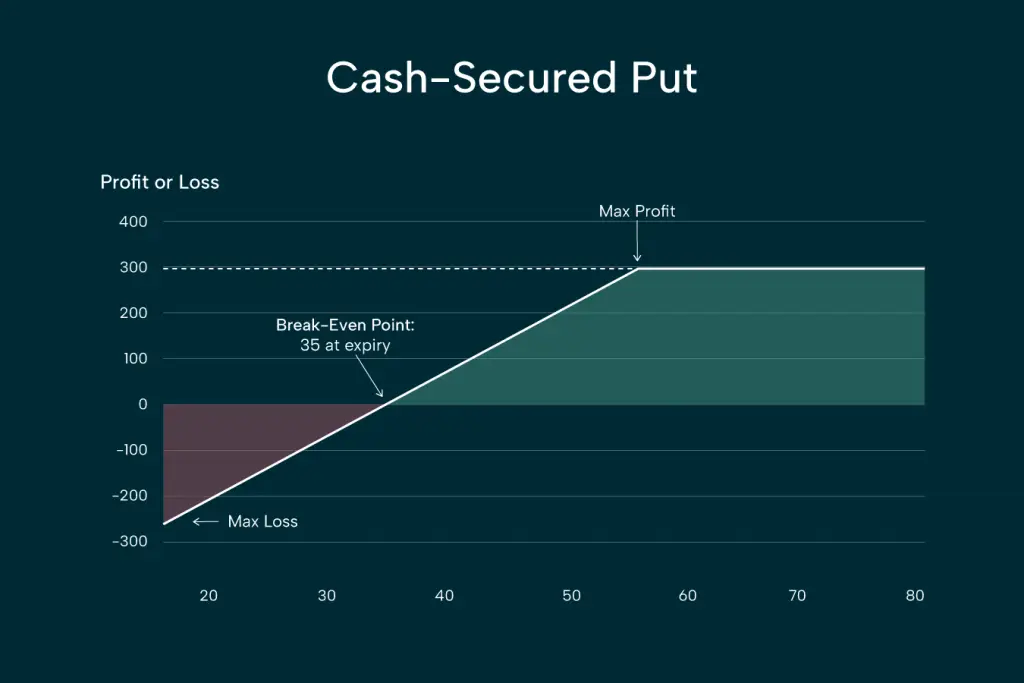

3. Cash-Secured Put

What it is

Selling a put option while holding enough cash to buy the stock if assigned. It’s a bullish strategy with a potential to acquire stock at a lower price.

When to use it

Use when you are willing to buy the stock at a lower price and want to earn income if it doesn’t drop that far.

Pros and cons

Pros:

- Earns premium upfront

- May buy stock at discount

Pros:

- Obligation to buy at strike if exercised

- Opportunity cost if stock rises

Example trade

Sell 1 cash-secured put on XYZ with a $40 strike, collecting a $5 premium

You must reserve $4,000 cash to potentially buy 100 shares

Breakeven: $35 (strike price minus premium received)

Max profit: $500 if stock stays above $40

Risk: Assigned shares if stock drops below $40; max loss occurs if stock goes to $0 (−$3,500)

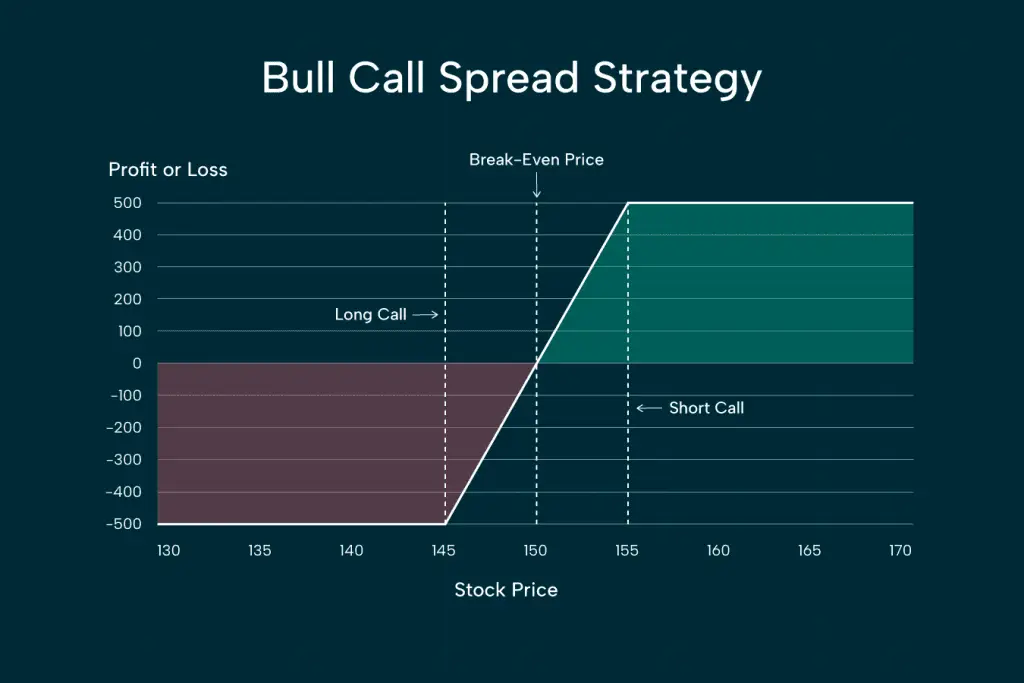

4. Vertical Spread (Bull Call Spread)

What it is

Buy a call at a lower strike and sell a call at a higher strike with the same expiration. This lowers cost but caps profit.

When to use it

Best used when moderately bullish on a stock and want to limit both risk and reward.

Pros and cons

Pros:

- Lower upfront cost than buying a call

- Defined risk and reward

Cons:

- Limited upside

- Both legs can expire worthless

Example trade

Buy 1 call option with a $145 strike for $7

Sell 1 call option with a $155 strike for $2

Net debit (cost): $5 per share ($500 total)

Max profit: $500 if stock is at or above $155 at expiry

Breakeven: $150 (lower strike + net cost)

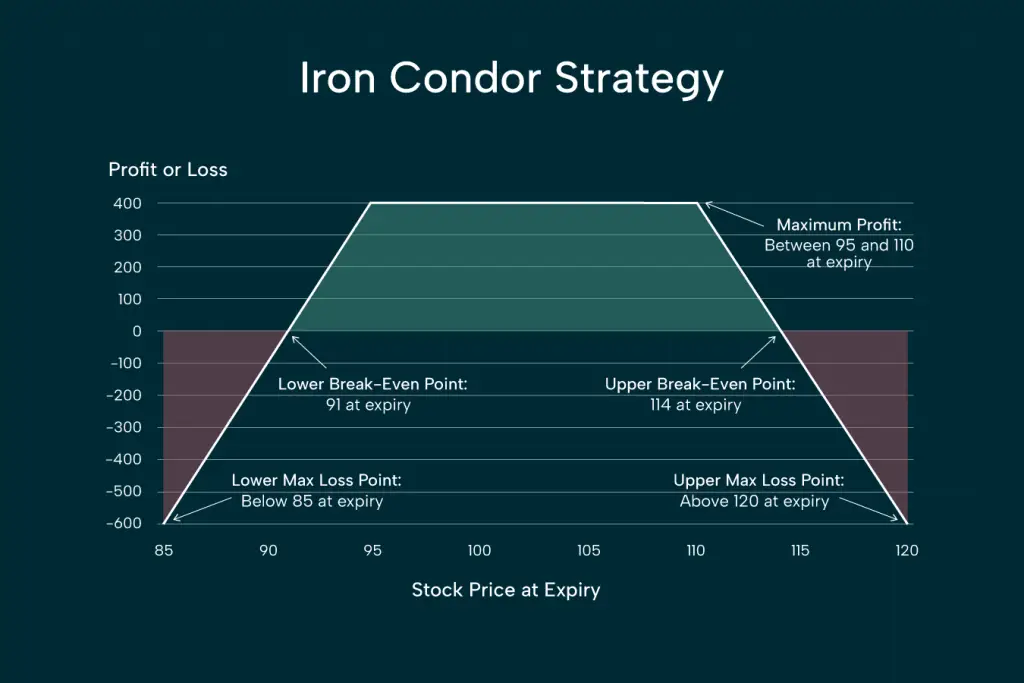

5. Iron Condor

What it is

A non-directional strategy that combines a bull put spread and bear call spread. You profit if the stock stays within a range.

When to use it

Use during low-volatility environments when you expect the stock to stay within a specific price range.

Pros and cons

Pros:

- Profitable in sideways markets

- Limited risk

Cons:

- High commissions (4 legs)

- Profit limited to premium

Example trade

Sell 1 put at $95 and buy 1 put at $85

Sell 1 call at $110 and buy 1 call at $120

Max profit: Earn full credit if stock closes between $95–$110

Breakeven range: $91 to $114

Max loss: Occurs if stock is below $85 or above $120 at expiry

Advanced Option Strategies Explained

As traders grow more experienced, they often move beyond basic strategies to more advanced, flexible tools that are better suited for unique market conditions—especially when dealing with volatility, range-bound behavior, or complex risk management. These advanced strategies may involve multiple legs and more intricate setups, but they offer greater control over potential outcomes and can be highly effective when deployed with precision. Whether you’re preparing for a big earnings move, trading sideways markets, or trying to capitalize on time decay, understanding these strategies can give you a tactical edge. Like the core strategies, each advanced strategy is broken down using a consistent format:

- What it is

- When to use it

- Pros and cons

- Example trade

What it is

A straddle involves buying both a call and a put option at the same strike price and expiration. It’s a market-neutral, volatility-based strategy that profits from large price moves in either direction.

Let’s explore the next level of options trading tools.

6. Straddle

When to use it

Use a straddle when you expect high volatility or a big move in the underlying stock but are unsure about the direction, such as before earnings, product announcements, or economic releases.

Pros and cons

Pros:

- Profits from large price moves in either direction

- Unlimited upside if the stock surges

- No directional bias needed

Cons:

- Expensive due to buying two premiums

- Needs a big move to break even

- Vulnerable to implied volatility (IV) crush after events

Example trade

Buy 1 XYZ call at $100 for $4

Buy 1 XYZ put at $100 for $3

Total cost: $7

Breakeven points: $93 and $107

Max gain: Unlimited

Max loss: $7 (if stock closes at $100 at expiration)

7. Strangle

What it is

A strangle is similar to a straddle but uses out-of-the-money options. You buy a call with a strike above the current stock price and a put with a strike below it—same expiration.

When to use it

Ideal when you expect a major move in either direction but want to pay less premium than a straddle. Often used before unpredictable events.

Pros and cons

Pros:

- Lower cost than a straddle

- Profits from large price swings in either direction

- Flexible and less capital intensive

Cons:

- Requires a larger move to reach breakeven

- Both options can expire worthless

- Still vulnerable to IV crush

Example trade

Stock is at $100

Buy 1 call at $105 for $2

Buy 1 put at $95 for $2

Total cost: $4

Breakeven points: $109 and $91

Max gain: Unlimited

Max loss: $4

8. Iron Butterfly

What it is

The iron butterfly combines elements of a straddle and an iron condor. You sell an at-the-money call and put, then buy a further OTM call and put for protection, all with the same expiration.

When to use it

Use when you expect very low volatility and the stock to stay close to a specific price. Ideal for tight range-bound trading.

Pros and cons

Pros:

- Higher credit (potential profit) than iron condor

- Defined risk and reward

- Capital-efficient for neutral outlooks

Cons:

- Narrow profit range

- Requires precision in price prediction

- 4-legged strategy with higher commissions

Example trade

Stock at $100

Sell 1 call at $100, buy 1 call at $105

Sell 1 put at $100, buy 1 put at $95

Net credit: $4

Max profit: $4 (if stock stays at $100)

Max loss: $1 (width of wings – credit)

9. Calendar Spread

What it is

A calendar spread involves selling a short-term option and buying a longer-term option with the same strike price. It takes advantage of differences in time decay (theta) and volatility.

When to use it

Best used when expecting little movement in the short term, but with potential for future movement or IV increase.

Pros and cons

Pros:

- Profits from time decay on short leg

- Can benefit from IV rise on long leg

- Flexible adjustments possible

Cons:

- Complex to manage

- Sensitive to IV shifts

- Requires accurate timing of price and volatility

Example trade

Stock at $50

Sell 1 call expiring in 2 weeks at $50 for $1

Buy 1 call expiring in 1 month at $50 for $2.50

Net debit: $1.50

Max profit: If stock stays around $50 at short-leg expiration

Max loss: $1.50

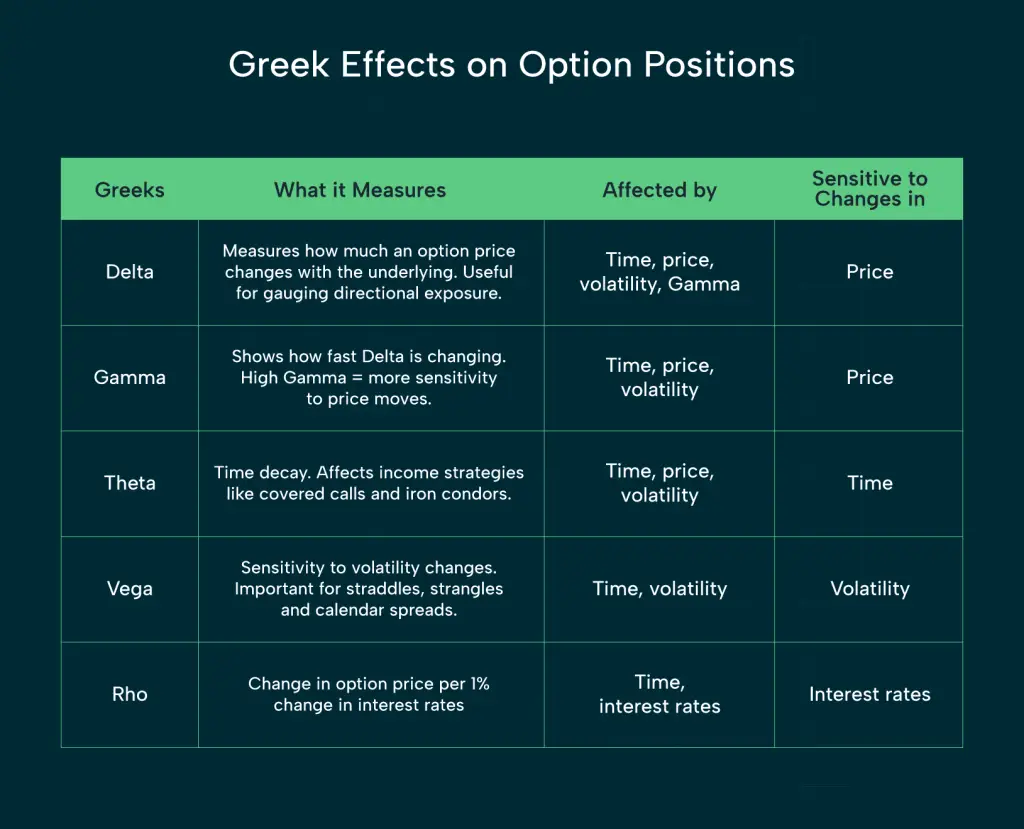

How the Greeks Affect Option Strategies

The “Greeks”—Delta, Gamma, Theta, Vega, and Rho—measure how different factors influence the price of an option. Understanding them can dramatically improve your strategy selection and risk management.

- Delta: Measures how much an option price changes with the underlying. Useful for gauging directional exposure.

- Gamma: Shows how fast Delta is changing. High Gamma = more sensitivity to price moves.

- Theta: Time decay. Affects income strategies like covered calls and iron condors.

- Vega: Sensitivity to volatility changes. Important for straddles, strangles, and calendar spreads.

- Rho: Interest rate sensitivity. Less impactful in most retail scenarios, but important in long-dated options.

Matching your strategy to the appropriate Greeks helps you fine-tune trades and avoid unwanted surprises.

Real Trade Example: Strategy in Action

Let’s walk through a real-world scenario using a Bull Call Spread:

Scenario: You’re bullish on XYZ stock currently trading at $100.

Trade Setup:

- Buy 1 XYZ 100 Call (cost: $4)

- Sell 1 XYZ 110 Call (credit: $1)

- Net debit = $3

Max Gain: $7 (difference in strikes – net debit) Max Loss: $3 (initial debit) Break-even: $103

If XYZ closes above $110 at expiration, you make the full $7 profit. If it closes below $100, you lose the $3 premium paid.

This is a lower-risk, lower-reward strategy ideal for modestly bullish views.

Common Mistakes to Avoid

Even the most promising options trading strategy can quickly unravel if you’re not mindful of these common pitfalls. Avoiding these mistakes can significantly enhance your consistency and accelerate your growth as a trader.

1. Overleveraging

Using too much capital on a single trade is one of the fastest ways to deplete your account. While options provide the allure of high returns, they also come with amplified risk. A disciplined approach to position sizing—typically risking only 1–3% of your account per trade—can help you survive drawdowns and remain in the game for the long term.

2. Ignoring Implied Volatility (IV)

Implied volatility plays a critical role in option pricing. Failing to account for IV can lead to misjudging a trade’s profitability. For instance, buying options when IV is high and it later contracts can result in losses—even if the underlying moves in your favor. Understanding when to use high-IV strategies (like credit spreads) versus low-IV strategies (like long calls/puts) is essential for maintaining a statistical edge.

3. Poor Strike Price Selection

Choosing strikes that are too far out-of-the-money or misaligned with your market outlook can diminish your odds of success. A poorly chosen strike might be inexpensive, but if it’s unrealistic given the timeframe, the trade is more like a lottery ticket than a calculated bet. Your strike selection should reflect your thesis on direction, magnitude, and timing.

4. Holding Until Expiration

While it may be tempting to hold an option to expiry for maximum gain, this approach often exposes you to unnecessary risks. Time decay accelerates in the final days, and unexpected volatility shifts can erode profits or deepen losses. Having a clear profit target or time-based exit rule often leads to better overall results.

5. Lack of a Trading Plan

Without a predefined plan—including entry criteria, exit targets, stop-losses, and adjustment strategies—you’re trading reactively rather than proactively. This opens the door to emotional decision-making, which is often costly. Treat every trade like a business plan: know why you’re entering, how you’ll manage the position, and under what conditions you’ll exit.

In Summary:

Avoiding these mistakes isn’t just about saving money—it’s about accelerating your learning curve and developing professional-grade habits. Staying disciplined, informed, and methodical gives you the staying power needed to thrive in any market condition.

Best Tools for Building Option Strategies

Executing options strategies effectively—whether in bull, bear, or sideways markets—requires more than just market knowledge. The tools and platforms you use play a critical role in your ability to analyze trades, manage risk, and respond to real-time conditions. From visualizing complex multi-leg positions to testing ideas in simulated environments, a robust trading platform can significantly enhance your edge. Below, we’ll explore some of the most respected platforms that support a wide range of options trading strategies, each offering unique features tailored to different trading styles and experience levels.

Thinkorswim (by TD Ameritrade)

Thinkorswim is a feature-rich platform tailored for traders who demand depth and precision in their analysis. It offers advanced charting tools with customizable indicators, real-time data, and the ability to overlay multiple asset classes for comprehensive technical evaluation. One of its standout features is the strategy builder, which allows users to design, test, and refine complex options strategies before risking capital. In addition, Thinkorswim’s paper trading functionality makes it a safe environment for traders to simulate trades and evaluate performance under various market scenarios.

Tastytrade

Tastytrade is known for its intuitive and educational approach to options trading. Designed with active options traders in mind, the platform integrates strategy visualizers that help users clearly understand profit/loss zones, breakeven points, and probabilities. Its options screeners streamline the process of identifying opportunities across market conditions, while the platform’s robust library of educational content empowers traders to improve their skills continuously. Tastytrade is particularly well-suited for those who want to explore creative, multi-leg strategies with a visually engaging interface.

Interactive Brokers (IBKR)

Interactive Brokers caters to both professional and retail traders who prioritize execution speed, access to deep liquidity, and global market connectivity. Its options trading suite includes multi-leg strategy support, flexible order routing, and comprehensive risk management tools. IBKR’s Trader Workstation (TWS) platform enables users to analyze volatility, Greeks, and exposure in real-time, making it ideal for managing portfolios with complex strategies. With a reputation for low commissions and powerful execution infrastructure, Interactive Brokers is a go-to choice for traders implementing high-volume or high-frequency options strategies.

Common Myths About Options Trading Strategies

One of the most persistent myths is that covered calls are safe and foolproof. While they can generate income, they also cap your profit potential. For example, if you own XYZ stock and sell a $105 call, but the stock rallies to $120, you miss out on all gains above $105. This strategy may seem “safe,” but it limits upside in strong bull markets.

Another widespread myth is that iron condors are low-risk, set-it-and-forget-it strategies. In reality, they carry significant risk if the market moves sharply. A surprise earnings result, a geopolitical event, or even an inflation print can push the underlying outside your spread range and lead to losses far larger than the premium received.

Traders also fall for the idea that high-probability credit spreads (like 90% OTM spreads) are “easy money.” The problem is, when they do fail, the losses are often large enough to wipe out the gains from multiple winning trades. This creates a false sense of security that leads to overconfidence.

Many believe that options strategies like calendar spreads or butterflies are too complex to lose money on if structured well. But if you ignore volatility changes or hold too close to expiration, even “smart” setups can unravel quickly.

Common Mistakes in Options Trading Strategies

A major mistake traders make is misjudging implied volatility, especially around earnings. They might buy a call expecting a post-earnings rally, but if the move is underwhelming or already priced in, the option value crashes due to IV crush—even if the stock moves in the predicted direction.

Another common mistake is poor strike selection. For example, in a bull put spread, placing the short strike too close to the stock’s current price without technical support nearby can expose you to unnecessary risk if the stock dips temporarily.

Many traders also over-leverage early on. They take large positions using credit spreads or naked options, assuming low odds of failure. One sharp move against them—and the result is a margin call or significant account drawdown.

Ignoring time decay is another trap. Beginners who buy cheap out-of-the-money options with only a few days to expiration often don’t realize that theta decay will quickly erode the option’s value unless the underlying moves fast—and far—in their favor.

Lastly, some fail to manage losing trades. Holding onto a losing spread, straddle, or long option in hopes of a turnaround often leads to greater losses. Exiting or adjusting early can limit damage, but many overlook this due to inexperience or emotional attachment.

Final Thoughts

Options trading is as much about precision and planning as it is about opportunity. With the right knowledge, tools, and mindset, you can build strategies that suit your goals—whether that’s generating income, managing risk, or speculating with confidence.

Remember: there’s no one-size-fits-all. Start simple, learn your lessons in simulated environments, and gradually layer in complexity as your comfort grows. Stay curious, stay cautious, and always stay informed.

FAQs

What is the safest option strategy?

The safest option strategies are those with defined risk and limited downside. Strategies like covered calls, protective puts, and vertical spreads (e.g., bull call spreads or bear put spreads) are often considered safer because you know your maximum loss in advance. While no strategy is entirely risk-free, these approaches offer a controlled exposure ideal for conservative traders.

Can you make consistent income with options?

Yes, many traders use options to generate consistent income—especially through premium-selling strategies like covered calls, cash-secured puts, and iron condors. These strategies aim to collect premiums over time, often during periods of low volatility. However, consistency requires discipline, sound risk management, and adapting to changing market conditions.

What strategy works best in volatile markets?

In high-volatility environments, strategies that benefit from large price swings are ideal. Long straddles and long strangles are popular because they profit when the underlying asset makes a significant move in either direction. Other effective strategies include calendar spreads and diagonal spreads, which take advantage of implied volatility differences across expiration dates.

How do I choose strike prices?

Strike selection depends on your market outlook, risk tolerance, and strategy goals:

- For buying calls or puts: choose strikes near the money for balance between cost and probability.

- For spreads: sell strikes where you expect the stock to be at expiration.

- For income strategies: sell out-of-the-money strikes with a high probability of expiring worthless. Use tools like delta, probability calculators, and support/resistance levels to guide your decisions.

Sources

- OCC: [Characteristics and Risks of Standardized Options (PDF)] https://www.theocc.com/getmedia/abebc05f-b9f1-43a4-a012-3c6c4a6015d2/risksDisclosure.pdf

- SEC Investor.gov – Options

- https://www.investor.gov/introduction-investing/investing-basics/investment-products/options

- FINRA – Options https://www.finra.org/investors/investment-products/options

- Cboe – Options Education Center https://www.cboe.com/learncenter

- Barchart – Options Screener & Strategy Tools https://www.barchart.com/options/strategies

- Sensibull – Options Strategy Platform (India-focused but useful) https://sensibull.com

- ThinkorSwim (TD Ameritrade) – Options Trading Platform https://www.tdameritrade.com/tools-and-platforms/thinkorswim.html

- Tastytrade – Options Trading Education & Tools https://www.tastytrade.com