Quantum computing has moved from theory into active experimentation, with major tech firms and financial institutions exploring where it may add value. But in 2026, most quantum hardware remains early-stage and noisy, and practical “trading advantage” claims should be treated cautiously. This article explains what quantum computing is, which finance problems it may help with, and what the realistic timeline looks like.

Quantum computing has the potential to improve some data-intensive tasks, especially certain optimization and simulation problems, but real-world impact depends on hardware stability, error correction, and whether quantum methods outperform strong classical alternatives.

We are still early in the practical adoption curve. Much of today’s progress is happening through hybrid research (quantum + classical methods), simulators, and limited cloud-access quantum hardware rather than fault-tolerant machines. The most useful way to read the current landscape is as R&D momentum, not as a guaranteed short-term edge for retail Forex traders.

2026 reality check: what quantum computing means for Forex traders today

Quantum computing is a real field with serious research momentum, but it is not a retail trading edge in 2026. Most quantum finance work is still experimental, often run on limited “NISQ” hardware (Noisy Intermediate-Scale Quantum) and hybrid simulators rather than fault-tolerant machines.

For individual traders, the practical impact today is indirect:

-

large institutions may use quantum or quantum-inspired methods for specific optimization tasks

-

the biggest near-term “quantum” risk is actually security/cryptography, not strategy performance

-

retail execution still depends far more on broker infrastructure, routing stability, spreads, and risk controls than on compute novelty

Think of quantum as a long-horizon research trend, not a near-term replacement for robust strategy engineering and execution discipline.

What Is Quantum Computing (And Why It Matters for Trading)?

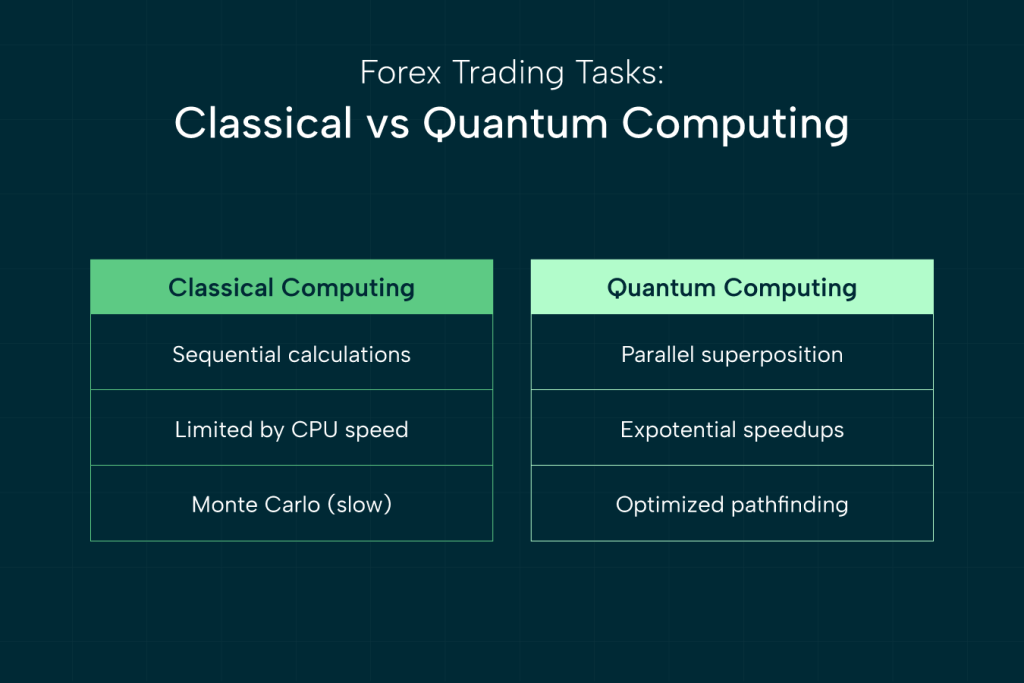

Quantum computing is an approach to computation that uses qubits and quantum-mechanical properties (like superposition and entanglement) to solve some types of problems more efficiently. It is not universally faster than classical computing; potential speedups depend on the problem type, the algorithm, and the maturity of the hardware running it.

To really understand how quantum computing works, one needs to know how conventional computers work and how this relates to the principles of quantum computing. Conventional computers operate through a binary system of bits. A bit represents a physical state of data that can be either on or off (1 or 0). It can only ever represent one of these two states at a time.

In order to solve a problem, a conventional computer must process each bit one after another. While incredibly fast, it’s a linear process. Unlike a classical bit, a quantum computer uses qubits. These non-binary bits can exist in a state of superposition, which means they can be a 0, a 1, or both at the same time. This allows a quantum computer to explore many possibilities simultaneously.

Two or more qubits can also become linked, with the state of one instantly influencing the state of the others, regardless of the distance between them. This phenomenon is known as entanglement. It allows qubits to work together on complex problems in a deeply interconnected way.

Trading Problems Quantum Computing Could Solve

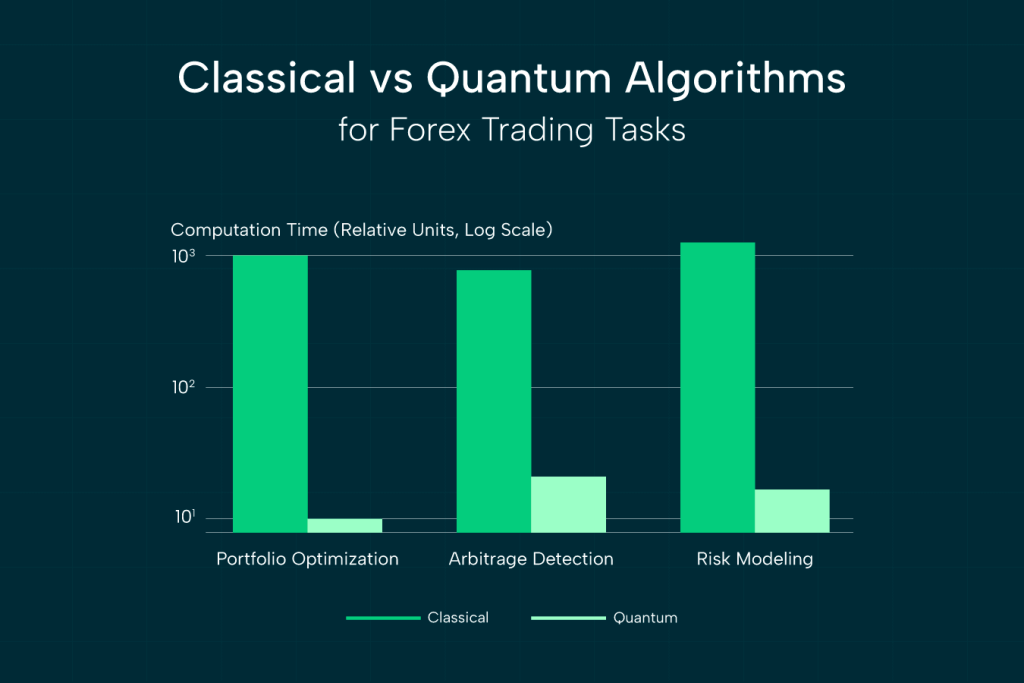

Finance is a major research target for quantum methods, particularly for optimization, simulation, and certain classes of probabilistic modeling. High-frequency trading is more nuanced: real-time execution is constrained by market microstructure, latency, and risk systems, so any quantum benefits are more likely to appear first in offline optimization and modeling rather than directly “faster trading” in production.

Portfolio Optimization

In trading, it is important to find a perfect balance between risk and reward. This problem becomes even bigger as the assets in a trader’s portfolio grow. The number of possible combinations and relationships explodes exponentially. Conventional computers struggle to find the truly optimal portfolio optimization strategy within a reasonable amount of time.

Quantum approaches may eventually accelerate parts of portfolio optimization, especially for very complex constraint sets. However, “real-time” optimization at meaningful scale is still an open challenge and depends on hardware maturity, error rates, and whether quantum or hybrid solvers beat classical methods in practical conditions. For now, most credible work is exploratory and benchmark-driven rather than production deployment.

Faster Risk Modeling And Scenario Simulations

Efficient trading strategies are built on complex risk models, which can be used to forecast potential losses under different market conditions. These models are created using complex simulations (that require immense computational power).

A quantum computer, through its ability to explore a vast number of scenarios at once, could dramatically speed up these simulations. This would give traders and risk managers the ability to analyze market volatility, test the resilience of their strategies, and respond to potential threats.

Efficient Pricing Of Complex Derivatives

Derivatives are financial contracts whose value is derived from one or more underlying assets. Pricing complex derivatives, such as multi-asset options, is a computationally intensive task. The mathematical models used to price them require a high-dimensional analysis that may be too much for classical computers to handle.

Quantum algorithms are uniquely suited to this challenge because they can efficiently handle these high-dimensional calculations. By rapidly and accurately pricing these instruments, quantum computing could create new trading opportunities and improve the overall liquidity and stability of the derivatives market.

What matters more than quantum for Forex execution (right now)

Even if quantum eventually improves certain models, Forex outcomes in live trading are still dominated by “boring” constraints:

-

Execution quality: spreads, liquidity, broker routing, and how orders are handled under volatility

-

Latency stability: spikes/jitter often matter more than best-case ping

-

System reliability: platform freezes, disconnects, and missed restarts silently destroy automation

-

Risk controls: position sizing, exposure limits, and fail-safes matter more than prediction accuracy

If your goal is better real-world performance in 2026, the highest ROI improvements are usually:

-

trading from the right infrastructure hub (near broker servers)

-

ensuring 24/7 reliability for EAs (stable environment + monitoring)

-

improving risk controls and testing methodology

Quantum may change parts of finance later, but it does not replace execution fundamentals.

How Quantum Computing Could Redefine Forex Strategy

Quantum computing will solve many problems that are currently impossible for conventional computers. This has the potential to redefine forex trading strategy. Its unique ability to process massive datasets in parallel and identify hidden correlations will transform how traders backtest strategies, adapt to market changes, and predict currency movements.

Massive Parallel Processing Of Strategy Backtests

Backtesting is a critical part of forex strategy development. It involves running a trading strategy against historical market data to see how it would have performed. On a classical computer, this is a linear, time-consuming process.

Quantum computers will be able to leverage the principle of superposition to test an enormous number of variables and market conditions simultaneously. This means a trader could backtest thousands of different versions of a strategy, using slightly different variables or rules for each one. This will be done in a fraction of the time it would take a classical computer to test just one. This capability will allow for a deeper, more robust understanding of a strategy’s potential performance and risk before it is implemented.

Adaptive Modeling for Real-time Market Changes

Forex markets are constantly changing, and what works one moment might not work the next. Traditional trading algorithms are often too slow to adapt to sudden shifts in volatility or liquidity. Quantum machine learning (QML) models can create more sophisticated, adaptive trading strategies that learn and adjust in real time. In the age of next-gen infrastructure and algorithmic evolution, leveraging a dedicated forex VPS helps ensure your automated systems stay connected and responsive.

For example, a QML model could use quantum annealing to continuously optimize a trading strategy’s parameters. This will ensure that the strategy remains profitable even when market conditions change. This could enable algorithms to exploit fleeting arbitrage opportunities or react to major news and events faster than ever before.

Quantum ML Models for Currency Prediction

Forecasting currency movements is a highly complex problem. There’s a huge volume of interconnected data points, from geopolitical events and economic indicators to social media sentiment, that can affect predictive models.

Classical machine learning models often struggle to find meaningful patterns in such “noisy” data. Quantum computers, using quantum neural networks, can analyze this data in new ways. By encoding data into a quantum state, they can identify hidden, non-linear correlations between seemingly unrelated events. This could lead to predictive models that are far more accurate at forecasting currency price trends, giving traders a significant edge in a market where information is power.

Early Experiments and Industry Movement

Quantum computing is gradually moving beyond the realms of theoretical research into practical experimentation. Many major financial institutions and nimble startups have begun a race to apply the technology to real-world problems by building powerful simulators and cloud-based quantum services. Some of the early experiments in this industry are highlighted below:

Banks Experimenting With Quantum Finance (JPMorgan, BBVA, HSBC)

Leading global banks are now actively engaged in quantum finance research, with dedicated teams exploring a range of use cases. JPMorgan Chase has been a pioneer in the field, collaborating with research institutions and tech companies like Quantinuum and IBM to explore quantum computing for portfolio optimization, option pricing, and risk analysis.

BBVA, a Spanish multinational bank, has conducted successful trials in distributed quantum simulation to run quantum algorithms across multiple conventional servers in the cloud. They are exploring how quantum computing can be used for sophisticated risk assessments.

HSBC is also collaborating with companies like Quantinuum and Haiqu to explore the potential of quantum machine learning (QML) and quantum natural language processing (QNLP). Their research aims to use quantum methods to efficiently encode large-scale financial data into quantum circuits, a crucial step for real-world applications.

Startups and Research Institutions Leading Quantum-for-trading R&D

Beyond the major banks, a vibrant ecosystem of startups and research institutions is driving innovation in quantum-for-trading R&D. Multiverse Computing is a notable startup focused on quantum-inspired algorithms for finance. They’ve partnered with banks and corporations to develop solutions for portfolio optimization, credit scoring, and fraud detection. QC Ware is another key player, offering a platform that provides access to quantum algorithms for a variety of industries, including finance. They’ve worked with financial firms to apply quantum algorithms to complex hedging strategies.

Use Of Simulators And Quantum Cloud Access (e.g., Qiskit Runtime)

Since a universal, fault-tolerant quantum computer is still years away, a significant amount of today’s quantum R&D is conducted on quantum simulators and through cloud-based services. Qiskit Runtime, an open-source development kit from IBM, is a core tool used by many financial researchers. It allows developers to build quantum applications and run them on real quantum hardware as well as powerful simulators that mimic a quantum computer. This approach allows banks to test and refine their algorithms, ensuring they’ll be ready to run on powerful quantum hardware as it becomes available.

Limitations and Barriers

Although the potential benefits are numerous, a few notable barriers must be overcome before quantum computing can be reliably used for mainstream financial trading. These challenges are a result of the technology’s early stage of development as well as the complex demands of the financial sector.

Hardware immaturity

Today’s quantum computers are still in a developmental phase. The current era is known as the “Noisy Intermediate-Scale Quantum” (NISQ) era. The hardware is not yet stable, consisting of a limited number of qubits that are highly sensitive to their environment. This requires them to be kept in highly controlled conditions, often at temperatures colder than outer space. Building systems that are not only powerful but also reliable and scalable for real-world financial applications remains a significant engineering hurdle.

Noisy Qubits = Unreliable Output

A core limitation of NISQ devices is that the qubits are “noisy,” meaning they are prone to errors. This decoherence causes qubits to lose their quantum state, introducing errors into calculations. For trading, where a single incorrect data point can lead to catastrophic losses, this unreliability is a major roadblock. While researchers are developing quantum error correction (QEC), it requires a significant number of physical qubits to create a single “logical” or error-corrected qubit, which is a major scaling challenge.

High Costs + Limited Real-World Scalability (For Now)

Quantum systems are expensive to build and operate because costs include specialized hardware, cryogenic cooling (for some architectures), facility requirements, and expert staffing. Exact figures vary widely by approach and vendor, but it is reasonable to treat large, fault-tolerant systems as extremely capital-intensive for now. Because the technology is still developing, cost and scalability projections should be viewed as estimates rather than fixed milestones.

Need For Quantum-Safe Encryption Alongside Trading Models.

Perhaps the most urgent barrier is the dual-use nature of quantum computing. While it promises to revolutionize trading, it also poses a direct threat to the financial system. When a sufficiently powerful quantum computer is built, it could easily break many of the standard encryption algorithms that currently secure everything from bank transactions to personal data. Therefore, the financial industry cannot simply adopt quantum trading models without first transitioning to quantum-safe encryption to protect itself from potential quantum attacks. The race is on to develop and implement these new cryptographic standards to ensure the integrity of the entire financial ecosystem.

What to watch over the next decade (without hype)

A realistic “watch list” for quantum in finance looks like this:

-

Error correction progress

Today’s systems are noisy; practical finance use depends on reducing error rates and scaling logical qubits.

-

Hybrid quantum-classical workflows becoming routine

Near-term adoption is more likely to be “quantum accelerators for specific tasks” rather than fully quantum trading systems. -

Post-quantum security migration

The most urgent quantum-driven change in finance may be security standards (quantum-safe cryptography) rather than faster trading strategies.

Bottom line: quantum is worth tracking, but avoid treating timelines or “speedups” as guaranteed until there’s repeatable, peer-reviewed evidence of quantum advantage in real trading workloads.

Future Outlook: When Will It Matter?

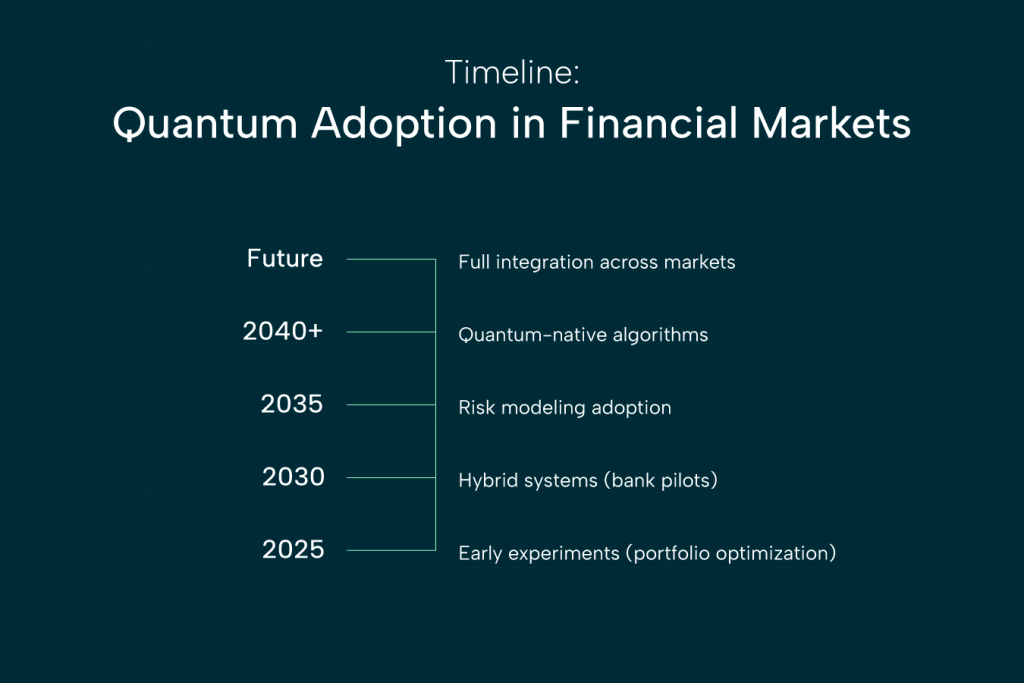

The arrival of a true “quantum advantage”, where quantum computers will be used to solve practical business problems, is only a matter of time. While the exact timeline is uncertain, a consensus is emerging among experts that it will likely happen in phases, over the course of the next decade.

We are currently in a quantum-safe and quantum-inspired era, where a growing number of banks and fintechs are using quantum-inspired algorithms on classical supercomputers to optimize financial models.

Over time, we will likely enter a hybrid Quantum-Classical Era. This is the period when quantum advantage is expected to become more widespread. Financial firms will begin to integrate quantum processors into their existing classical supercomputing infrastructure, creating a hybrid system. Quantum algorithms will be used for specific, high-value tasks like complex derivatives pricing and real-time risk modeling, while classical computers will handle the rest of the workflow.

Experts predict that by 2035, quantum infrastructure will reach a stage of maturity and become more accessible. This will pave the way for its full integration into financial operations. Both individual and institutional traders will be able to tap into the power of quantum computers for critical decision-making, dynamic portfolio rebalancing, and anticipating market shifts. The nature of algorithmic trading will be fundamentally transformed, with quantum-powered systems identifying and executing trades in ways that are currently unimaginable.

While we are still a long way off from this future, traders and fintechs can get ahead of the curve by building foundational knowledge in quantum computing. A key way to do so is by experimenting with quantum simulators and cloud services. They should also form strategic partnerships with quantum startups and research institutions while proactively transitioning to quantum-safe security to protect their data from future threats.

Final Thoughts

The integration of quantum computing into finance is not a matter of “if,” but “when.” The technology won’t overhaul your trading system overnight, but it has long-term potential to fundamentally reshape algorithmic finance. This is a tangible reality that forward-thinking traders and institutions cannot afford to ignore.

The journey from science fiction to practical application is well underway. The initial stages are about building foundational knowledge, experimenting with early-stage tools, and preparing for a future that will deliver a new level of computational power.

The key to leveraging these breakthroughs is to stay curious, not panicked. The future of forex trading will be defined by those who understand the promise of this technology, anticipate its arrival, and actively follow the breakthroughs. By doing so, they will be perfectly positioned to lead the next trading revolution by tapping into the immense power of quantum computing.

FAQ

Can quantum computing be used for trading?

Yes. Quantum computing has several potential applications across various fields, including forex trading. The fast processing capability of this technology can be leveraged for portfolio optimization, high frequency trading and improved risk management.

What is the biggest challenge to using quantum computing for forex trading right now?

The biggest challenge for applying quantum computing in trading is hardware immaturity. Current quantum computers have limited qubits, are prohibitively expensive and still susceptible to errors. The instability of these machines, along with the high costs and scalability issues, means they are not yet reliable enough to run the critical, real-time calculations needed for successful trading.

When can we expect to see quantum computing used in everyday trading?

The full integration of quantum computing into mainstream trading is likely still a decade away. The technology is currently in its “noisy” stage. However, analysts predict the first signs of a “quantum advantage” (where a quantum computer outperforms a classical one for a specific task) could appear within the next 5-10 years.

Will quantum computing replace all classical computers?

No, not in the foreseeable future. Quantum computers are not general-purpose machines; they are designed to solve very specific, complex problems that are impossible for classical computers.

How do I start quantum trading?

Learning how to trade with quantum computing is a proactive, long-term strategy, since current quantum computers aren’t quite useful for mainstream trading yet. However, you can get a head start by learning the core concepts, strengthening your trading skill and practicing with accessible tools like quantum simulators.