Monitoring CPU and RAM usage on your VPS is essential for maintaining performance and identifying potential issues early. This guide will show you how to monitor these resources using built-in tools.

Why monitoring VPS usage is important?

First of all, it is important to know, why VPS utilization monitoring plays a crucial role to ensure good overall experience. Here are the few reasons:

- Understanding how much CPU and RAM is utilized on your VPS helps to keep it running smoothly. Regular checks can help you catch any issues early, preventing slowdowns or even crashes;

- A well-maintained VPS enhances your overall experience by reducing possible problems and improving efficiency. When your VPS is running optimally, you can trade more effectively, leading to potentially better results.

How to Monitor CPU and RAM Usage

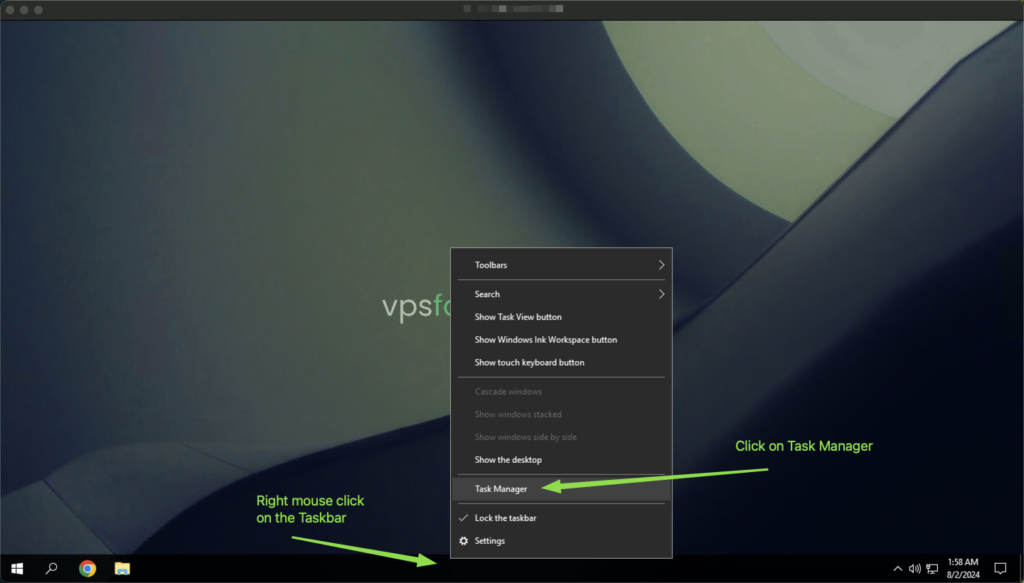

Step 1:

To open Task Manager, right-click on the taskbar at the bottom of your screen and select Task Manager. Alternatively, press Ctrl(Control) + Shift + Esc shortcut on your keyboard to open it quickly.

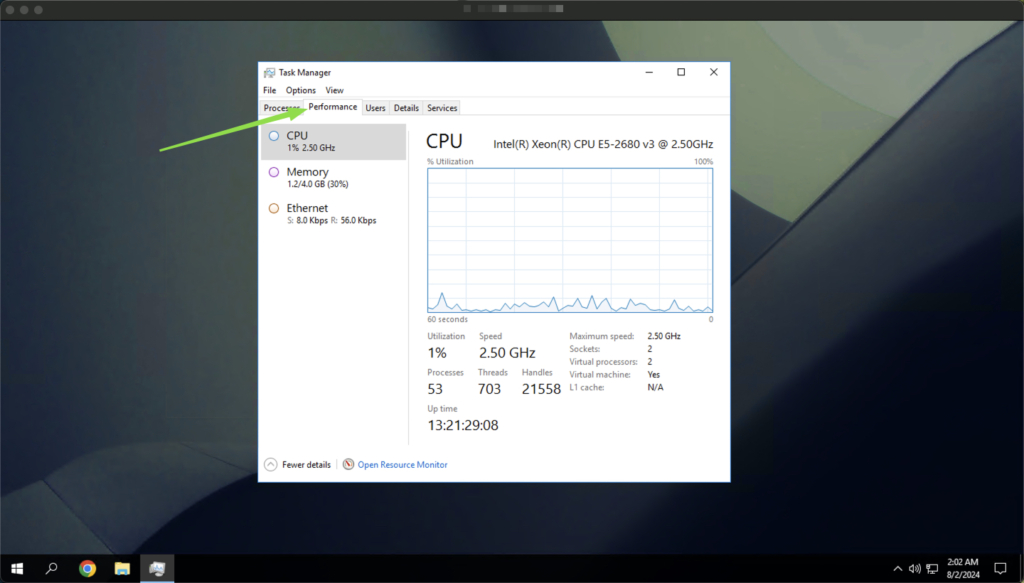

Step 2:

Once Task Manager is open, navigate to the Performance tab. This is where you can observe important information, such as CPU or RAM resources utilization. Click on CPU or RAM tab in the sidebar to see real-time graph and more information about your VPS resources.

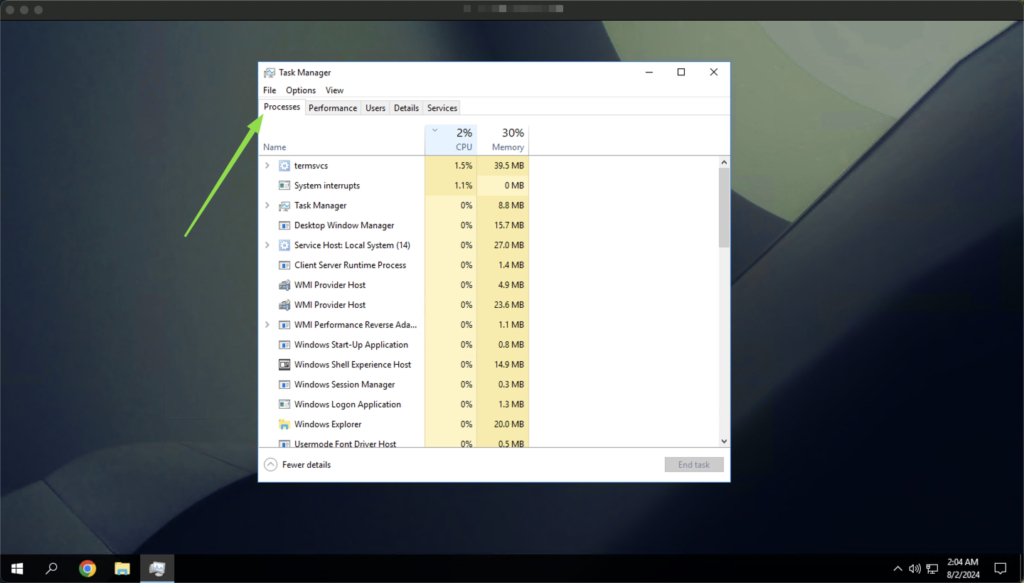

Alternatively, navigate to the Processes tab on your Task Manager. There you can find a list of all processes running on your system in real-time. By clicking on the CPU or Memory columns, you can quickly sort the list and double-check, what applications are using the most of your system’s resources.

Common Causes of an Overloaded System

An overloaded VPS can slow down or even crash, disrupting your trading platforms. Common causes of high resource usage include:

- Running more trading platforms than your VPS can handle. Each trading platform requires a share of your VPS’s resources, and if you exceed its capacity, the system can become unresponsive.

- Using high-frequency trading algorithms that demand extensive resources. Such algorithms can consume a significant amount of CPU and RAM, which can overwhelm your VPS.

- Having an outdated system that has been running for a long time without a reboot. Over time, various processes can accumulate, consuming more resources and causing the system to slow down. Regular updates and reboots help maintain optimal performance.

Tips for Maintaining Optimal Performance

- Regularly monitor your CPU and RAM usage to ensure your VPS is running smoothly. Keeping track of these metrics helps you catch potential issues early.

- Keep resource usage below 80% to maintain optimal performance. It will help to prevent your system from becoming overloaded and ensures better stability.

- Update and restart your VPS system regularly. This keeps your software up to date and clears out any accumulated processes that may be slowing down your system, ensuring it runs efficiently.

- Consider upgrading to a more powerful VPS plan if your trading platforms need more resources. This ensures that your VPS has sufficient amount of resources for smooth experience.