The idea of crypto tokens created and controlled by Central Banks is no longer a theoretical concept. Many central banks all over the world are in various stages of research, pilot programs, or even fully launched their own CBDC project.

In the Forex trading market, the introduction of CBDCs will eliminate many of the inherent risks and inefficiencies associated with traditional currency. As the traditional market architecture gradually gives way to instantaneous digital settlements thanks to CBDCs, forex traders and institutions must learn all about the potential impacts of this technology on execution, liquidity, and risk management. In this evolving environment, maintaining 24/7 trading continuity and ultra-low latency infrastructure via a dedicated forex VPS is increasingly vital.

This article is a deep dive into the concept of CBDCs. You’ll learn how this technology works, how it is different from traditional fiat currency and the various ways it could impact the forex market. This guide will also explore the opportunities (and risks) that this new technology could pose to Forex traders.

What Are CBDCs and How Are They Different?

A Central Bank Digital Currency (CBDC) is a digital form of a country’s fiat currency, directly issued by the central bank. It is essentially the digital equivalent of physical cash, carrying the full faith and credit of the issuing government.

CBDCs are designed to exist alongside physical cash and commercial bank deposits. It is not a replacement for fiat money. Instead, it represents a safe, risk-free settlement layer for the digital economy.

Central Bank Digital Currencies Vs Traditional Fiat Vs Crypto

While there’s some overlap between them, Central Bank Digital Currencies (CBDCs) are different from regular fiat money and private digital assets. These differences are as a result of who issues them, what backs their value and how they’re controlled. Understanding the distinction between these three currency forms will help you understand their potential market impact.

Traditional Fiat Money

Traditional fiat money exists in two forms: physical cash and commercial bank money. The latter is what most traders deal with on a daily basis. Physical cash is a direct central bank liability. However, the majority of money in circulation often exist as commercial bank deposits. This means the money is a liability of the private commercial bank, and while it is generally stable, it is only backed up to a certain limit by government deposit insurance (like the FDIC in the U.S.).

Traditional fiat money is backed by the issuing government and enjoys relatively stable value. Control is centralized, but filtered through the commercial banking system. Money transfers rely on clearing and settlement systems (like Fedwire or correspondent banking) that introduce time delays and settlement risk.

Central Bank Digital Currencies (CBDCs)

A CBDC is a direct digital liability of the central bank, making it the digital equivalent of physical cash. It is denominated in the national unit of account (e.g., one Digital Euro equals one physical Euro).

This type of digital money is issued and controlled by the sovereign central bank (e.g., the Fed, the ECB), meaning it carries zero credit or liquidity risk. Its value is completely stable, pegged 1:1 to the national fiat currency. The central bank also retains authority over monetary policy, supply, and (depending on the design) has the potential to monitor or program the currency.

Cryptocurrencies

Cryptocurrencies (like Bitcoin or Ethereum) and unbacked stablecoins are a radical departure from regular money. They represent a private, decentralized form of digital assets. Cryptocurrencies are primarily treated as speculative assets or store-of-value instruments, distinct from the functional unit of account used in forex trading. Their volatility makes them unsuitable for direct monetary policy or stable cross-border commerce.

Crypto tokens are issued by a decentralized network (miners, validators) or a private entity, with no government backing. With their value determined purely by market demand and sentiment, cryptocurrencies are highly volatile. Even stablecoins, while pegged to a fiat currency, carry the private credit risk of the issuer.

| Feature | CBDC (Central Bank Digital Currency) | Traditional Fiat Money | Cryptocurrency |

|---|---|---|---|

| Issuer | Central bank (sovereign authority) | Central bank via commercial banking system | Decentralized network or private issuer |

| Backing / Value Basis | Fully backed by the issuing government; pegged 1:1 to national currency | Backed by government trust and monetary policy | Not backed; value determined by market demand and supply |

| Control & Regulation | Centralized under government and monetary authority | Centralized but intermediated by banks | Decentralized; governed by network consensus |

| Volatility | Very low — same as fiat currency | Moderate — depends on macroeconomic factors | High — driven by speculation and sentiment |

| Settlement Speed | Near-instant (atomic, 24/7) | Slow — typically T+1 or T+2 clearing systems | Fast (depends on blockchain), but can vary by network congestion |

| Credit / Counterparty Risk | None — direct claim on central bank | Exists — relies on commercial bank stability | None in design, but subject to technical or exchange risks |

| Transparency / Traceability | Fully traceable; programmable depending on design | Limited — depends on payment rails | Pseudonymous but public ledger |

| Forex Market Impact | Could create new digital pairs (e.g., e-USD/e-EUR) and lower spreads | Current standard benchmark for all forex trades | Indirect — speculative and not used in mainstream forex pairs |

| Trading Hours | 24/7 continuous trading possible | Limited to traditional session overlaps | 24/7 global trading |

| Use Case in Forex | Future medium for digital cross-border settlements and on-chain arbitrage | Core trading instruments today | Alternative asset, not part of fiat forex pairs |

Current Development Status Globally

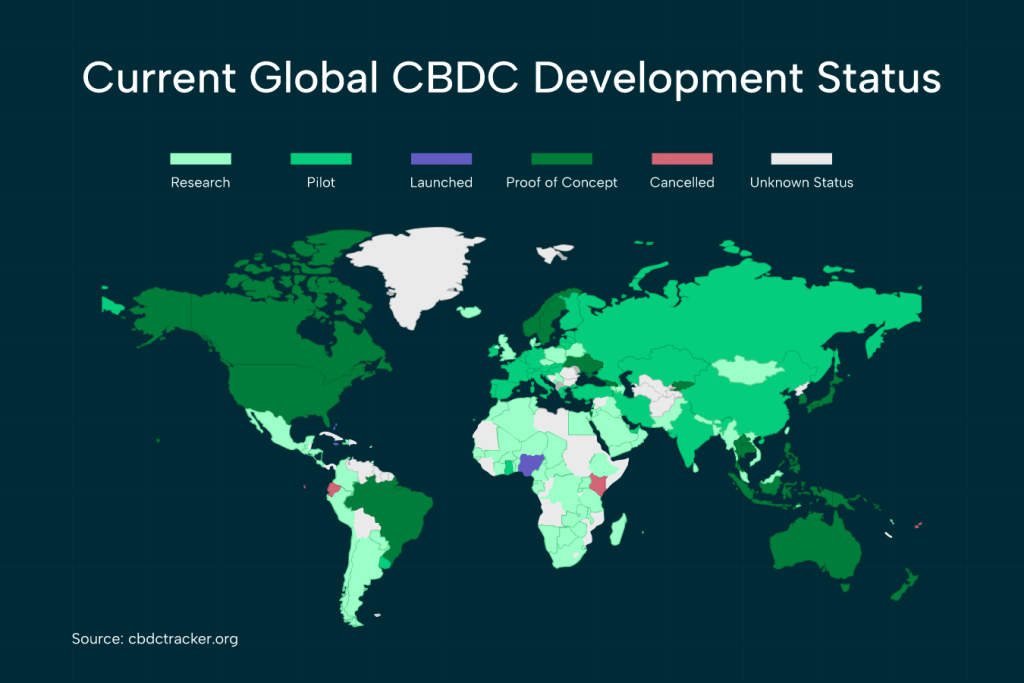

According to the Atlantic Council, up to 137 countries & currency unions (representing 98% of global GDP) are exploring the digital currency idea. This is impressive considering the fact that the concept of CBDCs only became popular within the past decade. In fact, only 35 countries were planning on launching their own digital tokens as of 2020. Now, up to 72 countries are in the advanced phase of exploring this concept.

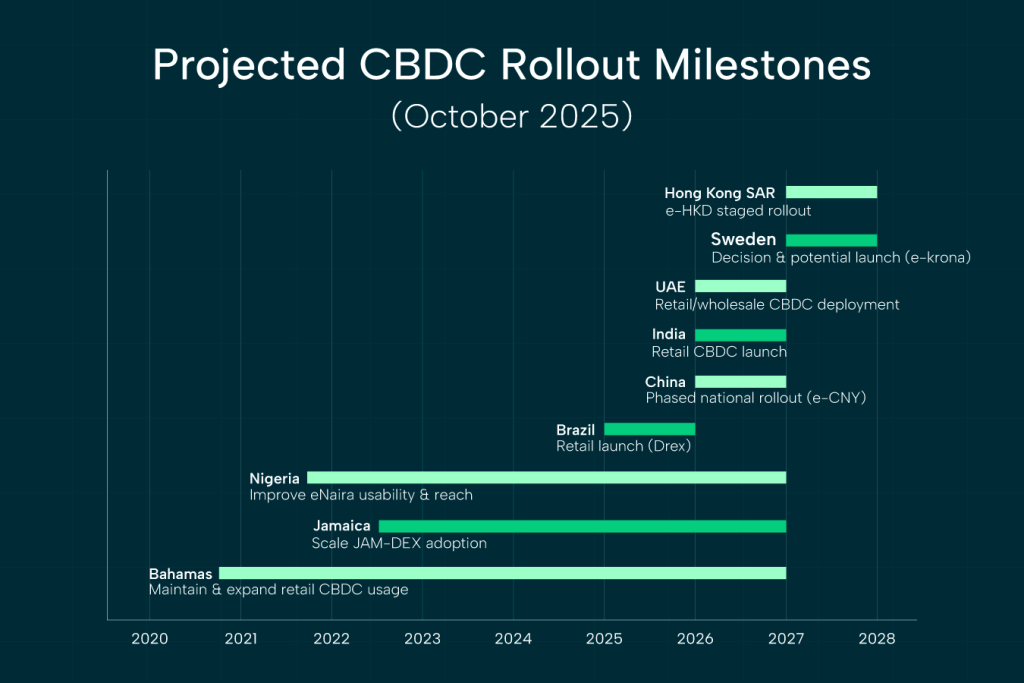

There are at least 49 CBDC pilot projects currently running in various countries all over the world. Three countries (Bahamas, Jamaica, and Nigeria), have fully launched their own CBDCs, and are currently focused on expanding its reach and usage domestically.

Countries Leading the CBDC Race

The race to issue Central Bank Digital Currencies (CBDCs) is accelerating globally, driven by a mix of geopolitical ambition, payment efficiency goals, and a desire to retain monetary control in the face of private digital currencies. For forex traders, understanding the development trend across different regions will help them gain an understanding of future mechanics of global payments and, potentially, currency pair dynamics.

China (digital yuan)

China has positioned itself as the clear global leader in retail CBDC deployment. The adoption of this technology is primarily driven by a top-down mandate to modernize its payments infrastructure and extend state surveillance capabilities.

The e-CNY is the world’s largest pilot, actively tested across dozens of cities and used for hundreds of billions of yuan in transactions including retail payments, social benefits, and government salaries. As of June 2024, the total transaction volume was up to 7 trillion e-CNY ($986 billion), with the currency already in use across 17 provincial regions.

Europe (digital euro)

The ECB is advancing a “global euro moment” by piloting the digital Euro. The goal is to strengthen the euro’s international role in the foreign exchange market, protect the region’s monetary sovereignty and offer a risk-free digital payment method across the Eurozone.

The ECB moved into a two-year “preparation phase” in late 2023, focusing on finalizing the rulebook, selecting providers, and conducting extensive testing. The earliest possible launch date is projected for 2029.

US (FedNow groundwork)

The US is an outlier amongst its peer central banks. The Federal Reserve has maintained a deliberate, cautious stance on a retail CBDC, focusing instead on upgrading existing payment rails instead of launching a new digital currency.

In 2025, President Trump issued an executive order that halted all work towards launching a retail CBDC. However, America still continues to engage in wholesale cross-border payments research through initiatives like the Project Agorá.

In July 2023, the United States launched FedNow, its new real-time gross settlement (RTGS) service that allows participating banks to clear and settle payments 24/7/365. FedNow is NOT a CBDC. It is a payment rail, a sort of payment highway that fasttracks settlements across commercial banks.

Emerging markets (India, Brazil, Nigeria)

Emerging markets are driving global retail CBDC growth. For many developing nations, CBDCs are not about geopolitical competition. Instead, the goal is to use central-bank backed digital currencies to address domestic structural issues like financial exclusion and high transaction costs. Some of these emerging markets include India, Brazil and Nigeria.

How CBDCs Could Reshape Forex Markets

The introduction of Central Bank Digital Currencies (CBDCs) could fundamentally reshape the forex market, altering everything from the types of currency pairs available to the very structure of trading sessions. These effects are listed below:

Introduction of new digital currency pairs (e.g., e-USD/e-EUR)

One likely direct impact of CBDCs on the forex market will be the emergence of new digital currency pairs, such as the e-CNY/e-EUR. This would allow traders to directly speculate on the relative strength of digital sovereign currencies. The existence of a digital asset and its physical counterpart (e.g., e-USD vs. physical USD) also opens up the possibility of on-chain arbitrage, where traders exploit minor price differences between the two forms of the same currency. This could lead to a highly efficient, self-correcting market for domestic money.

Effects on volatility, spreads, liquidity, arbitrage

CBDCs are designed to be stable, pegged 1:1 to their national fiat currency. This means they will not exhibit the high volatility of private cryptocurrencies like Bitcoin. However, their introduction and the policy shifts that accompany them could cause short-term volatility in the forex market as traders adjust. For instance, the use of CBDCs for large, instant cross-border payments could trigger sudden capital flows, potentially increasing volatility in major currency pairs.

CBDCs, with their instant and direct settlement, could lead to a significant reduction in spreads. The elimination of intermediaries and the increased speed of transactions mean that the difference between the bid and ask price for a currency pair could shrink, benefiting traders. Similarly, central bank tokens may also lead to an increase in market liquidity. The continuous flow of capital will make it easier to buy and sell large volumes of currency without a significant price impact.

Settlement speed improvements = lower friction

Another profound change that CBDCs will bring is the near-instantaneous settlement of cross-border transactions. Currently, traditional forex settlements can take up to two business days (T+2). This delay creates counterparty and settlement risks.

CBDCs, however, could settle transactions in seconds, effectively achieving “atomic settlement” where the exchange of currencies happens simultaneously. This dramatic improvement in speed reduces settlement risk and allows for faster capital turnover. Traders no longer have to wait for transactions to clear, freeing up collateral and enabling more agile trading strategies.

24/7 availability = death of fixed sessions?

Forex trading is currently split into major sessions (e.g., London, New York, Tokyo) that overlap. This is due to the fixed operating hours of traditional banks and payment systems. Because CBDCs can operate on a distributed ledger 24/7, they could lead to the death of fixed trading sessions. Instead of an “off-hours” market, there could be a single, continuous, and globally available forex market. This constant availability would increase market activity, forcing traders to adjust their trading strategies to adapt to a non-stop market.

New Opportunities (and Risks) for Forex Traders

The rise of CBDCs is not just a technical upgrade; it represents a fundamental shift that will introduce entirely new opportunities and risks for forex traders. The following are some new opportunities and risks that traders can look forward to:

New strategies around CBDC policy shifts

The biggest short-term opportunity for traders lies in anticipating and reacting to CBDC-related policy announcements. Unlike traditional fiat, where monetary policy is about interest rates, CBDC policy will be about design and integration, creating new speculative angles:

- Announcements regarding the integration of a CBDC into existing financial systems will generate volatility.

- Central banks may impose limits on how much of a CBDC a person or entity can hold to protect commercial bank deposits. These limits will affect demand and supply of CBDCs, potentially causing the changes in currency value.

- Speculations around the interest rate on CBDCs will generate significant price action

Speculating on monetary design differences

CBDCs are not uniform; each nation’s design choices regarding key features create inherent, tradable differences in monetary value and risk perception. For instance, a nation prioritizing retail CBDC over wholesale may signal greater faith in the digital currency’s role in the public economy, potentially strengthening its perception.

Differences in technology standards may also affect a currency’s perception in the trading market. Countries adopting systems that promise seamless cross-border use (like China’s participation in mBridge) could see their digital currency experience higher demand for global trade settlement.

Privacy, programmability, and trader impact

The design features of a CBDC, especially those related to privacy and programmability will affect where money is stored and how it is spent, which can be speculated upon. If a central bank issues a CBDC with strong anonymity features, it becomes a highly attractive, risk-free alternative to private digital assets and foreign fiat. This will potentially demand against less-private versions.

On the flip side, a “programmable” CBDC (that can only be spent on certain goods or that expires) is a major risk for free market traders. Speculation that a central bank may introduce such features could lead to an immediate flight of capital out of that CBDC to alternatives. Traders may profit by anticipating this “flight-to-safety” into alternative stores of value.

Regulatory arbitrage opportunities

Regulatory differences across jurisdictions will create new opportunities for regulatory arbitrage, especially in cross-border and cross-asset trading. For example, if Country A’s central bank places strict controls or taxes on converting their CBDC to cryptocurrency, while Country B has minimal restrictions, a trader could use a less-regulated intermediary currency to move funds between the two digital systems more cheaply.

How Institutions Are Preparing

The ongoing CBDC revolution is a multi-layered effort spanning across the central banks of various countries, financial intermediaries, and technology providers. Here’s how these stakeholders are preparing and contributing to the trend:

What central banks, brokers, and platforms are building

Central banks are leading the charge, focusing on research, policy, and cross-border cooperation to ensure the stability and functionality of their CBDCs. Central banks are defining the core features of their CBDCs while also working to develop unified standards and policies to guard the emerging sector.

Forex brokers and trading platforms are also preparing to onboard and service these new digital currency pairs. Of course, this requires significant technological updates as the platforms will need to integrate the core ledger or network of the CBDC to handle direct digital transfers.

Forex liquidity providers and market makers adapting

Liquidity providers (the high-frequency trading firms and banks that guarantee market depth) are facing the most immediate operational changes. They must adapt their risk models and treasury management to manage collateral and credit risk in real-time, requiring significantly lower latency in their systems. LPs and market makers will also need to shift to a non-stop operating model. This means continuous monitoring, pricing, and algorithmic liquidity provision to maintain tight spreads outside of traditional market hours.

Trading software updates

Technology is the core enabler, with specialized software being developed to handle the complexity and speed of CBDC trading. Some of the technical requirements for this new technology include advanced smart order routing systems, low-latency interoperability engines and upgrades to APIs/protocols.

Preparing for a CBDC Future – What Traders Can Do Now

For forex traders, the emergence of CBDCs is a new fundamental and technical variable that demands proactive study. Immediate action is required to position for the major market structure and volatility shifts that CBDC launches will trigger. Essential actions that traders must take right now include:

- Stay updated on pilot programs – Focus on major reserve banks (Fed, ECB, BoJ, BoE) and nations with advanced pilots or currencies that have been launched already.

- Practice trading on e-CNY, or mock environments – While official retail trading platforms for many CBDCs aren’t fully live, traders should seek out available testing environments to simulate new trading realities.

- Add CBDC-related pairs to watchlists – Anticipate digital currency pairs and add placeholder watchlists for likely future pairs,

- Consider privacy and capital controls in strategy planning – Plan for capital flight in case of unfavorable control and strategize around regulatory arbitrage.

Final Thoughts

CBDCs are coming. Whether fast or slow, the forex world will definitely feel the impact of this new wave of digital currency when it eventually arrives. Central Bank Digital Currencies directly address many of the inefficiencies of the legacy interbank settlement system.

CBDCs will fundamentally reshape the forex trading landscape, creating a distinct advantage for traders who adapt early to the new market structure. The future of forex will indeed be characterized by faster, flatter, and always-on markets. Traders who integrate CBDC analysis and technology now will gain a significant competitive advantage.

FAQs

Are CBDCs just another form of crypto?

No, CBDCs are fundamentally distinct from private cryptocurrencies like Bitcoin and Ethereum. Although both are digital, a CBDC is a direct liability of the issuing central bank. This makes it a centralized, risk-free digital form of a nation’s fiat currency. On the other hand, cryptocurrencies are decentralized, not government-backed, and are highly volatile, speculative assets whose value is determined by market demand.

When will CBDCs start affecting forex markets?

CBDCs are already affecting the forex landscape through policy announcements and pilot project news, creating geopolitical volatility and market sentiment shifts, but the major structural impact will likely take place over the next 2 to 5 years.

Can I trade CBDCs today?

No, for major world currencies, you cannot directly trade a CBDC yet as they are mostly in the research or pilot phase. However, the volatility caused by CBDC-related news already has an impact on the existing fiat currency pairs.

Will CBDCs be more or less volatile than fiat?

CBDCs are designed to be pegged 1:1 with its national fiat currency, thus maintaining the exact same exchange rate volatility as the existing currency against other world currencies. But policy decisions surrounding the CBDC’s design (e.g., interest-bearing features or holding limits) could introduce new, non-market volatility into the domestic money markets.

What are the geopolitical implications of CBDC adoption?

The global adoption of cross-border CBDCs creates a geopolitical shift by potentially challenging the US Dollar’s dominance in international trade and finance. In theory, interoperable CBDC networks could enable countries to settle transactions directly in local currency pairs, bypassing the US-centric correspondent banking system.

Sources

https://www.fxgiants.com/fxg/th/the-future-of-online-forex-trading-in-a-cbdc-world

https://www.atlanticcouncil.org/cbdctracker/

https://www.//coincub.com/the-impact-of-central-bank-digital-currencies-cbdcs-on-forex-trading/